Marqeta (NASDAQ:MQ) shares are trending nearly 16% higher today after the card issuing platforms’ third-quarter revenue of $108.89 million exceeded expectations by $13.2 million. Further, EPS of -$0.10 landed in line with estimates.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, total processing volume increased by 33% year-over-year to $57 billion. Despite this increase, the company’s gross profit declined by 9% to $73 million due to the impact of new Cash App pricing after its contract renewal in August.

However, cost reduction initiatives helped Marqeta lower its adjusted operating expenses by 20% to $75 million. The company is witnessing momentum in sales bookings and expects to return to strong growth by the third quarter of Fiscal Year 2024.

What is the Forecast for MQ Stock?

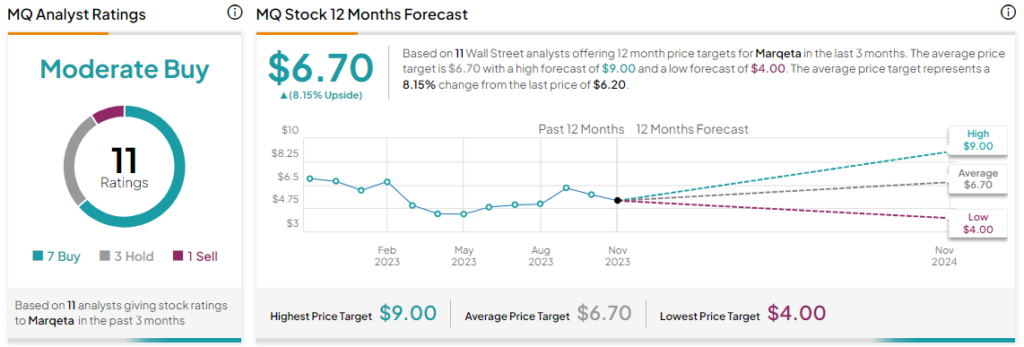

Overall, the Street has a Moderate Buy consensus rating on Marqeta. Following a nearly 38% jump in Marqeta shares over the past six months, the average MQ price target of $6.70 points to a modest 8.15% potential upside.

Read full Disclosure