As long as demand for AI remains relentless, Palantir Technologies (PLTR) stock will follow suit. That seems to be the market’s take on Palantir’s bullish thesis, and it’s also pretty much my investment thesis. I’m bullish for now, especially with the current market trends leading up to the company’s Q1 earnings, scheduled for publication following today’s U.S. trading session.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

This should be another quarter where the AI-powered defense darling easily beats expectations. However, investors should keep an eye on the Q2 guidance, as Palantir has consistently raised its forecasts, essentially acknowledging that demand from AI isn’t hitting the brakes anytime soon.

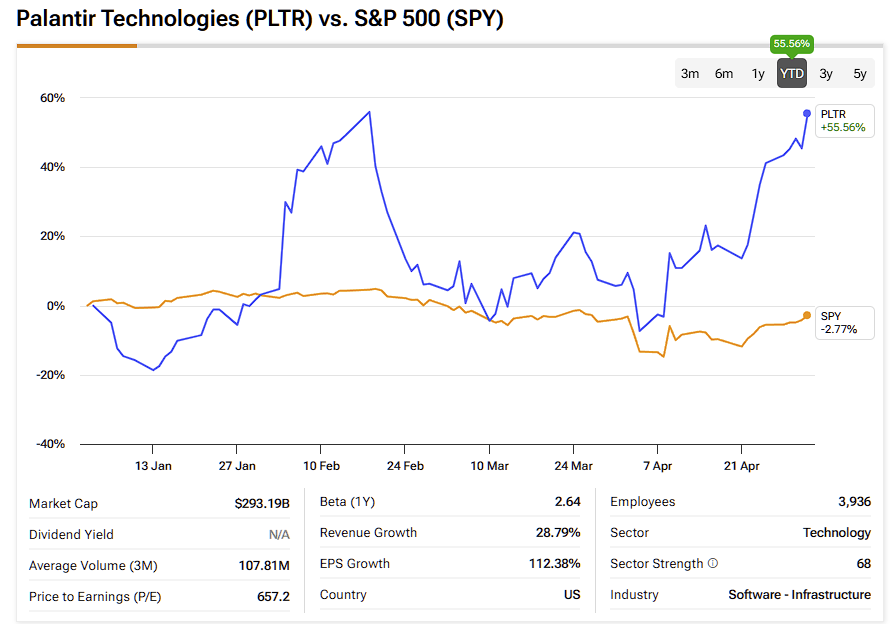

Looking at the recent developments, while the perceived risks from the macroeconomic scenario have started to ease in recent weeks, results from other Big Tech companies show that demand for AI remains strong, if not stronger than ever. The market has embraced Palantir’s high valuation ahead of its Q1 earnings, and upside remains open-ended without any caps in sight. Despite all the worldwide macro malaise in Q1, PLTR is up 55% year-to-date.

