Marathon Digital (MARA) stock jumped about 7% in after-hours trading following the release of stellar second-quarter results. The Bitcoin miner reported earnings per share came in at $1.84, which easily surpassed analysts’ consensus estimate of a loss of $0.07 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Further, revenue for the quarter soared by 64% to $238.5 million and came in well above analysts’ expectations of $227.45 million.

MARA’s Operational Updates

The revenue growth was driven by an increase in BTC prices in Q2, even though BTC production fell 30% YoY to 2,058 BTC, impacted by the bitcoin halving event and equipment failures. Nevertheless, Marathon now holds 18,488 BTC, up 170% year-over-year.

Moreover, the company improved its hash rate capacity to 31.5 EH/s (Exahash per second), with a target of 50 EH/s by year-end.

On the negative side, Marathon’s adjusted EBITDA dropped to a loss of $85.1 million, down from a $35.8 million gain last year. This was primarily due to a $148 million loss from fair value adjustments on digital assets and lower Bitcoin production.

Nevertheless, MARA is expanding globally, with joint ventures in the UAE and Paraguay nearing full operational capacity. Also, its adoption of the “HODL” strategy, which includes retaining all mined Bitcoin going forward, points to long-term confidence in BTC’s value.

Is MARA a Good Stock to Buy?

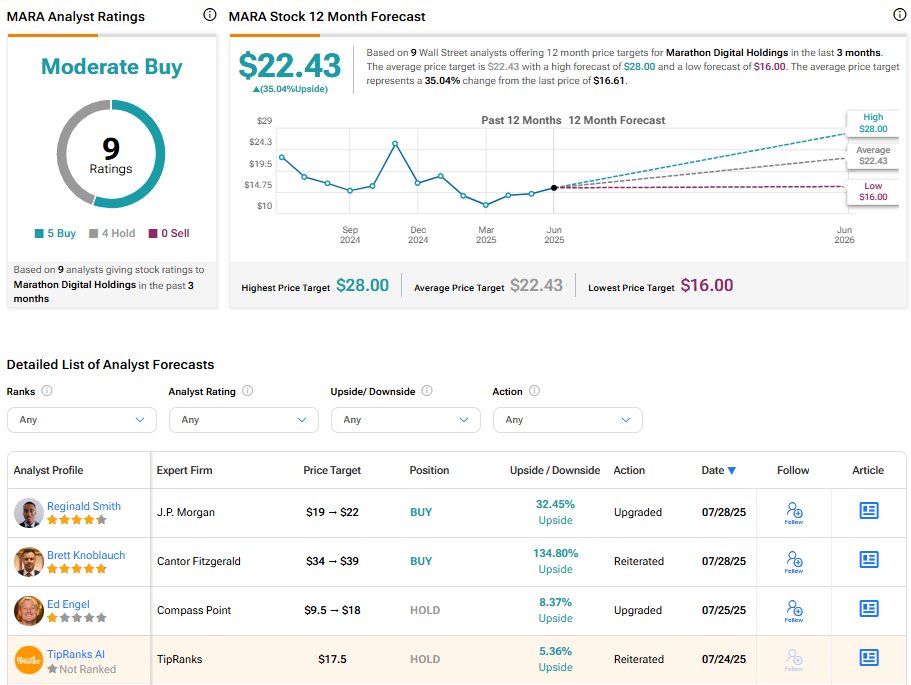

Turning to Wall Street, analysts have a Moderate Buy consensus rating on MARA stock based on five Buys and four Holds assigned in the past three months. Further, the average MARA price target of $22.43 per share implies 35.04% upside potential.

However, it’s worth noting that estimates will likely change following today’s earnings report.