Shares of healthcare technology company Masimo (NASDAQ:MASI) are nosediving today after investors were disappointed with its preliminary top-line numbers for the second quarter.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Consolidated revenue for the quarter is now expected to hover between $453 million and $457 million. In comparison, analysts were expecting revenue of $528.7 million for the period.

While healthcare revenue is anticipated between $280 million to $282 million, non-healthcare revenue is seen landing between $173 million and $175 million. Masimo is witnessing large order delays in the healthcare segment along with challenges in the conversion of new customers. Additionally, challenges in the non-healthcare segment continue to persist with tepid demand now extending from lower-end to higher-end audio categories as well.

Consequently, Masimo is now taking initiatives to streamline costs and more details are anticipated on August 8 when Masimo is slated to announce second quarter numbers. The Street largely expects EPS for the quarter at $0.93.

The company currently expects to decrease the lower end of its full-year revenue outlook for the healthcare vertical to $1.30 billion from $1.45 billion. It also expects to decrease the revenue outlook for the non-healthcare vertical to a range of $800 million to $850 million from the prior range between $965 million and $995 million.

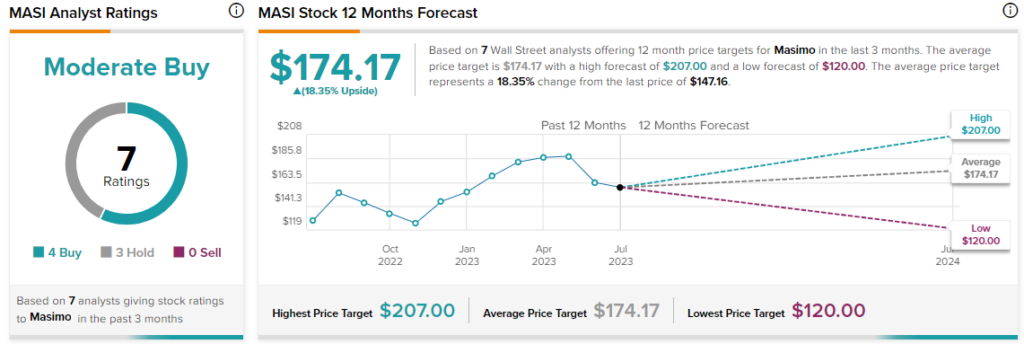

Overall, the Street has a $174.17 consensus price target on Masimo alongside a Moderate Buy consensus rating. Short interest in the stock is currently inching toward 6%.

Read full Disclosure