Pharmaceutical producer Merck & Company (MRK) has announced that it recommends its shareholders reject the recent proposal that it has received from TRC Capital Investment Corporation. According to a statement released by Merck, the company received an “unsolicited mini-tender” offer from TRC to purchase up to 1,000,000 MRK shares at $96.38 per share on November 12, 2024. Today, Merck made it clear that it does not believe shareholders should accept the offer, which is below today’s closing price of $99.18 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s Happening with Merck Stock?

While Merck stock declined slightly today, it responded positively to Merck’s recommendation. Shares popped in after-hours trading and have been slowly trending upward since news broke of the company’s recommendations. Despite some volatility, MRK stock has performed well over the past week and closed out trading for the past five days up 3%.

This suggests that the market supports Merck’s decision to advise shareholders against accepting TRC’s offer. In today’s statement, Merck noted that while the per-share price is not only below yesterday’s close-of-day price, it is “subject to numerous conditions, including TRC Capital’s ability to obtain financing.” These factors could complicate matters further if shareholders were to vote in favor of the mini-tender offer.

According to Merck, TRC Capital is known for making similar offers to companies, typically by acquiring less than 5% of a company’s outstanding shares. It notes that mini-tender offers “do not provide investors the same level of protections” that larger tender offers do. As long as MRK stock continues to trade above the offered price of $96.38 per share, shareholders are likely to reject it.

Is Merck a Good Stock to Buy?

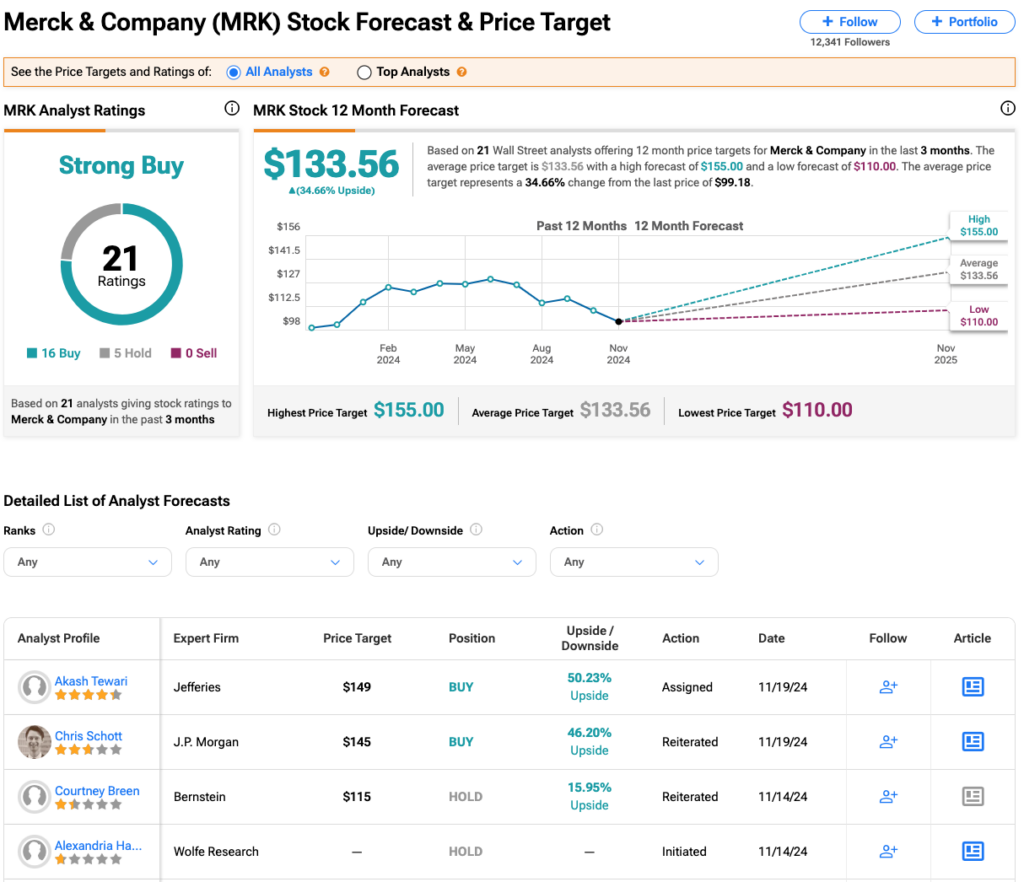

Turning to Wall Street, analysts have a Strong Buy consensus rating on MRK stock based on 16 Buys and five Holds assigned in the past three months, as indicated by the graphic below. Although shares have fallen 1% over the past year, the average MRK price target of $133.56 per share implies 35% upside potential.