According to a report published by Reuters, Mercedes-Benz Group AG (DDAIF) plans to cut its CO2 emissions by 50% by the end of this decade. This is in addition to its existing goal of becoming carbon neutral by 2039.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Additionally, by 2030, the company plans to meet 70% of its energy needs through renewable energy sources, compared to the current 45%-50%.

Joerg Burzer, the Production Chief at Mercedes-Benz, said, “Around 15% of this energy should come from solar and wind plants on or linked to Mercedes-Benz’ own sites.”

The luxury carmaker plans to source the remaining energy through Power Purchase Agreements (PPAs). Under these agreements, Mercedes-Benz will pay power companies to generate energy.

Burzer said the company is in advanced talks to buy wind energy worth €1 billion by 2025 through PPAs.

About Mercedes-Benz

Germany-based Mercedes-Benz manufactures and sells cars, trucks, buses and vans under the brands Mercedes-Benz Cars, Daimler Trucks, Mercedes-Benz Vans and Daimler Buses. It also offers financial services through its Daimler Financial Services business.

DDAIF stock lost 1.8% on Monday to close at $67.27.

Price Target

Overall, the stock has a Strong Buy consensus rating based on 13 Buys and two Holds. DDAIF’s average price target of $96.74 implies 43.8% upside potential. Shares have lost 20.1% over the past three months.

Blogger Opinions

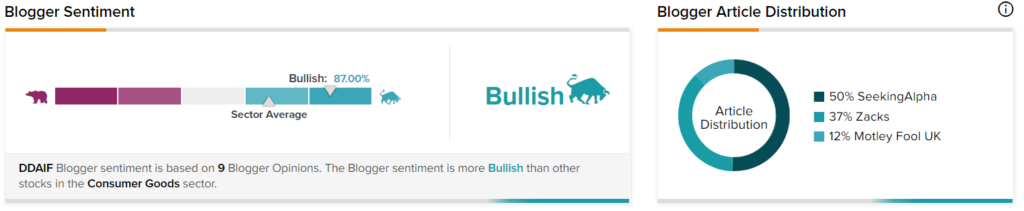

TipRanks data shows that financial blogger opinions are 87% Bullish on Mercedes-Benz, compared to the sector average of 68%.

Conclusion

With an increased number of consumers becoming aware of the harmful impacts of greenhouse gases on the environment, the adoption of renewable energy sources is what the future holds. Mercedes-Benz’s aim of becoming carbon neutral by 2039 is a step in the right direction. The company’s halfway target of reducing CO2 emissions by 50% by 2030 only shows its commitment to the plan.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Moderna Recalls 764,900 COVID-19 Doses in Europe

Strong Beginning Expected for Silicon Motion

Zynex Releases Q1 Expectations