Mastercard (NYSE:MA) shares fell around 1% in the early session today after the payment solutions provider announced its results for the fourth quarter. Revenue increased by 13% year-over-year to $6.5 billion, exceeding expectations by $20 million. Further, EPS of $3.18 fared better than estimates by $0.10.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, gross dollar volume increased by 10%, and purchase volume increased by 11%. The company is witnessing robust deal momentum as cross-border volume remains buoyant. Further, its value-added services and solutions net revenue jumped by 19% due to strength in cyber and intelligence solutions.

Notably, Mastercard repurchased shares worth $9 billion in 2023. In addition, it bought back $586 million worth of shares quarter-to-date through January and had nearly $13.6 billion remaining under its share repurchase programs.

Is MA a Good Stock to Buy Now?

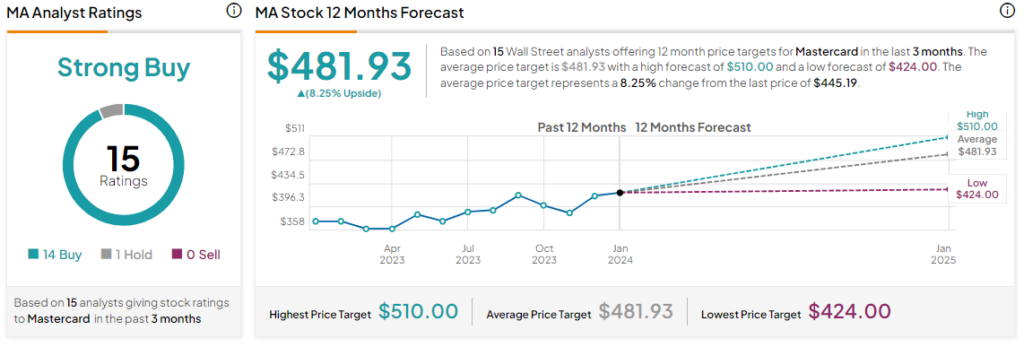

Overall, the Street has a Strong Buy consensus rating on Mastercard, and the average MA price target of $481.93 points to a modest 8.25% potential upside in the stock. That’s on top of a nearly 20% jump in the company’s share price over the past year.

Read full Disclosure