Shares of custom chip maker Marvell Technology (MRVL) plummeted over 6% in pre-market trading Monday after a major Wall Street firm, Benchmark Equity Research (SNEX), argued the company has lost a critical piece of business with Amazon (AMZN). Benchmark downgraded Marvell stock to Hold from Buy and withdrew its price target, citing a “high degree of conviction” that the company lost Amazon Web Services’ next-generation AI processors, Trainium 3 and 4, to its Taiwanese rival, Alchip.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This downgrade is controversial, as it directly contradicts the optimism that recently fueled an 11% surge in Marvell’s stock last week. This surge was driven by the company’s own forecast of better-than-expected growth for its data-center segment over the next two years, which many believed signaled Marvell had won the new Amazon deals.

Who Won Amazon’s Trainium 4?

The battle over the Trainium chip, Amazon’s application-specific integrated circuit (ASIC) for AI training, is central to Marvell’s long-term growth story.

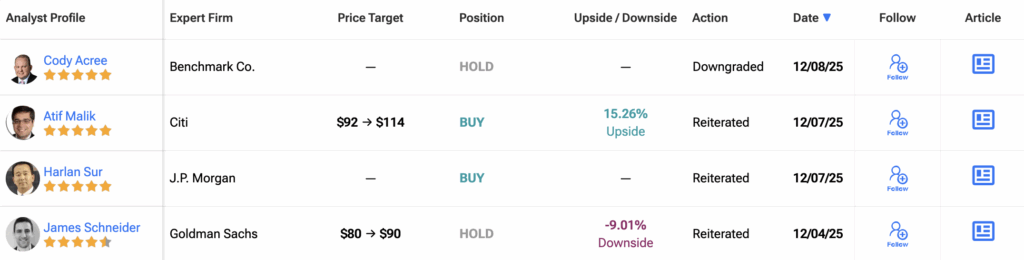

- The Bear Case (Benchmark): Analyst Cody Acree believes the recent upbeat guidance from Marvell comes only from continued volume on the older Trainium 2 program, not new wins. Based on recent industry meetings, Benchmark insists Marvell lost both the Trainium 3 and Trainium 4 designs, recommending investors “take near-term profits” due to what they call an “overly optimistic misread” of the company’s signals.

- The Bull Case (J.P. Morgan): J.P. Morgan (JPM) analyst Harlan Sur concluded the opposite from Marvell’s same outlook, believing the company did win the Trainium 4 program. J.P. Morgan stood by its Overweight rating and raised its price target to $130 from $120, betting on the continued partnership and strong growth projections for Marvell’s Data Center business.

Why The Custom Chip Fight Matters

Losing a next-generation ASIC design to a cloud “hyperscaler” like Amazon is a serious setback. These custom chips are highly lucrative, multi-year contracts that guarantee revenue growth. Marvell has spent years transforming itself into a leader in this custom silicon and optical connectivity market. If Benchmark’s claim is true, it means a significant portion of Marvell’s anticipated future AI revenue growth from its key client, Amazon, may not materialize.

Is Marvell Technology a Good Stock to Buy?

Analyst sentiment toward Marvell Technology (MRVL) is rated as a Strong Buy, based on the consensus of 29 Wall Street analysts tracked in the last three months. Of these ratings, 22 analysts call it a Buy, 7 recommend a Hold, and 0 recommend a Sell.

The average 12-month MRVL price target sits at $121.04. This target implies an upside potential of 22.37% from the last price.