Although consumer technology juggernaut Apple (AAPL) represents one of the top enterprises in the world, that doesn’t necessarily make AAPL stock a must-have asset. From where I stand, market experts expect shares to rise to $248.90, about 6% higher from the present juncture. I’m generally bullish on AAPL, but that’s not a riveting assessment. Still, with options, we can make Apple great again.

Specifically, I’d like to discuss a strategy called the short iron condor. Let’s address the confusion about being bullish and yet engaging in a “short” position. A condor play is unlike many other options strategies, as in that we’re targeting a defined range of price action and not a general trajectory. Further, the terminology refers to the fact that this iron condor is a credit-based approach, and thus, we start from a cash inflow position.

What makes the short iron condor particularly risky is that we’re dealing with four transactions. The structure is actually a combination of a bull put spread and a bear call spread. Think of flying an airplane in the context of a two-dimensional side-scrolling video game: the price can’t go too high nor can it go too low. Maximum profitability occurs when the target security is at or between the middle strike prices.

Calculating Anticipated Movements of AAPL Stock

Although we may be generally bullish on AAPL stock, it’s important that we’re not excessively so. If we genuinely believed that Apple shares would fly to the moon, we would probably take a directional wager, that is buy a call option and call it a day. Instead, we see shares moving moderately and thus wish to wager that the price action will stay within defined parameters.

According to TipRanks’ Options Chain and Prices screener for AAPL stock, its algorithm notes that the company’s next earnings date will be October 31. Moreover, the expected move is 4.14%, either to the upside or downside. That’s useful intel because it tells us how wide our iron condor’s “wingspan” of breakeven ranges must be to cover this anticipated movement.

However, we also need to calculate the market’s anticipated movement for the options chain we are targeting. For our purpose, let’s use the options chain expiring November 29. For this chain, the average implied volatility (IV) is 23.22%. Using stochastic analytics, we multiply the current price of AAPL stock, the IV, and the square root of the days to expiration divided by 365 calendar days. The end product is the anticipated nominal price swing ($18.29 or plus/minus 7.78%).

Playing with Wild Condors

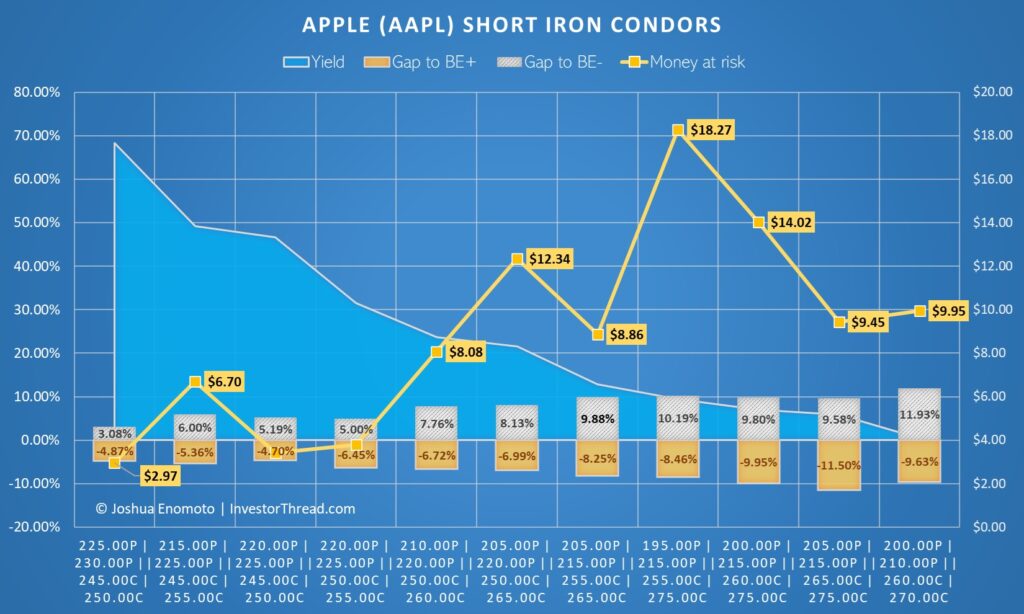

It’s critical to note that price volatility projections – whether developed by algorithms or by stochastic calculations – are just that, projections. They’re not set in stone. In reality, the volatility could be of a lesser or greater magnitude. And that’s the trick with iron condors: you can pick the ones with wide wingspans, but they’ll give you less yield and vice versa.