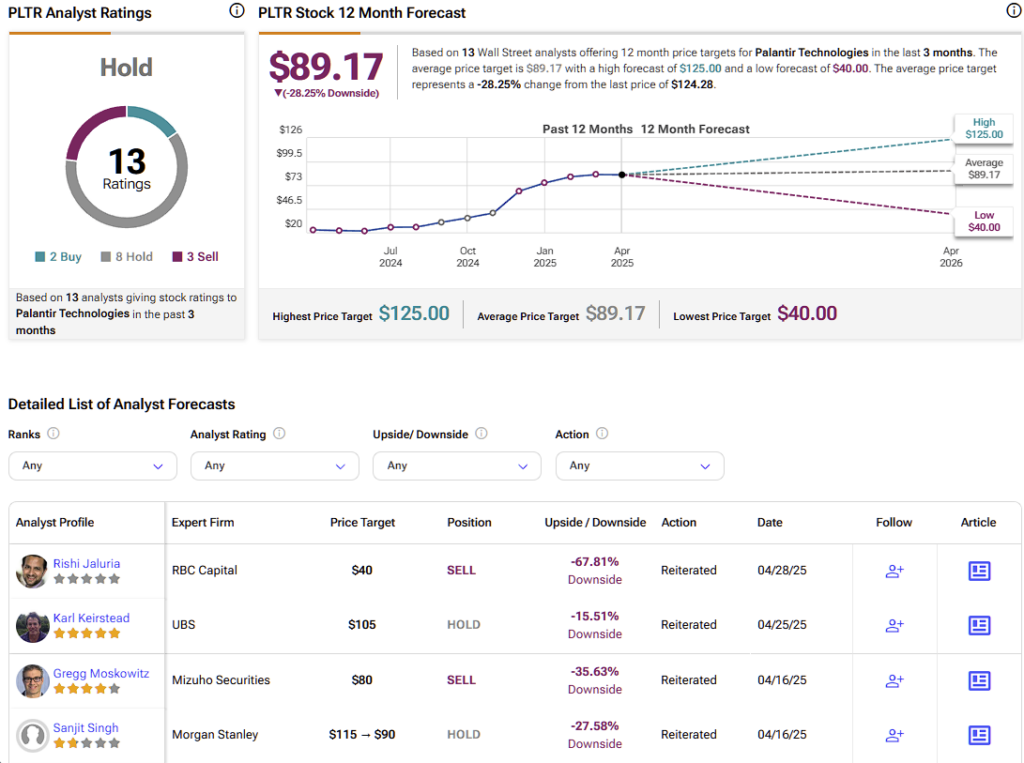

Karl Keirstead from Swiss bank UBS recently reiterated his Hold rating on PLTR and reiterated a Neutral rating with a $105 price target. He believes that Palantir seems “very resilient,” with the “one key risk being that the company is exposed to Fed deal delays.”

How the Market Values Palantir

Ultimately, a stock price comes down to how much buyers are willing to pay and how much sellers are willing to accept—that’s just a fact. That said, these amounts usually need to be anchored in actual results and future expectations.

Take Palantir, for example. In 2024, the company reported $2.86 billion in revenue and generated $310 million in operating profit, which translates to a relatively weak operating margin of just 10.8%. However, heading into Q1, expectations for 2025 are much more optimistic. That’s largely thanks to the series of guidance raises throughout 2024, driven by massive demand for Palantir’s uniquely positioned software in the AI space.

Based on current consensus, analysts expect Palantir to grow revenue at a 31.6% CAGR over the next five years, with EPS growing even faster at 36.1%. Assuming a healthy 7.6% spread between EPS and EBIT growth—reflecting efficient capital structure management—that would imply an EBIT margin CAGR of about 28.5% over the same period. Given Palantir’s recent operational progress, that seems realistic and would put its average EBIT margin around 41.8% over the next five years.

Now, let’s take it further and figure out how fairly valued Palantir is by discounting its future cash flows. Since Palantir is a software-first tech company that relies on cloud infrastructure, not manufacturing, it doesn’t need heavy capital expenditures. That makes a 3% CapEx-to-revenue ratio a fair assumption. Also, because CapEx in this space often includes fast-depreciating hardware like servers, a 60% D&A-to-CapEx ratio is a prudent estimate. And given Palantir’s subscription-based model, which provides stable and predictable cash flows, working capital needs are relatively low. So, assuming a 2% change in NWC as a percentage of revenue seems reasonable.

Lastly, if we assume no change in share count, a long-term growth rate of 2.5% (in line with GDP), and a very optimistic—if not outright irresponsible—discount rate of ~4.5%, that would be what’s needed to justify Palantir’s nearly $123 share price—implying a steep 210x forward earnings multiple.

How Much Risk Is Built into Palantir’s Q1 Expectations?

At current valuation levels, the market is clearly pricing in low risk and stable growth for Palantir. And to be fair, the company has delivered, revisited, and raised its guidance nearly every quarter. That said, even Palantir seems unsure about just how big the demand for its software could get, given the ongoing AI boom.

Palantir holds a net cash position, so its discount rate is basically a proxy for its cost of equity, since debt has little to no impact. But here’s the problem: using a very low rate to discount future cash flows implies a very low cost of equity, usually reserved for low-interest-rate environments or ultra-low-risk businesses. And let’s be honest, neither fits the current macro backdrop.

