Leading snack company Mondelez International (NASDAQ:MDLZ) delivered better-than-expected Q1 2024 financial results. However, MDLZ stock fell 1.31% in Tuesday’s after-hours trading due to slowing volume growth and expected cost inflation in the upcoming quarters.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Before delving into MDLZ’s first-quarter financial performance, it’s important to note that the company remains relatively well-protected against rising cocoa prices due to commodity hedging activities. Further, the company is focusing on pricing strategies to counter cost inflation.

Nevertheless, the company acknowledged that the impact of cost inflation will pose a more significant headwind in the remaining quarters of 2024 than in Q1.

Q1 Sales and EPS Exceed Expectations

Mondelez delivered total revenue of $9.29 billion in Q1, up 4.2% year-over-year, driven by a 6.3% increase in pricing. However, the company’s volumes decreased by 2.1% in the first quarter, reflecting customer disruption in Europe and softness in the biscuit market in the U.S. Moreover, unrest in the Middle East and production slowdowns in Mexico also remained a drag.

Meanwhile, higher pricing and cost efficiency drove its operating income in Q1 and supported bottom-line growth. Mondelez posted Q1 adjusted earnings of $0.95 per share, up 16.3% on a constant currency basis, reflecting a reduction in interest expenses, and a decrease in outstanding share count. Moreover, it surpassed the Street’s estimate of $0.89 per share.

Is Mondelez a Buy or Sell?

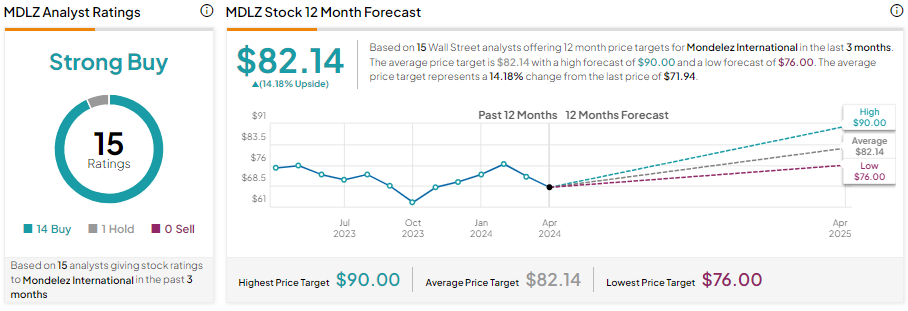

Wall Street is bullish about Mondelez stock. It has 14 Buy and one Hold recommendation for a Strong Buy consensus rating. MDLZ stock has remained flat so far this year. Analysts’ average price target on MDLZ stock is $82.14, which implies 14.18% upside potential from current levels.