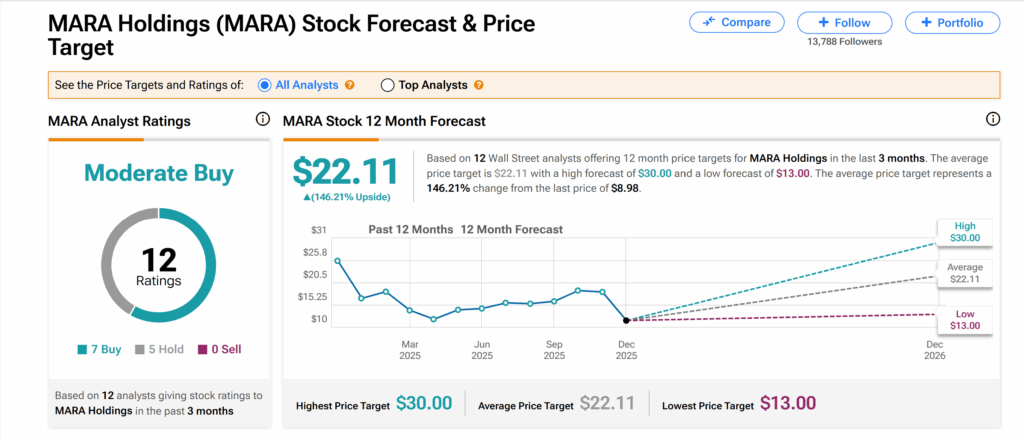

Shares in crypto miner Marathon Digital Holdings (MARA) ended 2025 about 46% lower. However, the analyst consensus on Wall Street is that MARA stock can rebound by over 146% over the next 12 months.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Marathon’s shares currently hold a Moderate Buy consensus rating from analysts based on seven Buys and five Holds issued over the past three months. This is accompanied by an average MARA price target of $22.11 that implies 146.21% upside.

Network Competition Piles Pressure on Bitcoin Miners

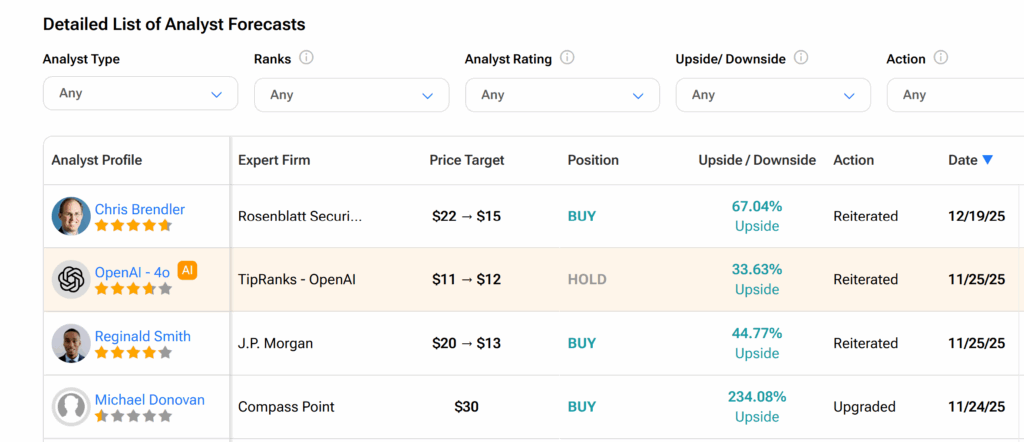

Recently, Rosenblatt analyst Chris Brendler trimmed his MARA price target by 32% from $22 per share to $15, implying about 67% upside. Brendler, who stuck to his Buy rating on the stock, noted that the high network competition that haunted Bitcoin miners throughout 2025 has “gone from bad to worse” amid the sharp drop in the price of BTC.

The analyst, however, contended that Bitcoin miners that also offer high-performance computing (HPC) capacity — an example is Sydney-based Iren Limited (IREN) — have less exposure to this development. This is possible because of “entirely uncorrelated and considerably more profitable HPC hosting opportunities.”

Will Marathon’s Strategic Shift Pay Off in 2026?

Already, Marathon Digital has outlined the intention to recalibrate its business. During its Q3 2025 earnings call, Marathon Digital stated plans to transition from a pure-play Bitcoin miner to a vertically integrated digital infrastructure business.

To execute this strategy, the firm aims to build a unified and scalable platform that brings together energy, Bitcoin, and artificial intelligence computing. However, Clear Street analyst Brian Dobson believes Marathon might be joining the party a little too late.

Dobson, who recently gave a Hold rating on MARA stock, argued that while the strategy is “sound,” its implementation lags behind competitors by about a year. The analyst trimmed his price target from $18 to $16, suggesting about 78% upside.

Other Factors That Could Lift MARA Stock

Several other factors, however, might explain why analysts on Wall Street see a huge upside potential in MARA stock. In its recent third-quarter earnings, the firm grew its revenue by 92% year-over-year to $252.4 million. The Nevada-based crypto mining company also expanded its Bitcoin holdings by 98% to 52,850.

In addition, MARA is currently working on acquiring Exaion, a subsidiary of the French utility company EDF (ECIFY), to bolster its AI-focused private cloud offering. The company has also entered a partnership with midstream energy infrastructure firm, MPLX (MPLX), to build power generation assets and data centers in West Texas, starting with 400 megawatts of capacity.

Is MARA a Good Stock to Buy?

Analysts on Wall Street, on average, see Marathon Digital’s shares jumping 146.21% over the next 12 months, with a few even forecasting upsides of more than 200%.