Shares of payment processing company Mastercard (NYSE:MA) fell in trading after a bleak forecast. The company expects revenues to grow in the low double digits year-over-year in the fourth quarter. Mastercard reported adjusted earnings of $3.39 per share in the third quarter, up by 24% year-over-year on a currency-neutral basis, which beat analysts’ consensus estimate of $3.21 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The company’s Q3 net revenues increased by 11% year-over-year to $6.5 billion, in line with analysts’ expectations.

Is MA a Good Stock to Buy Now?

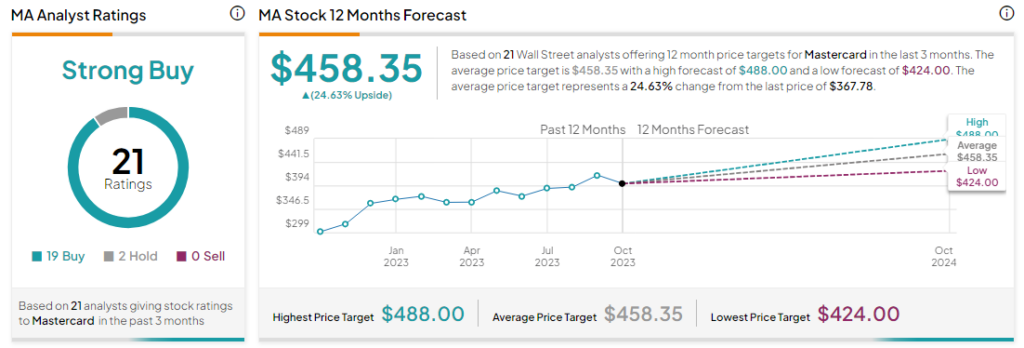

Analysts are bullish about MA stock, with a Strong Buy consensus rating based on 19 Buys and two Holds. The average MA price target of $458.35 implies an upside potential of 24.6% from current levels.