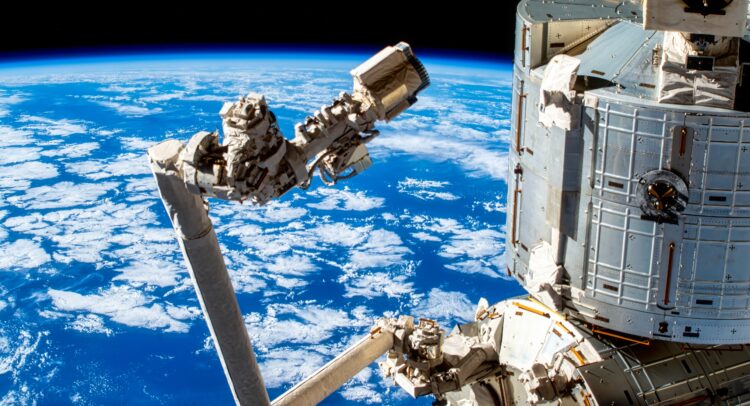

For those not familiar with MDA Ltd. (TSE:MDA), it actually has a pretty exciting product line. The Canadian company offers up a line of robotic arms geared toward use in space and just launched its latest version of the Canadarm system, known as the Skymaker. But this didn’t help it much with investors, who sent shares down fractionally in Monday morning’s trading.

MDA’s Skymaker is a refinement of the Canadarm system, which has been providing support to space missions since 1981. The Skymaker will offer a complete set of robotics that are both modular and scalable, helping to ensure that each mission has just enough arm to do its job without needing to overbuy to get the task accomplished.

This makes the Skymaker a more flexible and efficient option since its modular nature allows the product to adapt to conditions. Considering the rise of private enterprise space missions, that could make it particularly attractive.

A Boost from Another Source

But MDA isn’t just building better robotic arms. It’s also part of the Telesat project, which will bring the Lightspeed low Earth orbit (LEO) broadband constellation to Canada. This is similar to the Starlink project that’s already bringing high-speed internet access to points across the globe. In fact, the Canadian government recently announced that it was planning to boost its initial investment by as much as 50% to help Telesat get the project off the ground. Since MDA is making the satellites that will comprise the broadband constellation, that should mean good news for it as well.

What Is the Price Target for MDA Stock?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MDA stock based on three Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 106.42% rally in its share price over the past year, the average MDA price target of C$16 per share implies 11.27% upside potential.