The March Consumer Price Index (CPI) report is out, and economists were surprised by how inflation moved during the month. The big news is that year-over-year inflation came in at 2.4%, much better than the 2.6% that experts expected. It also dropped month-to-month from the 2.8% reported in February.

Core inflation, which cuts out volatile food and energy prices, was better than expected at 2.8%, compared to a 3% estimate. That was an improvement over the 3.1% reported in the February 2025 CPI report.

While inflation remains above the Federal Reserve’s 2% target, its slowing could affect interest rate decisions. The Fed will next meet on May 6 and May 7. That will allow for additional economic data to be released, such as the Personal Consumption Expenditures (PCE) report at the end of April. The PCE is the central bank’s preferred inflation measure.

Will Trump’s Tariffs Affect Inflation?

According to economists, President Donald Trump’s initial tariffs have already affected prices in the U.S. His 90-day pause on tariffs also means that prices likely won’t be affected for the next few months. The one exception to this is China, which is still feeling the full force of tariffs, now set at 125%.

Goldman Sachs says this is good news for the economy. It now expects inflation for 2025 to fall. The firm attributes this to falling car prices, rent, and wages, which spiked during the COVID-19 pandemic.

How Is the Stock Market Reacting to March Inflation Data?

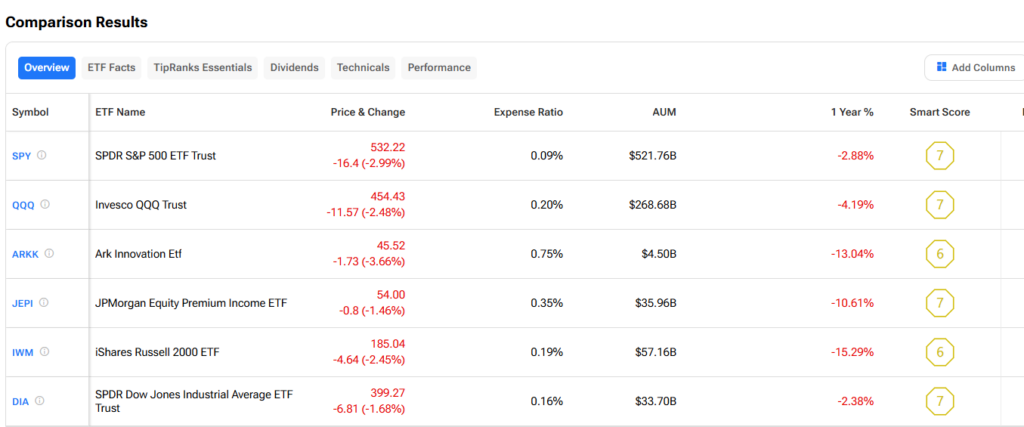

Despite inflation data being lower than expected, the stock market is still down today. The S&P 500 (SPX), Dow Jones Industrial Average (DJIA), and Nasdaq 100 (NDX) have all fallen on Thursday morning. This has also dragged down ETFs that track these indices, such as the SPDR S&P 500 ETF Trust (SPY), the SPDR Dow Jones Industrial Average ETF Trust (DIA), and the Invesco QQQ Trust (QQQ).