Some traders might buy Marathon Digital Holdings (MARA) shares as a way to get portfolio exposure to Bitcoin (BTC-USD), but it’s not a worry-free investment. Marathon Digital is borrowing money to fund its cryptocurrency hoarding plans, and this is a risky strategy. Consequently, I am neutral on MARA stock and am neither buying it nor short-selling it.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Florida-based Marathon Digital Holdings mines for Bitcoin, but the company also holds plenty of it. Thus, Marathon Digital has something in common with Microstrategy (MSTR), which holds astounding quantities of Bitcoin.

Frankly, I don’t like it when companies (and investors, for that matter) borrow money to potentially buy a speculative asset like Bitcoin. I like Bitcoin and believe it’s the future of money, but Marathon Digital’s risk-taking behavior should be considered a red flag for prudent people.

Marathon Digital: The Good News and the Bad News

Let’s backtrack for a moment. Not long ago, Marathon Digital Holdings released its quarterly financial results as well as the company’s operational results for July. Thus, it’s a good time to unpack the plethora of data.

The second quarter of 2024 presented a “good news, bad news” situation for Marathon Digital and its shareholders. The good news is that Marathon Digital’s revenue grew 78% year-over-year to $145.1 million. Most likely, this had something to do with Bitcoin’s rise to the $60,000 area. The company basically admitted this, stating, “The increase in revenue was primarily driven by a $78.6 million increase in the average price of BTC mined.”

Now, here’s the not-so-good news. In Q2 of 2024, Marathon Digital’s adjusted EBITDA deteriorated to a loss of $85.1 million versus a gain of $35.8 million in the year-earlier quarter. Adjusted EBITDA is an important bottom-line metric that some investors might overlook, and it currently doesn’t bode well for Marathon Digital.

More often, people look at net income/losses as a bottom-line metric. In Marathon Digital’s case, the company’s net loss widened from $9 million, or $0.07 per share, in the year-earlier quarter to a net loss of $199.7 million, or $0.72 per share, in Q2 2024. This result represented a big miss when compared to the analysts’ consensus estimate of a quarterly net loss of $0.10 per share.

So, what caused Marathon Digital to lose so much money? Here’s the company’s explanation:

“The decrease in earnings was primarily driven by the unfavorable fair value of digital assets from the newly adopted fair value accounting rules issued by the Financial Accounting Standards Board, ASU No. 2023-08, Accounting for and Disclosure of Crypto Assets, which requires ongoing measurement of crypto assets to fair value.”

Was Marathon Digital’s fast-widening net loss really just the result of accounting rules? I’ll let you decide for yourself, but for the time being, I’m staying neutral on MARA stock.

To conclude this section, I should mention that Marathon Digital produced 692 Bitcoins in July, up 17% month-over-month. That’s all fine and well, and I definitely wouldn’t question Marathon Digital’s aggressiveness as a crypto miner. Rather, I’m just wondering whether Marathon Digital will narrow its net loss anytime soon.

Marathon Digital Borrows Money to Buy Bitcoin

In other news, Marathon Digital Holdings announced its plans to sell $250 million worth of convertible senior notes due 2031 in a private offering. “Senior notes” are similar to corporate bonds, but it’s the “convertible” part that will bother some investors.

Here’s what I mean. Marathon Digital’s senior notes “will be convertible into cash, shares of MARA’s common stock, or a combination of cash and shares of MARA’s common stock, at MARA’s election.” Hence, don’t be too surprised if the company adds to the supply of circulating common shares.

Also, I will always remind investors that printing and selling senior notes doesn’t mean the company gets free money. This will be $250 million worth of debt that Marathon Digital will have to repay with interest.

What does Marathon Digital intend to do with the proceeds? The company stated that it plans to “use the net proceeds from the sale of the notes to acquire additional bitcoin” and for a variety of “general corporate purposes.” Note that Marathon Digital mentioned Bitcoin acquisitions first and “general corporate purposes” after that.

I think we all know what will probably happen next. I expect Marathon Digital to invest a large portion of the borrowed capital in Bitcoin. This could work out extremely well if the Bitcoin price increases. Otherwise, it could be disastrous for Marathon Digital and the company’s stakeholders.

Is MARA Stock a Buy, According to Analysts?

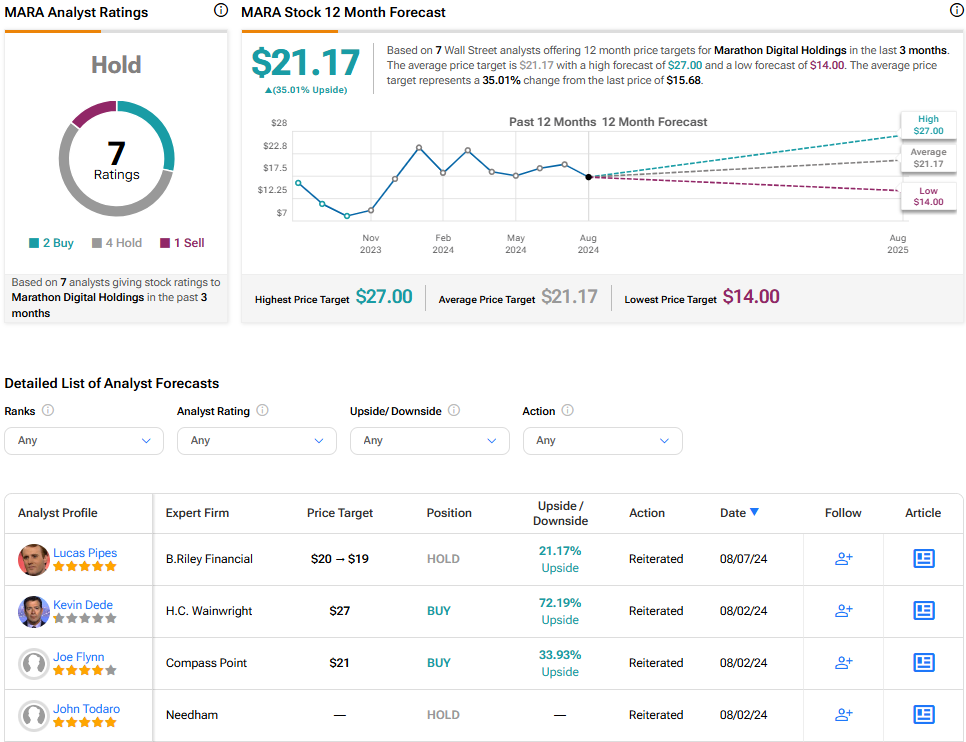

On TipRanks, MARA comes in as a Hold based on two Buys, four Holds, and one Sell rating assigned by analysts in the past three months. The average Marathon Digital Holdings stock price target is $21.17, implying 35% upside potential.

Conclusion: Should You Consider MARA Stock?

Marathon Digital Holdings’ financial situation is far from perfect, even though the company is undeniably mining a lot of Bitcoin. Furthermore, it’s worrisome (to me, at least) that Marathon Digital is willing to incur debt and potentially dilute the value of existing shares in order to buy more Bitcoin.

Remember, there are other ways to get portfolio exposure to Bitcoin, such as just buying Bitcoin or purchasing a spot Bitcoin ETF. You don’t have to participate in Marathon Digital’s faulty financials or money-borrowing practices. In the final analysis, I’m staying on the sidelines and wouldn’t consider purchasing MARA stock today.