One of Marathon Oil’s (MRO) shareholders has filed a lawsuit seeking to block the company’s proposed $22.5 billion merger with ConocoPhillips (COP), announced in May. The lawsuit, filed by investor Martin Siegel, alleges that the all-stock deal undervalues Marathon Oil by over $6 billion.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Additionally, Seigel has accused Marathon Oil’s management and financial advisor Morgan Stanley (MS) of misleading shareholders about the benefits of the deal. He also alleged a conflict of interest, pointing out that Marathon Oil’s CEO Lee Tillman could gain over $70 million from stock grants if the deal is completed, while Morgan Stanley stands to earn $42 million in fees.

The lawsuit aims to suspend the shareholders’ votes until a trial is conducted or the companies provide revised disclosures.

Merger Deal Faces a New Hurdle

The deal has been facing obstacles since its announcement. In July, the Federal Trade Commission (FTC) requested more information about the merger, signaling potential regulatory scrutiny. Now, the shareholder lawsuit adds another hurdle to the deal.

Although the merger is viewed as a strategic move to enhance the scale and competitiveness of the combined company in the oil and gas sector, the recent shareholder lawsuit could delay its completion.

Is MRO a Good Buy Now?

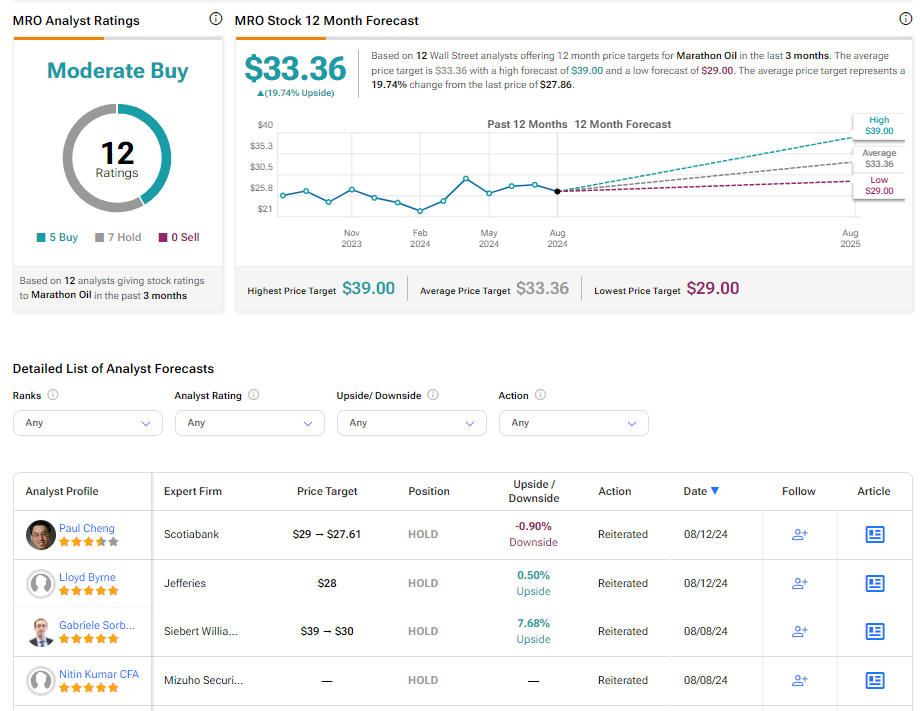

Overall, Wall Street analysts are cautiously optimistic about MRO. It has a Moderate Buy consensus rating based on five Buy and seven Hold ratings. The analysts’ average price target on Marathon Oil stock of $33.36 implies an upside potential of 19.74%. Shares of the company have gained 26% over the past six months.