Ford Motor Company (F), a leading American automaker based out of Detroit, has lost 21% of its market value in the past 12 months due to lackluster EV momentum, product quality issues, and the threat of new-age automakers. The company, however, seems like the best-positioned American automaker to surf Trump’s tariff wave. With global markets settling and gradually recovering following a “tariff pause,” Ford and several other U.S. auto stocks are in the running to become the beneficiaries of Trump’s tariff regime.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Despite the challenges faced by the broad automotive sector, I am bullish on Ford. I believe its cheap valuation fails to accurately reflect the car maker’s potential to thrive in the fast-growing U.S. EV market, now safeguarded by protectionist tariffs.

New Tariffs Will Dent Total Vehicle Sales

Although I am bullish on Ford, new tariffs will significantly impact domestic auto sales this year. The Trump administration has proposed a 25% tariff on imports from Canada and Mexico to safeguard the American auto industry, which will likely result in a significant increase in vehicle prices.

For context, in 2023, Mexico and Canada accounted for almost 50% of total motor vehicle imports and more than 54% of total motor vehicle body parts imports. The new tariffs, therefore, will have a meaningful impact on vehicle pricing in the coming months as automakers try to pass them on to consumers.

Ford CEO Jim Farley has already raised concerns regarding these new tariffs. At an investor conference last February, CEO Farley claimed that these tariffs would allow the company’s South Korean, Japanese, and European rivals to win market share in the domestic market, given that imports from these countries face lower tax rates. According to Wells Fargo analysts, new tariffs would add approximately $2,100 to American-made vehicles. Furthermore, cars produced in Canada or Mexico are likely to see a price increase of at least $8,000 due to tax policy changes.

A further increase in new car prices is likely to dent vehicle sales. According to CarEdge, the average price of a new car in the U.S. was near an all-time high of $48,641 in March. For comparison, the average new car price was close to $38,000 five years ago. This sharp increase in vehicle prices has already pushed some buyers away, and new tariffs will not help the cause.

Ford’s Domestic Production Strengths to the Rescue

One of the main reasons behind my bullish stance on Ford despite the threat posed by new tariffs is the company’s strong domestic manufacturing capabilities. As confirmed by CEO Jim Farley, Ford produces around 80% of the vehicles it sells domestically in the U.S. According to Barclays analysts, Ford’s rivals General Motors Company (GM) and Stellantis (STLA) produce only half of the vehicles they sell in the U.S. within the country. These numbers suggest that Ford is better positioned to weather the impact of new tariffs compared to its closest rivals.

Additionally, I am impressed by Ford’s recent strategic investments in expanding its domestic manufacturing capabilities further. For example, Ford announced a $7 billion investment to create one of Tennessee’s largest auto manufacturing facilities. In partnership with SK Innovation, the company has also announced a nearly $6 billion investment in a battery plant based out of Kentucky. Ford is also investing over $500 million across several states to train auto technicians in its electrification strategy. These investments highlight Ford’s commitment to growing its local manufacturing footprint, which positions the company to mitigate some of the impact of higher tariffs for imports as the Trump administration supports domestic manufacturing.

Ford’s Strategic Response is Encouraging

In addition to Ford’s domestic manufacturing strengths, I am encouraged by the company’s strategic response to new tariffs. A month before the new tariffs took effect, Ford announced a new discount campaign named “From America, For America” to offer employee pricing to all Americans.

Ford is leveraging its domestic manufacturing strengths compared to its peers and the current inventory build-up to provide these discounts at a time when its rivals are forced to hike prices to account for new tariffs. I believe these discounts will help Ford grab market share from rival Detroit automakers as the discounted prices are very attractive. For instance, an F-150 XLT hybrid model can be purchased under this program for approximately $55,000 instead of the standard price of $65,000.

Moreover, Ford has decided to extend its promotion period for EVs, dubbed “Power Promise,” despite the looming effect of tariffs. The company provides free home chargers and installation services for EV buyers as part of this program. Given Tesla’s (TSLA) charging infrastructure advantages, these types of promotions are necessary to win market share in the domestic EV market. Ford, admirably, has decided to keep its foot on the accelerator pedal despite active tariff threats.