In other words, if Palantir’s business risks or growth outlook were to shift, and most importantly, if the macroeconomic backdrop were to deteriorate—say, higher rates, inflation, or risk-off sentiment—using such a low discount rate might suddenly look unrealistic, potentially triggering a valuation reset. We’ve already seen a glimpse of this disconnect: despite broader market volatility, analyst consensus only trimmed earnings estimates for 2025 by 0.2%, and by 0.2% and 0.5% for 2026 and 2027, respectively. Yet the stock is still up nearly 40% over the past month.

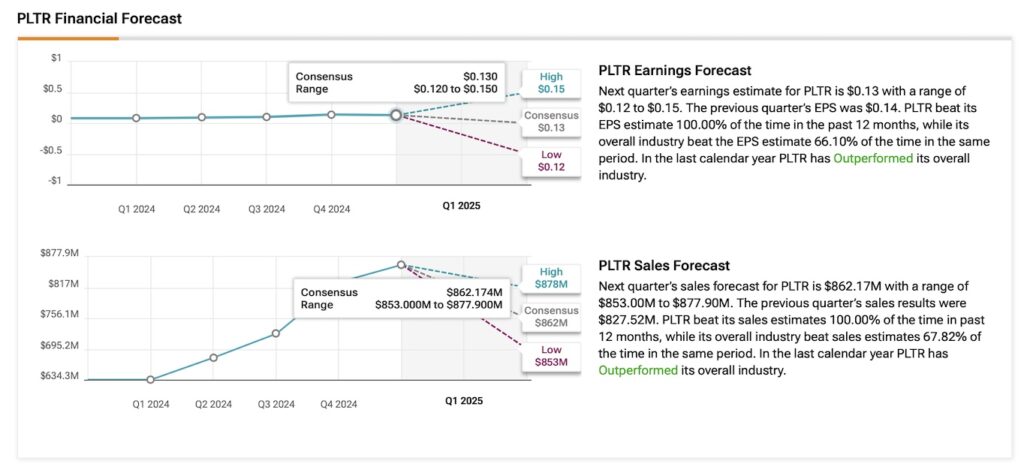

Expectations are high heading into Q1. The market is looking for an EPS of $0.13, which would mark nearly 61% year-over-year growth, and revenue of $862.1 million, up about 36% from last year. Based on Palantir’s recent performance, there’s a decent chance it beats those numbers. However, investors may care more about whether the company raises guidance again. That would reinforce the idea that the “low business risk” baked into its valuation is more than hope.

Palantir in the Epicentre

A strong reason to stay bullish on Palantir heading into Q1 is the clear sector momentum working in its favor. Big Tech isn’t tapping the brakes on AI—if anything, companies like Microsoft (MSFT), Meta (META), and Amazon (AMZN) are ramping up capex to build out AI infrastructure at scale. That’s a big deal for Palantir, whose Artificial Intelligence Platform (AIP) is built to sit directly on top of that infrastructure, tapping into hyperscaler compute to power real-time decision-making, automation, and simulations.

But it’s not just about infrastructure. On the enterprise side, demand remains solid, with companies doubling down on operational AI. That’s where Palantir’s commercial story comes into sharper focus, with platforms like Foundry and Gotham explicitly designed to meet that need.

In short, the more AI capacity the world builds, the more room Palantir has to scale. The entire AI software stack rises with the tide, and Palantir is positioned front and centre. So heading into Q1, I don’t expect any signs of slowing demand or a cautious tone from management. The momentum is still very much intact.

Is PLTR a Good Stock to Buy?

Even though Palantir’s outlook is undeniably optimistic, Wall Street consensus suggests the current valuation leaves little room for error. Out of 13 analysts covering the stock, only two rate it a buy at current levels, while eight are neutral and three are bearish. PLTR’s average price target is $89.17, which implies a potential downside of more than 28% from the latest share price.

Palantir Isn’t Blinking, and Neither Are the Bulls

With sticky, mission-critical software and a market that’s rushing to adopt AI, Palantir looks set to keep delivering solid growth in Q1 and beyond. Even recent macro uncertainty hasn’t shaken investor confidence—or led analysts to make any major changes to their models.

That said, the bullish thesis isn’t without risk. Palantir’s current share price bakes in the assumption of strong growth with very little downside risk—an overly optimistic setup, to say the least. Still, I don’t expect Q1 to break the pattern we’ve seen in recent quarters: a likely beat on expectations and yet another guidance raise.