Shares of Marvell Technology (MRVL) jumped over 4% on Friday. The upside came after Amazon (AMZN) highlighted rising demand for its custom-built Trainium processors, which are manufactured by Marvell. These Trainium processors are custom AI chips designed for AI training workloads in AWS.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The bullish commentary came during Amazon’s Q3 earnings call, where CEO Andy Jassy revealed that Trainium2 has become a multibillion-dollar business, growing a staggering 150% quarter-over-quarter and now fully subscribed.

“Trainium2 continues to see strong adoption,” Jassy said, adding that currently a “small number” of “very large customers” are using the chips. He expects broader adoption of the upcoming Trainium3, which is set for preview by the end of 2025.

Why It Matters for Marvell

Marvell’s role as the silicon backbone behind Amazon’s Trainium chips puts it in a key position to benefit from the AI infrastructure boom.

As Amazon expands its Bedrock AI platform, Jassy noted that most of its operations already run on Trainium, giving MRVL a strong opportunity to gain from rising demand.

Also, it is important for Marvell as it has been shifting its focus to making custom chips for cloud and AI workloads.

What Is the Forecast for MRVL Stock?

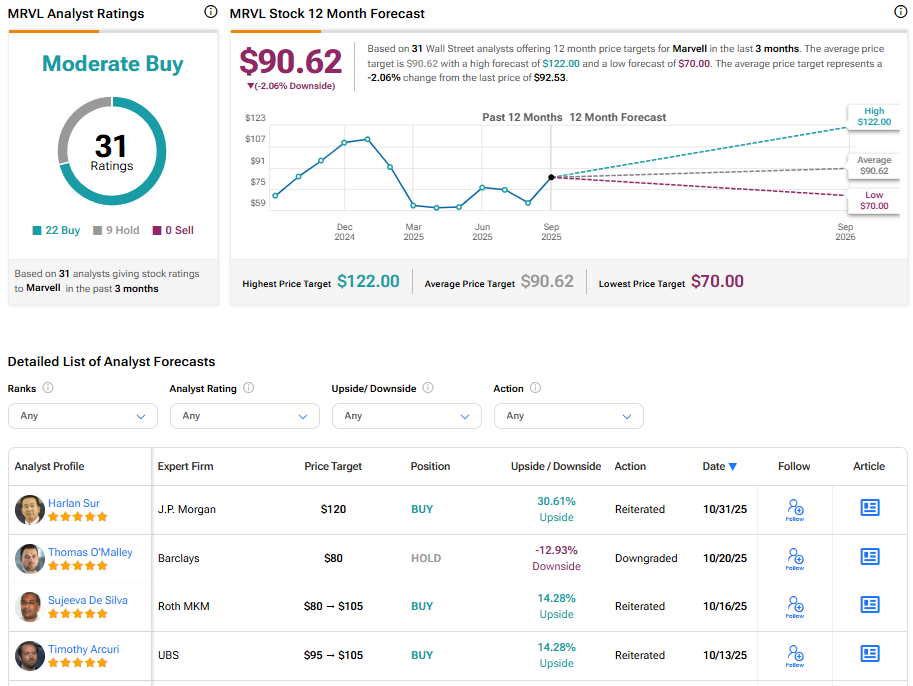

Currently, Wall Street has a Moderate Buy consensus rating on MRVL stock based on 22 Buys and nine Holds. The average Marvell stock price target of $90.62 indicates a 2.06% downside risk from current levels.