Is Ford Motor Co. Stock a Buy or Sell?

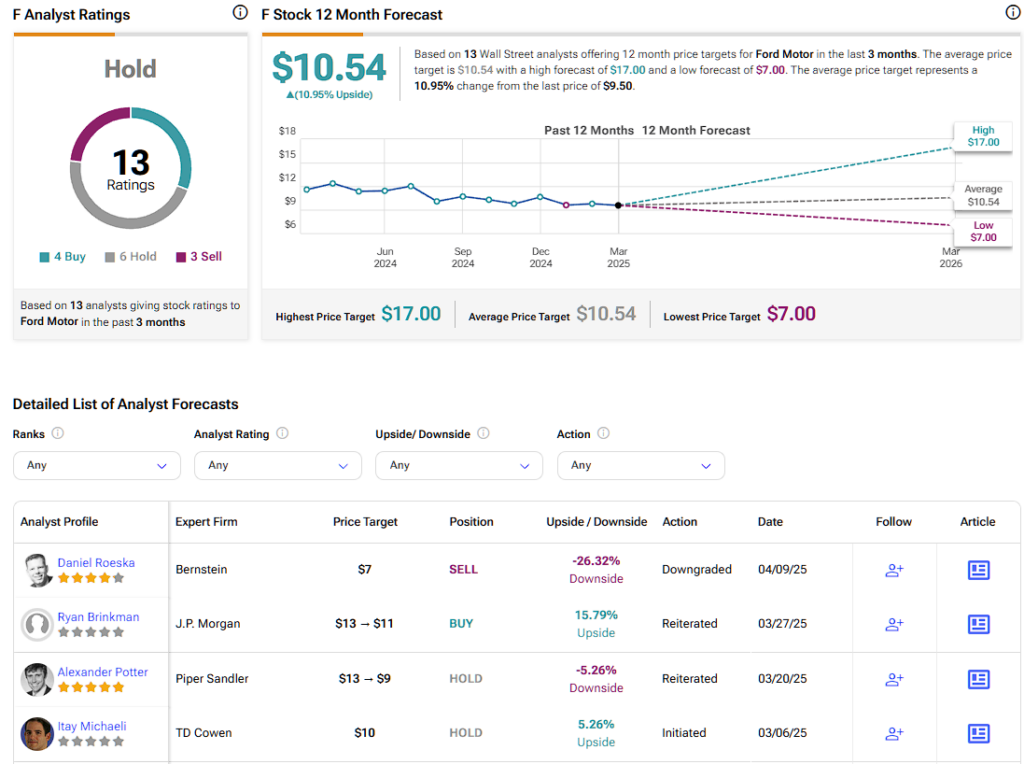

On Wall Street, Ford stock carries a Hold consensus rating based on four Buy, six Hold, and three Sell ratings over the past three months. Ford’s average price target of $10.54 implies approximately 11% upside potential over the next twelve months.

Ford’s current valuation does not accurately reflect the growth opportunities ahead of the company. At a forward P/E of just 6.4, Ford is valued like a company in financial distress when, in reality, Ford has almost $30 billion in cash and short-term investments.

The depressed valuation has also pushed the dividend yield to a very attractive 8.12%. Ford’s EV strategy seems to be on track despite recent challenges, and a recovery in this segment should lead to an expansion in the valuation multiple, as EV makers often enjoy premium valuations in the market.

Driving Forth in the Trump Era

Ford is in a better position than its Detroit rivals to weather the new tariffs imposed by the Trump administration. The company’s domestic manufacturing strengths and recently announced investments will help mitigate the threat posed by tariffs. Although it would be impossible to entirely negate the tariff impact, Ford’s current valuation offers a timely discount for investors looking to go long on U.S. protectionism. If Donald Trump sticks to his word and policy initiatives, large-scale domestic U.S. manufacturers like Ford will likely enjoy the benefits of reduced competition in the U.S. market.

.