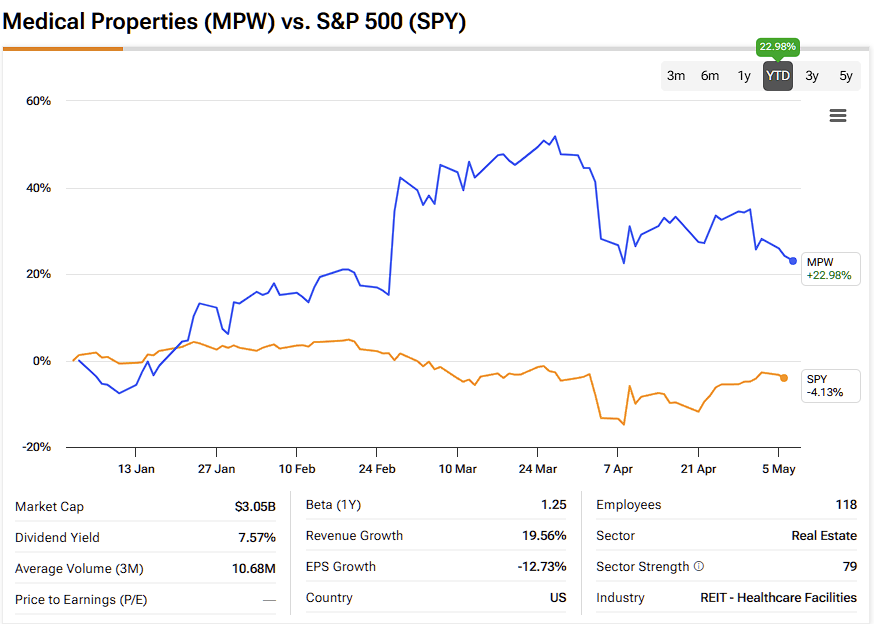

Medical Properties Trust (MPW), the real estate investment trust (REIT) specializing in acquiring hospital facilities, and one of the largest owners of hospital real estate worldwide, recently reported Q1 2025 results impacted by higher financing costs. The company’s cash generation is set to improve as tenants taking over bankrupt Steward Health Care properties are scheduled to pay higher rents in the coming quarters.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I remain bullish on MPW stock as the company is gradually recovering from tenant bankruptcies. Moreover, MPW’s exposure to Europe is significantly overlooked, with the REIT trading at a significant discount to recent M&A transactions in healthcare real estate on the Old Continent.

Q1 2025 Result Highlights

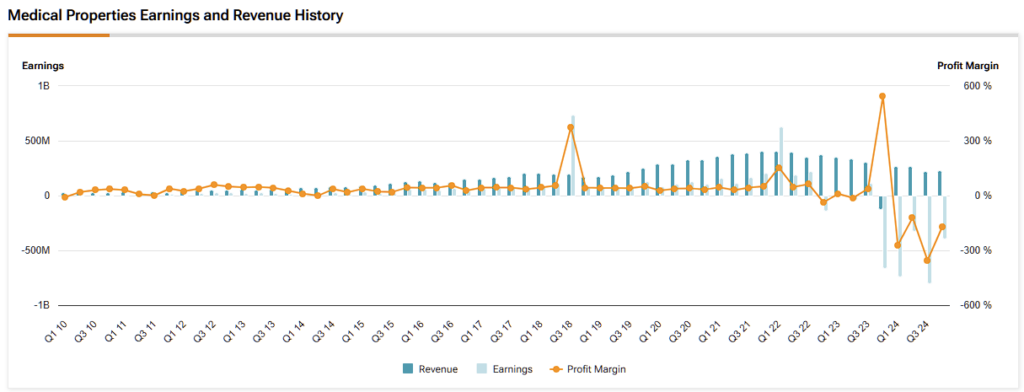

Medical Properties Trust uses normalized funds from operations (NFFO) as its key performance measure. In Q1 2025, NFFO stood at $0.14/share, down $0.04/share quarter-over-quarter, reflecting primarily the impact of recently issued financing. The bottom in NFFO will likely be reached in Q2 2025 when the company anticipates an incremental $0.02/share NFFO impact from higher interest expenses.

The good news is that the REIT has addressed all 2025 maturities, implying that interest costs should remain broadly stable over the remainder of the year. At the same time, tenants who took over bankrupt Steward Health Care properties are ramping up rent payments, indicating that NFFO should tick up in the second half of 2025 and 2026.

For example, rent from former Steward Health Care properties amounted to only $4 million in Q1 2025. It is scheduled to increase to $23 million in Q4 2025 and $40 million in Q4 2026. All in all, quarterly NFFO is set to jump by as much as $0.06/share by the end of 2026.

MPW’s European Portfolio

While Medical Properties is best known for the recent bankruptcies of some of its U.S. tenants, the REIT has a significant presence outside the U.S. In fact, at the end of Q1 2025, only 53% of the REIT’s portfolio was located in the U.S., with non-U.S. properties accounting for the remaining 47%. The largest overseas market for MPW is the United Kingdom, followed by Switzerland and Germany.

