Iconic toy manufacturer Mattel (MAT) is at a critical juncture following a takeover bid from private equity firm L Catterton. Amid struggling turnaround efforts and stagnant sales, this news caused a 17% spike in Mattel’s stock price in the past few days and has sparked anticipation about a potential counterbid from sector rival Hasbro(HAS), who has previously shown an interest in Mattel.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The toy giant’s ability to successfully manage its IP while remaining profitable has been scrutinized. However, the recent takeover offer may present a new opportunity to unlock Mattel’s value in the marketplace. It’s a highly speculative and long-term situation, so investors may want to watch from the sidelines.

Mattel Under Pressure

Mattel is a global toy manufacturing giant that produces and markets a wide array of toys and games, spanning notable brands such as Barbie, Hot Wheels, Fisher-Price, and UNO. Mattel has an extensive portfolio, including dolls, die-cast vehicles, and infant and toddler products, and licensing popular brands from partners like Disney (DIS) and WWE (WWE).

Reuters recently reported a potential acquisition offer from L Catterton, a private equity firm backed by LVMH (LVMUY). It’s anticipated this news might trigger a bidding war with other potential contenders. It should be noted that Mattel is not actively seeking a sale at this moment. However, the company has been under pressure from activist investors like Barington Capital to enhance performance and consider strategic options for some of its brands.

The acquisition talks come at a difficult time for the toy industry, which is grappling with decreased demand due to rising prices. According to the Toy Association, U.S. retail sales of toys generated $28.0 billion in 2023, a year-over-year decrease of 8%.

Mattel’s Recent Financial Results & Outlook

Mattel recently released its Q2 2024 financial report, reporting revenue of $1.08 billion, slightly short of the analysts’ estimates of $1.1 billion. Total net sales were down 1%, as sales performance varied across regions and segments, with North American sales down by 3% and International sales increasing by 2%. Gross margin improved to 49.2%, marking an increase of 410 basis points. Operating Income improved by $20 million to $83 million, with an adjusted operating income of $96 million. The company also reported a net income improvement of $30 million, reaching $57 million. Adjusted earnings per share (EPS) came in at $0.19, exceeding the analysts’ estimates of $0.17.

Management has released its full-year guidance for 2024, predicting net sales of roughly $5.4 billion. The adjusted gross margin is projected to be between 48.5% and 49%, up from 47.5% in 2023. Adjusted EPS is expected to range from $1.35 to $1.45, compared to $1.23 in 2023. Adjusted EBITDA guidance is set between $975 million and $1.025 billion, an increase from $948 million in 2023. Also, capital expenditures are estimated between $175 million and $200 million. However, free cash flow is expected to decrease to around $500 million from $709 million in 2023.

What Is the Price Target for MAT Stock?

Shares have been relatively range-bound over the past three years, leaving the stock down roughly 10%. It trades near the middle of its 52-week price range of $15.87 – $22.64 and, thanks to the recent price spike, shows positive price momentum by trading above its 20-day (17.09) and 50-day (17.33) moving averages. It trades at a slight discount to industry averages, with a P/S ratio of 1.24x, compared to the Leisure industry average of 1.9x.

Analysts following the company have been cautiously optimistic about the stock. For example, Bank of America analyst Alexander Perry recently reiterated a Buy rating on the shares, with a price target of $26.00. Perry noted the company’s higher-than-anticipated quarterly earnings per share, owing to gross margin improvements from cost savings and deflation. Further, he believes that Mattel is well-positioned for a robust second half.

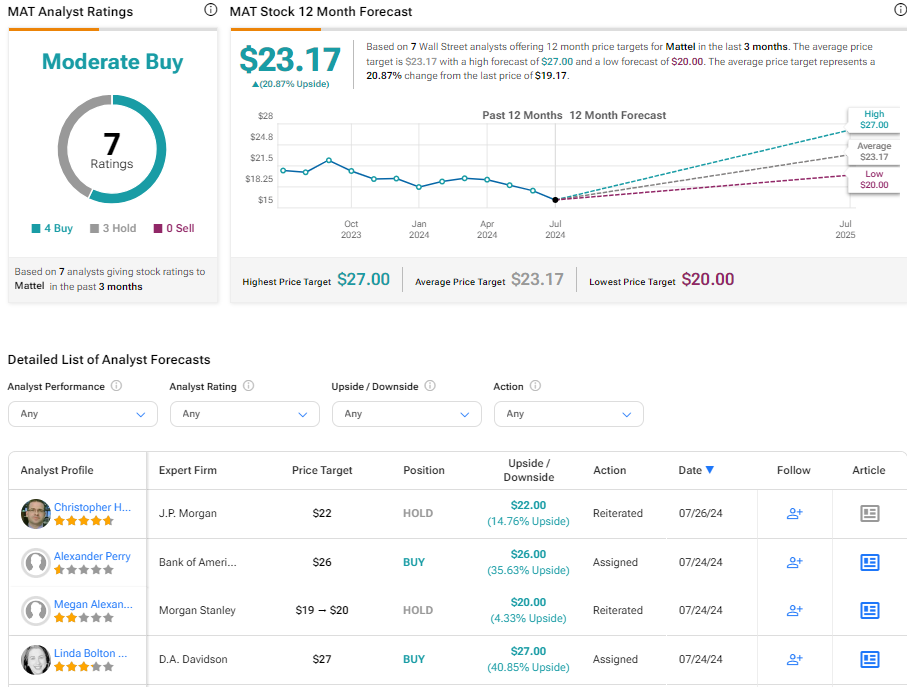

Based on seven analysts’ recommendations and price targets, Mattel is rated a Moderate Buy overall. The average price target for MAT stock is $23.17, representing a potential upside of 20.87% from current levels.

Mattel in Summary

The report of a proposed acquisition by L Catterton sparked a noticeable upsurge in Mattel’s stock price. The company boasts a robust product portfolio of iconic brands. Yet, the toy market has had a rough few years, and while the company’s financial results revealed some growth areas, overall net sales were down. While the company’s future direction is uncertain, the recent unfolding events at Mattel are intriguing, especially for speculators looking to play the potential acquisition. Long-term investors, however, may want to leave this one to the gamblers for now.