There’s nothing fancy about the popular Schwab U.S. Large-Cap Growth ETF (SCHG), but an investment doesn’t have to be complicated to be a good one. This $36.5 billion ETF, with the simple strategy of investing in large-cap U.S. growth stocks, has made SCHG a major winner over time.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I’m bullish on SCHG based on its track record of long-term market-beating performance. Plus, its diverse portfolio of large-cap growth stocks and ultra-low expense ratio combine to make it an efficient choice for investors looking to gain exposure to a broad swath of the U.S. market’s top growth stocks.

What Is the SCHG ETF’s Strategy?

SCHG’s strategy is simple. According to Charles Schwab (SCHW), SCHG is a “straightforward, low-cost fund offering potential tax-efficiency. SCHG gives investors “Simple access to large-cap U.S. equities that exhibit growth style characteristics.”

Long-term Performance

The strategy may be simple, but it has been effective. In fact, SCHG has beaten the broader market over various time frames and for many years.

As of October 31, the Vanguard S&P 500 (VOO), a good proxy for the S&P 500, which represents the broader market, generated an annualized return of 9.0% over the past three years. SCHG edged out this performance with an annualized return of 9.3% over the same time frame.

Zooming out to five years, SCHG widens its margin of victory. While VOO returned an impressive annualized return of 15.2% over this time frame, SCHG beat it with an excellent annualized return of 19.7%. Lastly, while VOO returned 13.0% over the past decade, SCHG again bested it with an annualized return of 16.1%.

Past performance does not guarantee future results, but it’s rare to find a fund (or any investment) that can beat the S&P 500 over the past three, five, and ten years, like SCHG. When you do, it’s usually worth sticking with these long-term winners.

Eyes on the Prize

Looking at it differently, this consistently strong performance has created significant wealth for SCHG’s holders over time. As of the most recent month, an investor who put $100,000 into the fund 10 years ago would have an investment worth $431,580 today.

Portfolio of Top Growth Stocks

SCHG offers investors diversified exposure to top large-cap U.S. growth stocks. It owns 228 stocks and its top 10 holdings combine to make up 54.5% of its portfolio.

Below, you’ll find an overview of SCHG’s top 10 holdings using TipRanks’ holdings tool.

SCHG gives investors significant exposure to the stocks that have powered U.S. markets higher in recent years, like its top holding, Nvidia (NVDA), which has a weighting of 10.7%. While this weighting may be a bit high for a diversified ETF, it has served SCHG well, as Nvidia has gained 200% over the past 12 months.

Nvidia is joined in SCHG’s top 10 holdings by familiar faces in the world of mega-cap tech like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), Tesla (TSLA), Broadcom (AVGO), and Alphabet (GOOGL) (GOOG). This exposes investors to many of the U.S. and the world’s best and brightest companies and to compelling long-term themes like semiconductors, artificial intelligence, the cloud, e-commerce, and more.

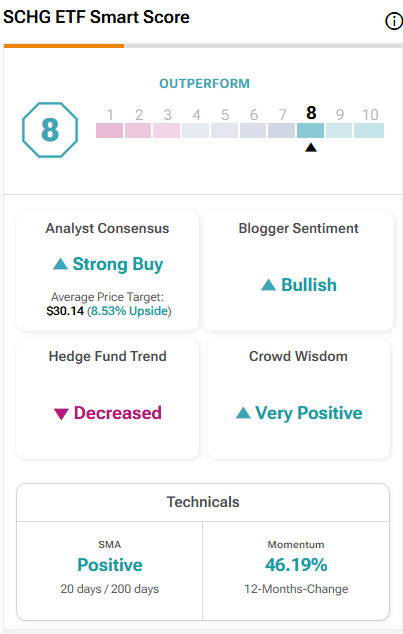

Many of these stocks are viewed favorably by TipRanks’ Smart Score system. The Smart Score is a quantitative stock scoring system created by TipRanks. Based on eight key market factors, it gives stocks a score from one to 10. Scores of eight, nine, or 10 are equivalent to an Outperform rating. Top-10 holdings like Amazon and Meta Platforms receive perfect 10 Smart Scores, while others like Nvidia, Tesla, Broadcom, and Alphabet are also highly rated. SCHG receives an Outperform-equivalent ETF Smart Score of 8 out of 10.

While SCHG certainly skews towards tech (information technology has a weighting of 48.8% within the fund), it isn’t limited to this sector—it also owns plenty of prominent names from other sectors, like Eli Lilly (LLY), Costco (COST), Visa (V), Mastercard (MA), and more.

The Low-Cost Choice

What does this market-beating performance and a strong portfolio of blue chip stocks cost investors? Not very much. SCHG charges an expense ratio of just 0.04%, meaning that an investor putting $10,000 into the fund will pay just $4 in fees over the course of a year.

These savings can really add up as your nest egg grows over time. For example, if SCHG maintains this 0.04% expense ratio and returns 5% per year going forward, which both seem like reasonable assumptions, this same investor will pay just $51 in fees over the course of the next decade.

Split in the Rearview Mirror

One interesting fact about SCHG is that it recently underwent a 4-for-1 split. Splits are common for stocks but rarer for ETFs. Still, the split doesn’t make any real difference from a fundamental perspective, as it does not change the value of a shareholder’s investment; one share of SCHG at $100 is the same as four shares of SCHG at $25 apiece.

Many high-profile stocks have executed stock splits in recent times. Like Nvidia (NVDA) or Chipotle (CMG), they have had share prices well north of $1,000 a share, so a split at least made gaining exposure to the stock more feasible for retail investors. SCHG was trading at about $105 per share before the October 10th split, so the need for a split is less obvious.

However, a split can bring some minor benefits. Lowering the price per share can make it easier for smaller retail investors to buy shares and lower the bar for starting a position, which can help to broaden SCHG’s base of holders and increase liquidity.

Primary Risk

The primary risk I see for SCHG is that many of its large holdings trade at premium valuations—the fund itself features a price-to-earnings ratio of 37.0, which is significantly higher than the broader market.

However, the fund has proven to be a consistent winner time and time again. Over a long time horizon, these are some of the market’s best and most innovative companies, so they should continue to increase their earnings power and smooth out the issue of valuation.

Additionally, it’s important to remember that, as with any investment opportunity, investors never have to go all in on SCHG or buy their full position right now. They can start a position and add a dollar-cost average over time as the market fluctuates. SCHG is also well-suited to be one building block in a balanced portfolio.

Is SCHG Stock a Buy, According to Analysts?

Turning to Wall Street, SCHG earns a Strong Buy consensus rating based on 194 Buys, 34 Holds, and one Sell rating assigned in the past three months. The average SCHG stock price target of $30.17 implies an 8.32% upside potential from current levels.

A Top Choice

I’m bullish on SCHG as a long-term investment and a great building block for investors’ portfolios. The fund simply owns a diversified portfolio of the U.S.’s top large-cap growth stocks and charges investors very little for doing so. This strategy has worked well over time, as the fund has beaten the S&P 500 over the past three, five, and 10 years and generated significant wealth for its investors.