U.S. equity markets recovered on Oct. 23, rising after falling sharply in the previous trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The benchmark S&P 500 rose 39 points or 0.58%, boosted by technology stocks as investors resumed buying after a batch of strong third-quarter financial results. The blue-chip Dow Jones Industrial Average

traded up 144 points, or 0.31%, and the Nasdaq proved to be the strongest performer, rising 201 points or about 1% on the day.

Markets got a jolt from strong gains in leading technology names such as Nvidia (NVDA), Broadcom (AVGO), and Amazon (AMZN). A 3% rise in artificial intelligence (AI) play Oracle (ORCL) also underpinned the rally in stocks and sent the market higher.

China Meeting

U.S. markets also rallied after officials in the White House said that U.S. President Donald Trump will meet with Chinese President Xi Jinping on Oct. 30 in South Korea. The announcement eased investor concerns about U.S.-China trade relations that had been exerting downward pressure on equities in recent weeks.

The rebound on Oct. 23 was welcomed after markets swooned a day earlier, with the S&P 500 losing 0.5% and the Dow falling by 334 points or 0.70%. The Nasdaq lost nearly a full percentage point as investors rotated out of riskier assets, though it made up that lost ground on Thursday.

The market also got a lift from a continued string of decent third-quarter financial results, including from technology concerns Tesla (TSLA) and IBM (IBM).

Is the SPDR S&P 500 ETF Trust a Buy?

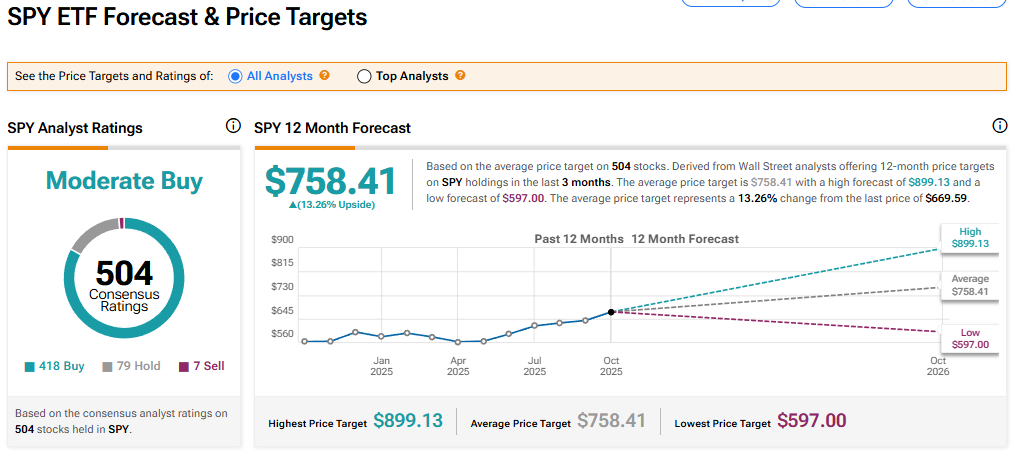

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 418 Buy, 79 Hold, and seven Sell recommendations issued in the last three months. The average SPY price target of $758.41 implies 13.26% upside from current levels.