When a company trades at an extreme valuation multiple, there’s no alternative but to overdeliver and prove that such performance is repeatable. And that’s precisely what Palantir Technologies (PLTR) did in Q3. On Monday this week, the AI-software darling once again delivered results well above market expectations—and then guided to even more substantial numbers for the current fiscal year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Still, despite another wave of upward estimate revisions, the post-earnings share-price reaction was relatively bearish. This likely reflects a growing market awareness that any business priced near 300x earnings must continue to deliver near-flawlessly—especially in an environment where headlines increasingly warn of AI bubbles and undue government protectionism.

In my view, while it’s almost impossible to argue that Palantir isn’t expensive at current levels—since such a multiple demands sustained top-line growth and margin expansion at a pace rarely seen in hypergrowth software—this is a company that has actually been delivering both. And, at this stage, only Nvidia has executed that combination better than Palantir.

That’s undoubtedly valuable. Whether it’s worth anything close to 300x earnings, however, remains debatable. But as long as Palantir continues to execute this playbook—consistently forcing analysts to meaningfully revise their forecasts higher—I believe the stock remains a Buy.

Palantir Is Executing Flawlessly, But Expectations Are Doing the Heavy Lifting

Given that Palantir trades at valuation multiples in the hundreds, any marginal shift in sentiment—whether bullish or bearish—does not necessarily reflect a change in fundamentals, but rather a repricing of future expectations embedded in those multiples.

This dynamic becomes clear based on the asymmetry between Palantir’s realization and expectation, which keeps implied volatility elevated. With implied volatility (IV) at 52.7, currently sitting above 20-day realized volatility at 51.6, even after periods of volatility compression, the market is essentially signaling that large moves in either direction are structurally normal.

This is why post-earnings swings of -8% to -12%, as well as +24% rallies, are no longer anomalies—but statistically expected outcomes. And that’s despite Palantir continuing to deliver near-flawless execution.

Take Q3, for example: Palantir once again beat expectations across the board, posting EPS of $0.21 and revenue of $1.18 billion, coming in 25.5% and 8% above consensus, respectively. Consistent with recent quarters, demand is exceeding the company’s own assumptions, leading management to raise FY2025 revenue guidance to ~$4.39 billion, up from ~$4.15 billion previously. However, the market is now pricing in an even more aggressive top-line of ~$4.41 billion, slightly above Palantir’s updated outlook.

On the profitability side, analysts have also revised estimates higher. EPS expectations for 2025 and 2026 are now up 12.7% and 15%, respectively, compared to pre-earnings levels. The market now expects $0.73 EPS for FY 2025 (+77.8% YoY) and $0.98 EPS for FY 2026 (+34.5% YoY).

Palantir Is the Most Efficient SaaS Business Operating Today

One of the metrics most frequently highlighted by Palantir’s management team, especially CEO Alex Karp, is the Rule of 40—a benchmark suggesting that a healthy software business should have the sum of its annual revenue growth rate and operating margin exceed 40%.

Palantir is currently operating far beyond that threshold. The company is growing revenue at an impressive 63% YoY, while expanding operating margins by 1,300 bps YoY to 51% (and 500 bps QoQ). This combination results in a Rule of 40 of 114%, a level that is virtually unprecedented in the SaaS industry.

In practical terms, this places Palantir second only to Nvidia (NVDA), at ~120%, when comparing Rule of 40 performance among the 25 largest companies by market capitalization worldwide. It reinforces the idea that Palantir today operates with one of the most efficient and scalable business models in enterprise software—balancing hyper-growth with margin expansion in a way few companies in history have achieved.

When Flawless Execution Occurs in a Cautious Market

Even though there were virtually no weaknesses in Palantir’s reported results or guidance, the market still hesitated to respond more constructively. I believe this is partly due to valuation optics—with the stock trading at over 290x earnings—and partly due to growing questions around broader AI sentiment.

Across this earnings season, reactions to the companies most exposed to AI have been muted (with the notable exception of Amazon (AMZN)), at least in the short term. A slightly louder narrative is forming around whether AI infrastructure spending is being allocated realistically—or whether some portion of it reflects bubble-like dynamics.

It is in that context that Michael “The Big Short” Burry’s sizable short position in both Nvidia and Palantir gained attention. On one hand, his trade reflects a rational concern about companies priced with extreme forward expectations. On the other hand, the bull case argues that what is happening at Palantir is so fundamentally uncommon that repeated repricing is not only justified but inevitable.

