Online furniture retailer Made.com (GB:MADE) became the latest British-listed company to slash sales and earnings forecasts amid the cost-of-living crisis, with the company saying it did not expect a rise in demand for big-ticket items in the near future.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

On Monday, British food delivery unicorn Deliveroo also cut its revenue guidance as British consumers tighten their belts.

Made.com’s gross sales fell 19% in the first half of 2022. The company’s gross sales are predicted to slip 15-30%, compared to previous guidance of flat to 15%.

In a trading update, the company said it expects to report a loss of between £50m and £70m for 2022, compared to a previously predicted full-year loss of £15m-£35m.

Consumers cutting back

CEO Nicola Thompson said in a statement, ‘It’s clear that things are tough for consumers at the moment.

‘Understandably, we’ve seen a worsening in consumer confidence since May and this has had an impact on this period’s performance. As such it’s prudent for us to take a conservative view of what we can expect in the second half of this year.’

Thompson said that the company would cut costs and strengthen its balance sheet to steer through “to navigate what will undoubtedly continue to be challenging conditions”.

Shares in Made.com down 80%

Shares in Made.com have slipped more than 80% in the past year after it listed in June 2021.

In May, after Made.com issued a warning over profits, Russ Mould, investment director at AJ Bell, said: “Big ticket items are the first things consumers will delay when the going gets tough, as the idea of shelling out £1,000 or more on a sofa seems excessive when the cost of energy, food, drink and more is racing ahead.”

View from the City

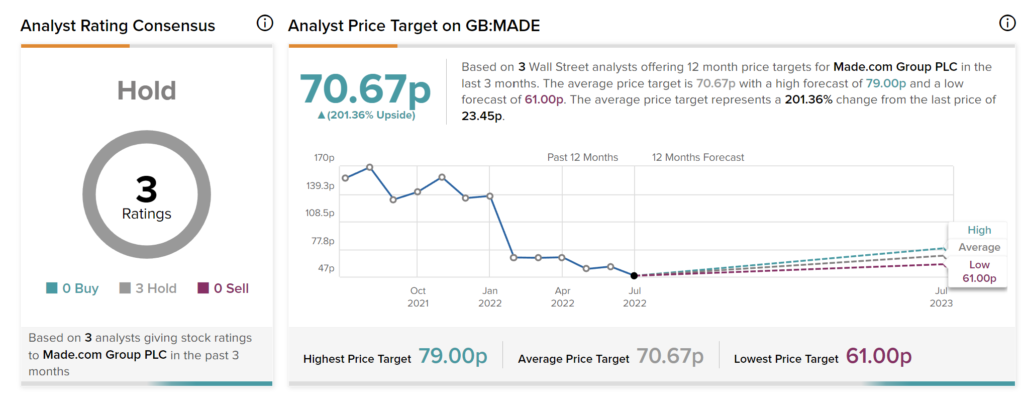

According to TipRanks’ analyst rating consensus, Made.com’s stock is a Hold. That’s based on three ratings from the analysts, which include zero Buy, three Hold and zero Sell recommendations.

The average price target of 70.67p implies upside potential of 201.36%. Analyst price targets range from a low of 61p per share to a high of 79p per share.

Conclusion

Companies such as Made.com are bearing the brunt of the cost-of-living crisis as consumers slash their big-ticket purchases.