Shares of dating services provider Match Group (NASDAQ:MTCH) are feeling the heat today after the company’s fourth-quarter numbers disappointed investors.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue dropped 2.5% year-over-year to $786.15 million, missing the cut by about $1.2 million. EPS at $0.30 though missed expectations by an even wider margin of $0.16. The number of payers dropped by 1% to 16.1 million and RPP too trended lower to $16. Further, Tinder’s direct revenue remained flat year-over-year and saw a 2% drop in RPP. All other brands of the company saw a 5% revenue decline coupled with an 8% decline in payers.

On the bright side, Hinge saw a 30% jump in direct revenue during this period. For 2023, the company is banking on expanding monetization, optimizations, and boosting core experience and engagement to drive app usage and top line.

MTCH expects revenue growth to range between 5% and 10% and Hinge to generate ~$400 million in direct revenue for the year.

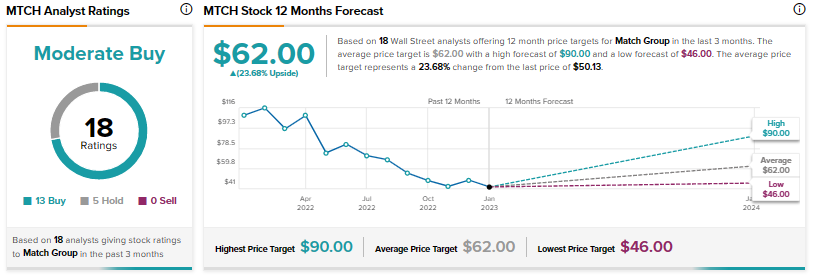

Overall, Wall Street’s consensus price target of $62 points to a potential 23.68% upside in the stock. That’s after a 55% drop in MTCH shares over the past year.

Read full Disclosure