Medtronic (MDT) reported better-than-expected Fiscal Q2 results. The medical device company reported adjusted earnings of $1.26 per share in the Fiscal second quarter, compared to $1.25 per share in the same period last year. This was slightly above consensus estimates of $1.25 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

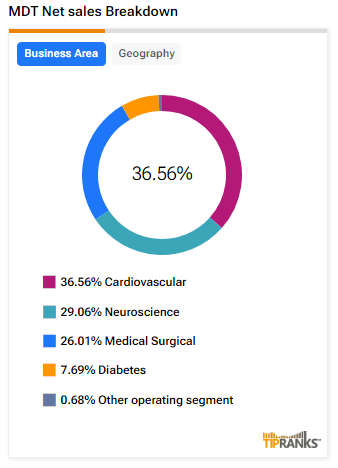

MDT’s Cardiovascular Unit Drives Q2 Revenues

Furthermore, the company’s second-quarter revenues increased by 5.3% year-over-year to $8.4 billion in the third quarter. This exceeded Street estimates of $8.27 billion.

The company’s cardiovascular unit clocked revenues of $3.1 billion in the second quarter, up by 6.1% year-over-year and comprised more than 35% of its total revenues.

MDT Raises FY25 Revenue Guidance

Looking ahead, the company raised its FY25 revenue guidance and expects its organic revenues to rise in the range of 4.75% to 5%, compared to its prior forecast of 4.5% to 5%. Furthermore, MDT has projected adjusted earnings in the range of $5.44 to $5.50 per share, up from its previous outlook of $5.42 to $5.50 per share. For reference, analysts are expecting earnings of $5.45 per share.

Gary Corona, MDT’s Interim CFO, commented, “…as the impact from foreign currency abates, we expect to report high-single-digit adjusted EPS growth in the back half of our Fiscal year, in line with our long-term commitment to deliver durable, mid-single-digit organic revenue growth with EPS leverage.”

Is MDT a Good Stock to Buy?

Analysts remain cautiously optimistic about MDT stock, with a Moderate Buy consensus rating based on 10 Buys, 10 Holds, and two Sells. Over the past year, MDT has soared by more than 15%, and the average MDT price target of $94.37 implies an upside potential of 7.7% from current levels. These analyst ratings are likely to change following MDT’s results today.