Global mergers and acquisitions reached $4.8 trillion in 2025, according to Dealogic data. That marked a 41% increase from 2024 and made this year the second-strongest on record, behind only 2021. The rise came as large firms pursued scale and leveraged looser regulatory conditions under the Trump administration.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Mega Deals Lead the Charge

One of the year’s most notable trends was the return of high-value deals. A record 70 transactions globally were valued above $10 billion, with 22 of them announced in the fourth quarter. Companies moved quickly to expand their footprint while market conditions remained favorable.

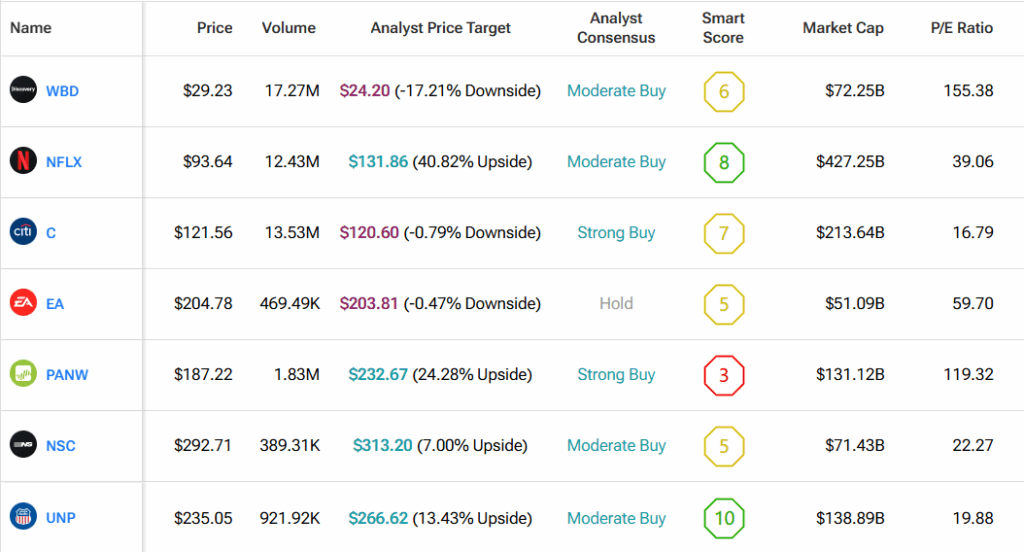

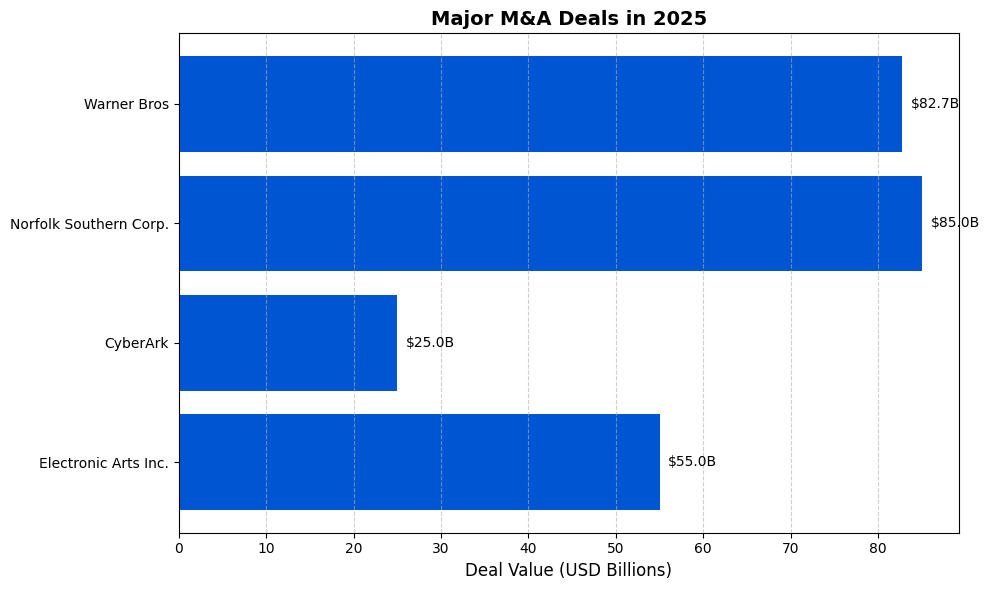

Key transactions included Netflix (NFLX) acquiring Warner Bros. (WBD) for $82.7 billion. Union Pacific Corp. (UNP) announced an $85 billion merger with Norfolk Southern (NSC). Palo Alto (PANW) also acquired CyberArk (CYBR) for $25 billion, highlighting ongoing consolidation in cybersecurity.

Private equity was also active. Global buyout value hit $1.1 trillion, up 51% from 2024. The largest leveraged buyout on record closed this year, as Electronic Arts (EA) was taken private for $55 billion by a group that included Silver Lake, Saudi Arabia’s Public Investment Fund, and Affinity Partners.

Cross-Border and Tech Activity Rise

Cross-border M&A saw a major rebound, with deal value rising 46% to $1.24 trillion. That made 2025 the strongest year for international deals since 2021. Companies based in the U.S. and U.K. were the most common targets, while acquirers from the U.S., France, and Japan were the most active.

Meanwhile, technology remained a hot sector. M&A in tech climbed 76% to $478 billion. Much of that was driven by increased spending on AI platforms and infrastructure, as firms raced to build or acquire new capabilities.

Outlook for 2026

Dealmakers expect momentum to carry into 2026. Several potential transactions valued between $50 billion and $70 billion are already in development. According to Citi (C), a $100 billion tech deal is also possible if current trends continue.

The broader environment continues to favor larger firms with access to capital and policy tailwinds. As companies seek growth through consolidation, deal volume could remain high in the near term.

We used TipRanks’ Comparison Tool to align all the tickers mentioned in the piece. This is a great tool for gaining an in-depth look at each stock and the broader industries.