The March Producer Price Index (PPI) report is out, and with it came a look at the strength of the U.S. economy last month. The big news is that final demand decreased by 0.4% compared to February. For perspective, final demand increased 0.1% in February and 0.6% in January. Excluding volatile food and energy prices, final demand was up 0.1% in March after 0.4% increases in the two months prior.

On a year-over-year basis, final demand was up 2.7% in March. That’s an improvement compared to a final demand increase of 3.2% in February and 3.7% in January. When food and energy prices are excluded, year-over-year final demand for March was up 3.4%, compared to 3.5% and 3.4% increases in February and January, respectively.

Breaking that data down further, March’s final demand goods decreased 0.9% month-to-month and increased 0.3% when excluding food and energy. Final demand services were down 0.2% in March, thanks to a 0.7% decrease in trade and a 0.6% drop in transportation and warehousing.

What Does This Say About the U.S. Economy?

The March PPI report showed that the economy was strong last month, even as investors waited for President Donald Trump’s trade war and tariff updates. However, the market has changed much following Trump’s Liberation Day last week. With tariffs a chief concern for investors and consumers, it’ll be interesting to see how the April PPI report looks.

Of course, President Trump did pause the majority of his tariffs for 90 days to allow for negotiations. One exception to this pause is China, which now has a 145% tariff on its U.S. imports. China retaliated to these actions with a 125% tariff on imports from the U.S.

More Economic Data on the Horizon

More economic data is coming out in April that traders need to know about. A few key reports to keep in mind are the March Import price index on April 15, the March U.S. retail sales data on April 16, initial jobless claims on April 17, and the March Personal Consumption Expenditures Index on April 30. All of these reports will be taken into account during the Federal Reserve’s next meeting on May 6 and May 7.

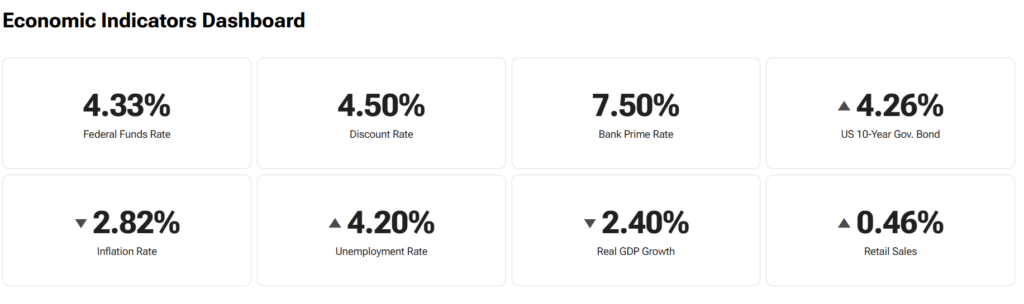

Traders can keep track of all of these dates with the TipRanks economic calendar and will find the latest macroeconomic news on the Economic Indicators Dashboard.