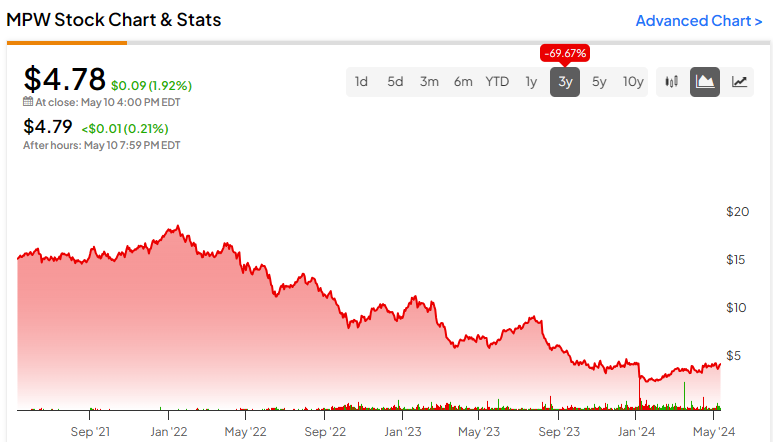

Medical Properties Trust (NYSE:MPW), a REIT involved with medical properties (also known as MPT), recently reported its Q1-2024 earnings results. In a nutshell, efforts to stabilize Steward Health, the REIT’s largest tenant operator, have failed, with the company filing for bankruptcy. As a result, Medical Properties Trust had to write off certain loans and investments it had made to Steward. Even so, Medical Properties Trust remains attractively priced relative to peers, with a rebound in operating performance expected once Steward-operated hospitals change to new operators later this year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I am bullish on the stock due to its attractive valuation on a firm-wide basis and the defensive nature of its hospital portfolio. Nevertheless, investors need to be mindful of its high leverage and the need for management to preserve liquidity.

Medical Properties Trust’s Operational Overview

Medical Properties Trust, or MPT, is one of the largest owners of hospital real estate. The company is active in 31 U.S. states and several international markets. As of Q1 2024, MPW managed a total of 436 properties, with 60.2% of the company’s revenue coming from the U.S. market, with the remaining 39.8% coming from international operations, primarily in the U.K.

MPT’s Q1-2024 results were characterized by significant impairments and write-offs primarily related to long-troubled tenant Steward Healthcare, which filed for Chapter 11 bankruptcy. MPT provided a $75 million debtor-in-possession lifeline so that the hospitals Steward manages continue operating until they are transferred to a new operator under the bankruptcy procedure.

Together, these charges had a negative impact of $744 million on MPT’s bottom line. To adjust for these effects, MPT reports normalized funds from operations (an indicator similar to adjusted funds from operations, or AFFO, a cash-flow metric commonly reported by REITs).

In Q1 2024, normalized funds from operations were $0.24/share, down 35.1% year-over-year. The decrease was the result of lower revenues and higher interest costs despite some deleveraging over the past year. Importantly, Steward Healthcare was not paying full rent in Q1 2024, as MPW was involved in efforts to save the troubled hospital operator.

Hence, while the normalized funds from operations drop is dramatic, there should not be a greater reduction in Q2 2024, notwithstanding the uncertainty related to MPW transferring hospitals to new operators under the bankruptcy procedure.

Net debt amounted to $9.9 billion at the end of Q1 2024, significantly above the company’s $2.8 billion market capitalization. As a result, generating liquidity through asset sales and retained earnings remains a priority for the company.

After the end of Q1, MPT sold a 75% interest in five Utah hospitals for total proceeds of $1.1 billion. Even after this transaction, net debt will account for 76% of Medical Properties Trust’s enterprise value (a metric that combines the company’s market capitalization and net debt), underscoring the need for further disposals. The good news is that management expects to exceed their initial target of $2 billion in 2024 cash generation from disposals.

What Medical Properties’ Capitalization Rate Tells Us

It is always important to consider the capitalization rate (the rate of return on a real estate investment property based on its expected cash flows) of a REIT you invest in and not just the yield based on normalized funds from operations. Usually, to increase returns, REITs borrow from banks and other lenders. This often results in high normalized funds from operations yield.

However, if the REIT needs to sell a property on the market, the buyer will consider the capitalization rate, as it encompasses all cash flows of the property to equity and debt holders combined.

To arrive at Medical Properties Trust’s capitalization rate, we can combine the current normalized funds from operations run-rate amount and interest expense, multiply it by four since it is a quarterly number, and divide the result by the company’s enterprise value. Importantly, normalized funds from operations already exclude meaningful rent contributions from Steward Healthcare.

In Q1 2024, normalized funds from operations amounted to $142 million, while the company’s interest expense was $109 million. As a result, MPT currently produces about $1 billion annually, available to pay interest on debt and dividends to shareholders. Against an enterprise value of about $12.7 billion, the market-implied capitalization rate is about 7.9%.

