Membership Collective Group Inc. (NYSE: MCG) revealed that its Board has authorized a stock repurchase program to repurchase the Company’s Class A common stock worth $50 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, MCG shares of the company gained 2.8% during the extended trading hours.

The Membership Collective Group (MCG) is a global membership platform of physical and digital spaces that connects a vibrant, diverse, and global group of members helping them work, socialize, connect, create and flourish all over the world.

According to the current buyback program, the company will repurchase its outstanding Class A common shares either on the open market or in privately negotiated transactions in the United States.

CEO Comments

Sharing his confidence in the positive long-term outlook, MCG Chairman, Ron Burkle, commented, “This step reflects our belief in the favorable long-term opportunity ahead, given the company’s scale and pace of international growth.”

He further added, “With an accelerated pipeline of nine new Soho House openings this year and eight to ten per year thereafter, together with an increased demand for memberships, expansion into new markets, and positive momentum post Covid, we remain increasingly confident in the future performance of MCG.”

Analyst Recommendation

On March 18, Morgan Stanley analyst Thomas Allen reiterated a Buy rating on Membership Collective Group with a price target of $11 (47.85% upside potential).

The rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on two Buys and one Hold. The average Membership Collective stock price projection of $10 implies 34.41% upside potential to current levels, at the time of writing.

Investors Weigh In

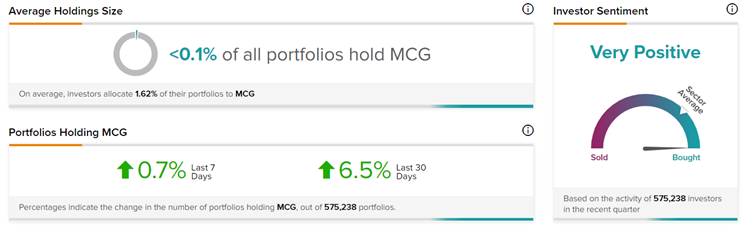

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Membership Collective, with 6.5% of investors increasing their exposure to MCG stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Wallbox Q4 Revenues Grow Over 165%; Shares Leap 10%

RumbleOn Smashes Q4 Estimates; Shares Up 18%

Williams-Sonoma Shares Gain 8.2% on EPS Beat & 10% Dividend Hike