Palantir CEO Alex Karp was quick to push back against Michael Burry’s short position, arguing that betting against the company today is a fundamental misunderstanding of the real-world adoption already underway. As Karp put it: “Find a company in the world that has a Rule of 114, that has U.S. commercial growing at 121%, that aggregate growth in the U.S. is 77%, that is throwing off free cash flow in a way that’s enormous, and that is fully aligned with its customers—and then you figure out what the value should be.”

Is PLTR a Buy, Hold, or Sell?

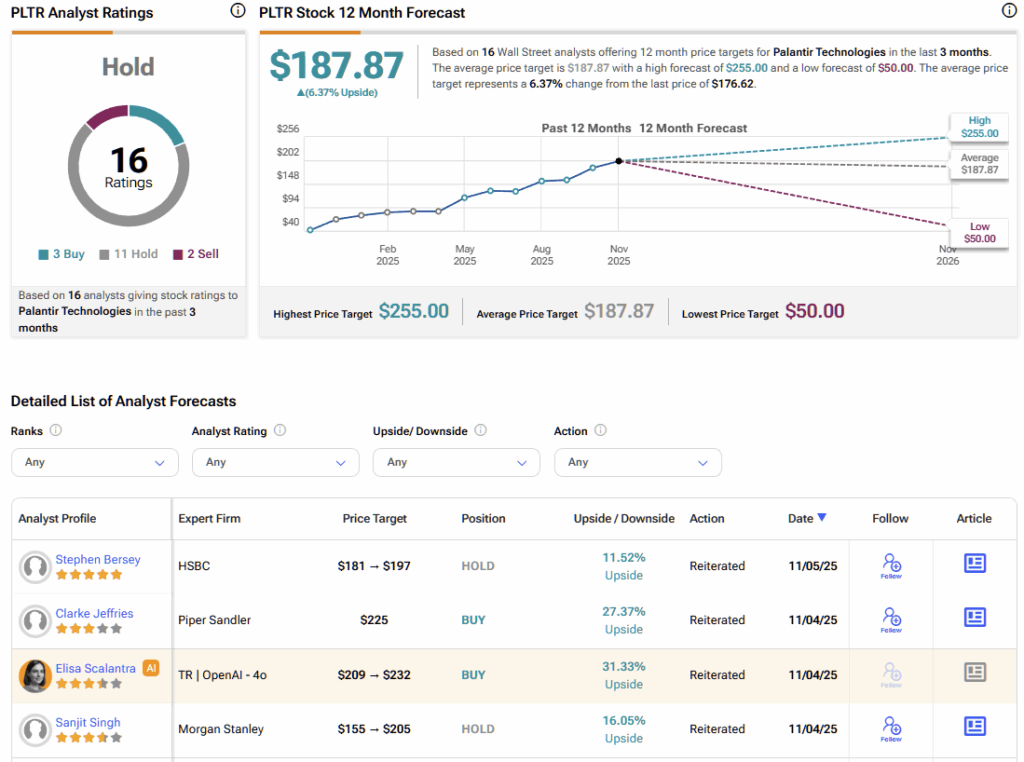

The current analyst consensus reflects a clear level of caution regarding Palantir’s valuation. Among the 16 analysts who have issued ratings over the past three months, only three recommend the stock as a Buy, while eleven rate it as a Hold and two as a Sell. The average price target is $187.87, which, relative to the stock’s latest trading level, suggests approximately 6% upside over the next 12 months.

Palantir Remains a Buy as Results Continue to Exceed Expectations

Palantir delivered again. With another quarter of near-flawless results and yet another round of upward analyst revisions, a bearish post-earnings reaction would seem counterintuitive. I believe the more cautious tone this quarter reflects broader market hesitation toward high-valuation AI names, rather than anything specific to Palantir’s fundamentals. On the positive side, the fact that the post-earnings pullback remained relatively moderate (rather than a double-digit reset) should be viewed as a win for Palantir bulls, especially given the stock’s historically sensitive nature to sentiment swings at high multiples.

While I understand and even agree, in part, with Alex Karp’s argument that Palantir’s execution and operating efficiency justify a premium valuation, it’s also hard to ignore the reality of a 290x earnings multiple. That said, valuation alone isn’t a compelling reason to abandon the thesis when both financial and operational performance continue to trend meaningfully above expectations.

As long as revenue growth remains strong, margins continue to expand, and consensus estimates continue to move higher, I believe the risk-reward still leans positively. For that reason, I continue to see Palantir as a Buy, even at a valuation that demands ongoing, high-level execution.