As Steward hospitals restart operations under new operators, MPT’s revenues are likely to see a rebound, with the exact amount highly uncertain. My best estimate is an incremental revenue of about $50 million on a quarterly basis, providing an uptick to MPT’s market cap rate of about 1.55% after property expenses.

The capitalization rate allows investors to compare REITs with different levels of financial leverage (the portion of the enterprise value funded by debt, which, at Medical Properties Trust, is about 75%, a very high amount) since it looks at cash flows at the enterprise level rather than to shareholders specifically. The high amount of financial leverage exposes MPT to excessive interest rate risk.

The cap rate is also useful when comparing the absolute return potential of Medical Properties Trust as an investment and makes it easy to compare it to other alternatives, such as government bonds. For instance, the 10-year U.S. government bonds currently yield around 4.45%.

Last but not least, the 7.9% cap rate can be seen as the expected return before the use of leverage, inflation indexation, or rental growth.

MPW Stock Is Attractively Priced Relative to Peers

Despite receiving little rent from Steward in Q1 2024 and seeing normalized funds from operations fall 35.1% year-over-year, MPT is attractively priced relative to peers. This is shown in the table below, where I highlight Cofinimmo (DB:COF), a company active in European healthcare real estate, and Sabra Health Care REIT (NASDAQ:SBRA), which owns healthcare facilities primarily in the United States:

As you can see from the data above, even if we exclude the potential restart of Steward-operated hospitals and the associated revenue boost for Medical Properties Trust, MPT is attractively priced relative to peers, notwithstanding MPT’s elevated leverage.

Given recent sales of U.S. assets and the bankruptcy of Steward, the importance of European operations for MPT has increased significantly. Interest in these assets is potentially higher as well, given the faster rate cuts expected from the Bank of England and the European Central Bank, as opposed to the Federal Reserve.

Federal Reserve Interest Rate Cuts Coming

While initial expectations for the Federal Reserve to cut interest rates in March/June proved too optimistic, the broad market consensus now expects the long-awaited monetary policy easing cycle to commence in July/September. Futures pricing indicates a Fed funds rate of 4.75-5.00% in December 2024, or 0.5% lower than today’s 5.25-5.50% target range.

Will Medical Properties Trust Cut Its Dividend?

As discussed on the conference call, the management board of MPT will meet on May 30 to discuss the dividend level, which currently sits at $0.15/quarter. While the current payout is a manageable 63% of normalized funds from operations, the company can only finance the large dividend payments due to the low 4.16% weighted average cost of its debt. As such, I reckon a dividend reduction cannot be ruled out and will largely depend on the progress the company makes with asset sales and the quick resolution of Steward’s bankruptcy.

In the longer term, I expect the dividend to move to $0.1/quarter, which would be in line with the company’s cash generation potential and the need to repay debt. If the company cuts its dividend and the stock drops, I would certainly see it as a buying opportunity.

Is MPW Stock a Buy, According to Analysts?

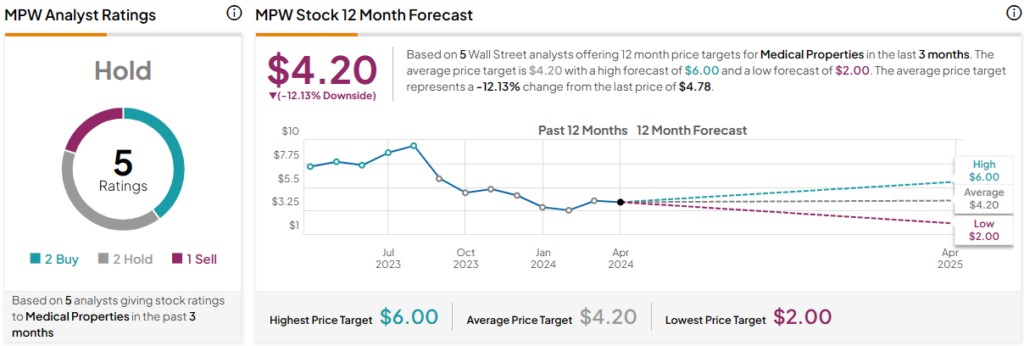

Turning to Wall Street, Medical Properties Trust earns a Hold consensus rating based on two Buys, two Holds, and one Sell rating. Additionally, Medical Properties stock’s average price target is $4.20, implying 12.1% downside potential.

The Takeaway

Efforts to stabilize Steward Health have failed, with Medical Properties Trust’s largest tenant filing for bankruptcy. Even so, the negative outcome was already priced in the shares, with the company trading at a discount to peers, even if we exclude Steward’s incremental revenue contribution once hospitals move to new operators.

I am bullish on MPW stock, given the persistent discount relative to peers, with deals to transfer Steward-operated hospitals later this year likely to be a catalyst for the stock. That said, leverage remains elevated and I expect the company to reduce its dividend payment to $0.1/quarter in a bid to preserve liquidity and align its payout with the underlying cash generation of the business.