Cryptocurrency mining companies and their stakeholders have to deal with many unknowns regarding the near-term future. Marathon Digital Holdings (MARA) is well-known among Bitcoin (BTC-USD) aficionados as a way to gain exposure to the cryptocurrency complex. However, I am neutral on MARA stock because there are multiple near-term events that could help or hinder the company’s prosperity.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Florida-headquartered Marathon Digital Holdings specializes in mining Bitcoin. Ever since the most recent Bitcoin halving event which took place in April (when the reward for mining Bitcoin got cut in half) investors may be re-examining whether Bitcoin mining can remain a profitable venture in the coming years.

That’s one of the unknowns that Marathon Digital Holdings’ investors will have to deal with. There are other factors that could make or break Marathon Digital as well. We can make predictions, but we don’t have a crystal ball. So, I encourage investors to be cautious and selective, and to stay on the sidelines if they’re unsure about MARA stock’s future prospects.

Is MARA Stock Cheap?

Marathon Digital Holdings has a GAAP-measured trailing 12-month price-to-earnings (P/E) ratio of 17.16x. This looks favorable when compared to the sector median P/E ratio of 29.13x. On the other hand, looks can be deceiving. It’s true that Marathon Digital has been profitable during the past year, but the company actually posted an earnings loss of $0.72 per share for the recent second quarter. That was a wide miss when compared to Wall Street’s consensus estimate for a loss of just $0.10 per share.

Marathon Digital Holdings might appear to be very reasonably valued based on tried-and-true valuation annual metrics. However, a quick glance at the chart and price action of MARA stock will show that Marathon Digital shares have nearly doubled over the past year. This adds to my caution on Marathon Digital Holdings shares at this time. Even if you’re a strong Bitcoin believer, it’s important to assess risks to MARA and know when to take profits or simply watch from the sidelines.

Wait for Marathon Digital Holdings to Report Earnings

Interestingly, Marathon Digital Holdings is expected to report its third-quarter earnings results on November 6. That’s just a day after the U.S. presidential election on November 5. Analysts don’t expect Marathon Digital to post a profitable third quarter, and this supports my neutral stance on MARA stock since consecutive unprofitable quarters are a cause for concern, in my view.

To be honest, I really don’t know what to expect from Marathon Digital Holdings. The company delivered a wide EPS miss in the second quarter. For the third quarter, analysts estimate that Marathon Digital will suffer a loss of $0.32 per share. It remains possible that the company could deliver better-than-expected EPS results, and analysts’ pessimistic estimates for Q3 might already be reflected in the current stock price. On the other hand, cautious investors may wish to avoid holding stocks of companies that are posting losses. If this is a concern for you, then you may not want to jump into MARA stock right now.

No investor knows for certain what the near future holds, and the actual third-quarter EPS result could be much worse than what analysts anticipate. MARA stock could be susceptible to coughing up some of the significant gains it’s posted over the past year. In my view, it just doesn’t sound like a favorable risk-to-reward proposition for investors. Investors can choose to wait until the third quarter earnings results to reassess the situation at that point.

Uncertainty about Bitcoin and the Election

In addition to all the company-specific unknowns, there’s a U.S. Presidential Election on the horizon, and the result could very likely have a profound impact on Bitcoin and companies that mine it. The election uncertainty further supports my hesitation on Marathon Digital Holdings stock at the current time.

Marathon Digital Holdings’ stock price tends to correlate with the price of Bitcoin. Former President and current presidential candidate, Donald Trump, appears to strongly support cryptocurrency and Bitcoin. Trump was even spotted buying burgers with Bitcoin at a pub recently.

Meanwhile, Vice President and presidential candidate Kamala Harris’s position on Bitcoin is more uncertain. It seems possible that Bitcoin and MARA stock could jump if Trump is elected, but go sideways or decline if Harris wins the election. Harris might not reveal additional views on cryptocurrency until after the election, and it’s possible she could champion regulation on Bitcoin. At the same time, it remains possible that Harris emerges with a more positive perspective on Bitcoin than is currently expected; a scenario that could lend price support. So there are both downside and upside risks heading into the U.S. Election, and too many question marks from my vantage point.

Is MARA Stock a Buy, According to Analysts?

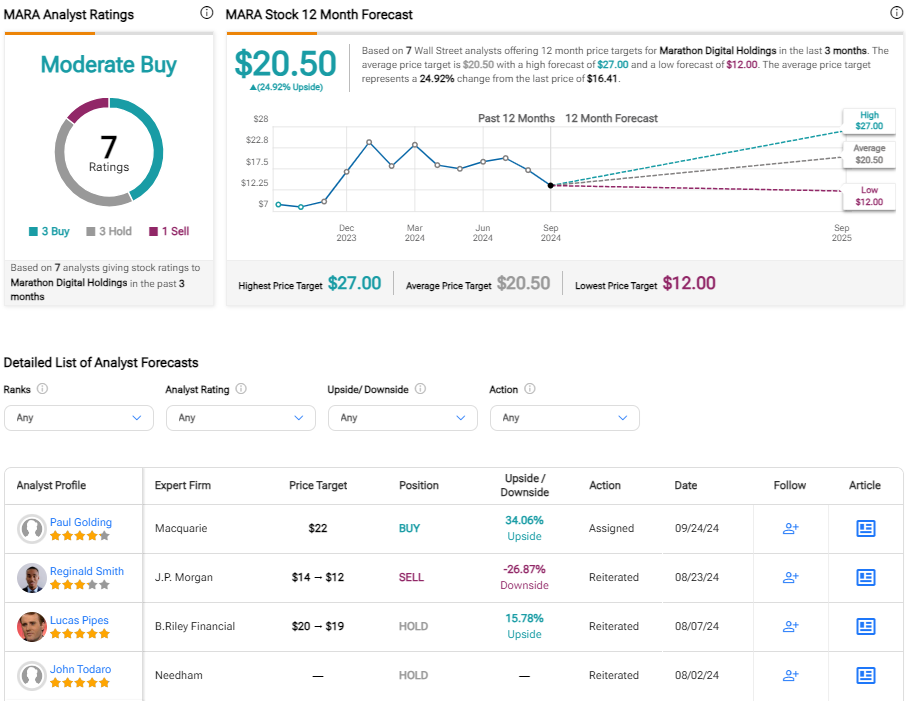

On TipRanks, MARA comes in as a Moderate Buy based on three Buys, three Holds, and one Sell rating assigned by analysts in the past three months. The average Marathon Digital Holdings stock price target is $20.50, implying 25% potential upside.

If you’re wondering which analyst you should follow if you want to buy and sell MARA stock, the most accurate analyst covering the stock (on a one-year timeframe) is Kevin Dede of H.C. Wainwright, with an average return of 48.98% per rating.

Marathon Digital Stock Conclusions

I’m choosing to stay neutral on Marathon Digital given that there are multiple unknown near-term factors that can’t easily be predicted. That’s my main takeaway for investors today. It would seem safer to wait until Marathon’s Q3 earnings and the U.S. Election outcome before considering a position in MARA stock.

This is, of course, the cautious approach. It remains possible that cryptocurrencies and MARA stock post additional gains between now and the first week of November.