Payment card company Marqeta (NASDAQ:MQ) took it on the chin today, as investors and analysts weren’t happy about the forward guidance that was provided. As a result, Marqeta shares plunged over 22%, proving just how bad things were.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Marqeta actually led off on the right foot, putting up an earnings report that came in ahead of expectations. While Marqeta still posted a loss of $0.05 on its earnings per share figures, analysts were expecting it to post a loss of $0.09. Revenue, meanwhile, was an outright win. Marqeta generated $203.81 million in revenue, which beat the expected $202.67 million. Plus, Marqeta’s revenue figures came in 31.1% higher on a year-over-year basis. Overall, Marqeta processed $47 billion in payments for its various clients.

However, it was forward projections that proved hard to swallow for investors. Marqeta looked for net revenue growth of between 26% and 28% for the first quarter of 2023. Consensus estimates, meanwhile, expected 28.28%. That hit was enough for J.P. Morgan analyst Tien-Tsin Huang to drop his rating from Buy to Hold. Huang noted that the stock was being “…moved to the sideline” thanks to the sluggish growth projection.

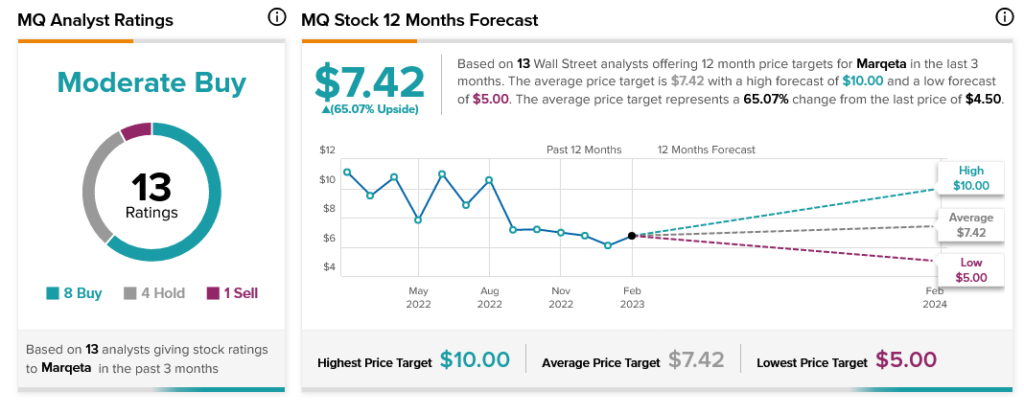

Despite this, analysts are still largely on board with Marqeta. Currently, analyst consensus calls Marqeta stock a Moderate Buy, with 65.07% upside potential thanks to its average price target of $7.42.