M&A activity is picking up on the Old Continent, with Aedifica offering to acquire Cofinimmo in an all-stock deal. My estimates show that the transaction may occur at a capitalization rate (net rent minus property operating expenses relative to the property’s value) of around 6.1%.

MPW’s Market-Implied Cap Rate

Putting the 6.1% capitalization rate into context, Medical Properties Trust reported annualized Q1 2025 NFFO and interest expenses of about $788 million, set to increase to about $932 million by the end of 2026 due to the aforementioned rents from former Steward Health Care properties. Relative to MPW’s enterprise value of $11.4 billion, we see that MPW’s market-implied capitalization rate stands at about 8.16%.

Moreover, it is common practice in real estate transactions to add general and administrative expenses when calculating the capitalization rate. General and administrative expenses have averaged $140 million in recent years at MPW. As such, MPW’s 2026 cash flows are likely to reach $1 billion to a strategic buyer, indicating the market-implied cap rate from an acquirer’s perspective is even higher, at 9.39%.

The silver lining is that MPW’s enterprise value is 73% funded with debt. As such, I believe MPW’s common stock offers significant upside should it decide to sell its European portfolio at terms close to those of the Aedifica/Cofinimmo transaction.

It would be fair to say that the value of MPW’s European portfolio is considerably overlooked. Instead, investors have paid outsized attention to MPW’s troubles with U.S. tenants, which are now slowly being addressed.

Is Medical Properties Trust Stock a Good Buy?

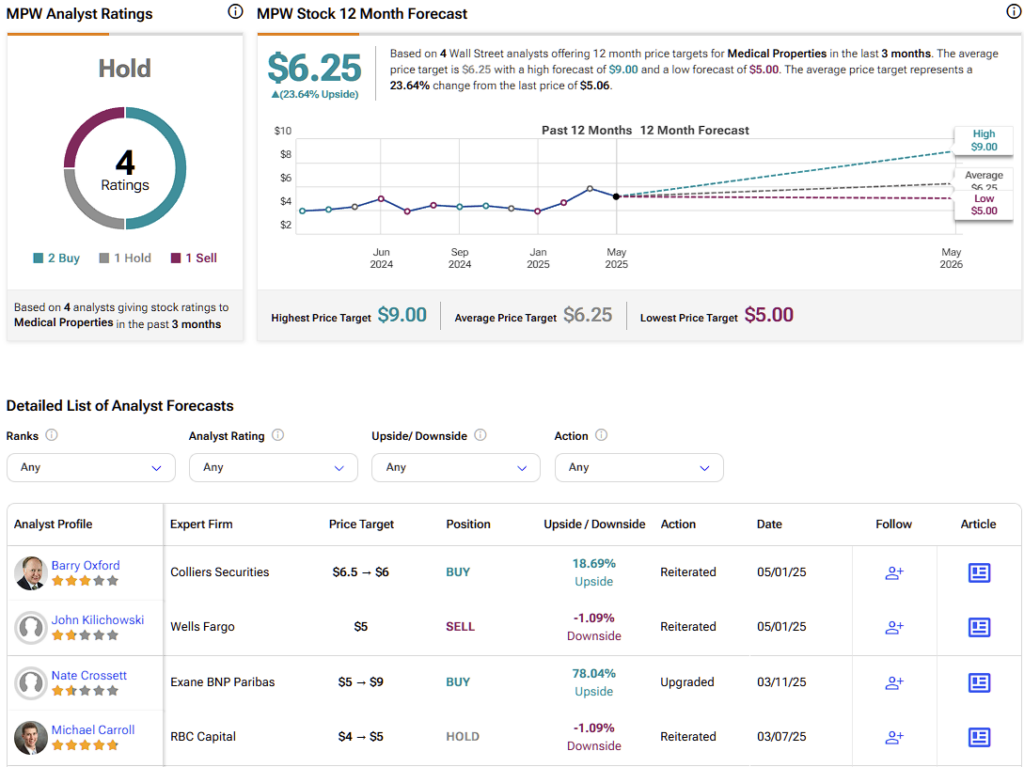

On Wall Street, MPW stock has a consensus rating of Hold based on two Buy, one Hold, and one Sell ratings over the past three months. MPW’s average stock price target of $6.25 implies more than 23% upside potential over the next twelve months.

MPW Set for Rebound as Europe Strengthens

In Q1 2025, Medical Properties Trust reported slumping normalized funds from operations relative to the prior quarter as the company began to absorb the cost of recently issued financing. Looking ahead to 2026, NFFO is set to improve primarily thanks to higher rent payments of tenants taking over properties from Steward Health Care.

MPW’s exposure to Europe remains significantly overlooked. There, MPW has faced few problems with tenants. Moreover, recent M&A transactions such as Aedifica’s offer to acquire Cofinimmo point to significant upside in MPW stock. This is due to the attractive market-implied capitalization rate MPW trades at relative to its expected 2026 cash flow run-rate.

Wall Street analysts also share my enthusiasm for MPW, forecasting an average return of about 23% over the next 12 months. As such, I remain bullish on MPW, notwithstanding risks related primarily to the company’s huge debt pile as evidenced by the 73% proportion of net debt in the REIT’s enterprise value.