Consider our stochastic projection of a price swing of plus/minus 7.78%. To fully cover this range to either the upside or down, you can choose the 205P(ut) | 215P || 255C(all) | 265C condor. However, the yield for this trade sits at only 12.87%. Also, you would have to put $886 at risk to receive a maximum reward (income) of $114.

On the other hand, if you believe that AAPL stock will only move a net of 4.14% up or down from Friday’s closing price, you could be more adventurous and select the 220P | 225P || 245C | 250C condor. That would give you a yield of 46.83% or the potential to earn $159 while risking $341.

Risks to Consider Before Wagering on Apple Condors

While the short iron condor may sound like a tempting wager for those who are only moderately optimistic on AAPL stock, the strategy has significant risks to consider. In the first condor, it’s true that the margins to breakeven are wide. On the upside, AAPL can move about 8.25%. On the downside, it can slip around 9.9%. However, if volatility is more than anticipated, that’s almost $900 down the drain.

As for the second condor, the yield of almost 50% in a little more than a month sounds tempting. However, the wingspan is considerably narrowed. On the upside, AAPL stock can only move 4.7%. On the downside, the allowed kinesis is 5.19%. While you’re putting less money at risk with $341, a greater chance exists that you’ll lose it all.

On the positive side, momentum has slowed recently for AAPL stock. Yes, it did gain almost 27% year-to-date. However, in the trailing month, it gained only 3%. A similar performance by late November may translate to success for the higher-yielding condor.

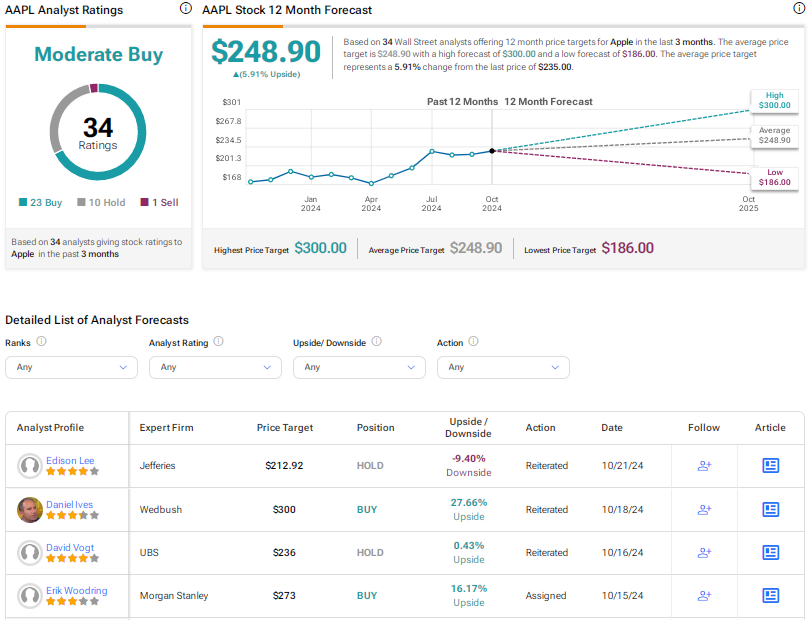

Is Apple Stock a Buy, According to Analysts?

Turning to Wall Street, AAPL stock has a Moderate Buy consensus rating based on 23 Buys, 10 Holds, and one Sell recommendation. The average AAPL stock price target is $248.90, implying 5.91% upside potential.

The Takeaway: Add Some Spice to Apple Stock

As a world-renowned consumer tech giant, Apple is important but not nearly as exciting as it once was. Fortunately, the options market can turn a relatively slow-moving asset like AAPL stock into a lucrative wager. Through a short iron condor, traders can generate income, so long as shares stay within a defined price range. Plus, the opportunity is modular, with investors choosing the width of the condor’s wingspan depending on their risk tolerance.