Instacart owner Maplebear (CART) saw its stock fall alongside updated analyst coverage following the grocery delivery company’s most recent earnings report. Results were mixed for the quarter with earnings per share of 53 cents alongside $883 million in revenue, compared to Wall Street’s estimate of 38 cents and $891 million.

CART stock took an initial 1.18% beating yesterday after the release of its latest earnings report. That came with 9.24 million shares traded, compared to a three-month daily average of 4.24 million. The negative movement continues today with CART stock down 7.75% during pre-market trading. This is set to take a chunk out of its year-to-date gains of 17.77%.

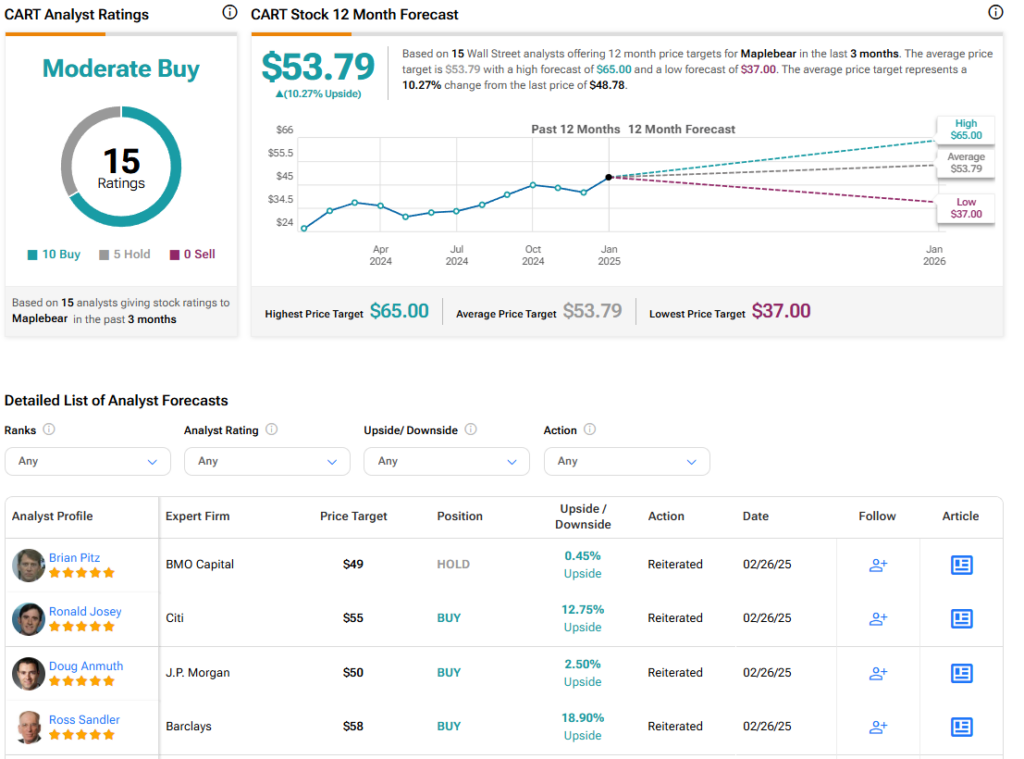

CART Stock Analyst Ratings

Maplebear received a wave of updated analyst coverage following its Q4 earnings report. Most of that was reiterations of previous ratings and price targets. One change worth noting was five-star Morgan Stanley analyst Brian Nowak increased the firm’s price target for CART stock from $44 to $45 and maintained a Hold rating.

Bank of America Securities analyst Justin Post also reiterated a Hold rating for CART stock with a $53 price target. He points to slowing growth compared to the prior quarter as one reason for the rating. Additionally, Post believes Maplebear is a less attractive investment compared to delivery rivals DoorDash (DASH) and Uber (UBER). Adding to this is mixed Bank of America (BAC) card and Sensor Tower data suggesting a cautious outlook for the stock.

Is CART Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Maplebear is Moderate Buy based on 10 Buy and five Hold ratings over the last three months. With that comes an average price target of $53.79, a high of $65, and a low of $37. This represents a potential 10.27% upside for CART stock.