Growth stocks are mostly trading lower at the time of writing following a strong post-Fed rally in the previous session. However, it remains uncertain whether investors are ready to jump back into high-valuation tech stocks. On Wednesday, the “Magnificent 7” stocks—Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA)—officially entered into bear market territory. This decline raises concerns about whether or not the AI-driven boom that fueled these stocks in recent years is beginning to fade.

The Nasdaq 100 (QQQ), which is heavily weighted toward tech stocks, has seen a significant decline from its peak, with Societe Generale noting that nearly all of the AI-driven valuation premium has been erased. This premium refers to the extra amount investors were willing to pay for stocks above their fundamental value, which is measured by 12-month forward earnings per share. Analysts suggest that if the Nasdaq 100 drops another 5% in the next month, it would completely eliminate the valuation boost these stocks have enjoyed since the launch of ChatGPT in November 2022.

Looking ahead to 2025, strategists believe that profits will be the key driver of market performance. While the S&P 500’s (SPY) growth rate (excluding the Nasdaq 100) is improving, the Nasdaq 100’s growth has been slowing down since June of last year. As a result, analysts recommend favoring the S&P 500 Equal Weight index while reducing exposure to the Nasdaq 100 to avoid concentration risk. Indeed, they emphasize that diversification should remain a priority for investors in 2025.

Which Magnificent Seven Stock Is the Better Buy?

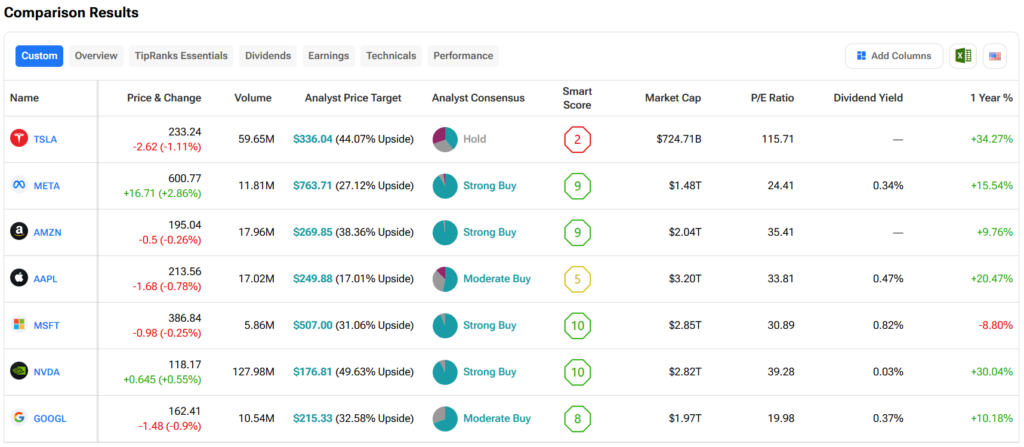

Turning to Wall Street, out of the magnificent stocks mentioned above, analysts think that NVDA stock has the most room to run. In fact, NVDA’s average price target of $176.81 per share implies more than 49% upside potential. On the other hand, analysts expect the least from AAPL stock, as its average price target of $249.88 equates to a gain of 17%.

Questions or Comments about the article? Write to editor@tipranks.com