Zimmer Biomet Holdings (ZBH) has entered into a definitive agreement to buy Paragon 28 (FNA) in a $13 per share all-cash deal. The acquisition values Paragon 28 at $1.1 billion. The offer price reflects about 8.3% premium to Paragon 28’s closing share price on Tuesday. The deal is approved by the board members of both companies and is expected to be completed in the first half of 2025. The acquisition is subject to certain regulatory conditions and Paragon 28’s shareholder approval. FNA shares jumped over 9% in after-hours trading on the news.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Zimmer Biomet is a medical technology company that develops and offers a comprehensive portfolio of integrated digital and robotic technologies aimed at improving the patient’s mobility and health.

Meanwhile, Paragon 28 is a medical device company that designs and develops orthopedic solutions and instrumentations focused on foot and ankle ailments.

Details of the Zimmer Biomet-Paragon 28 Deal

Zimmer Biomet will pay the entire cash consideration upfront to acquire all of the outstanding common stock of Paragon 28. The company is expected to fund the acquisition through cash on hand and some debt financing sources. Additionally, FNA shareholders are expected to receive up to $1 per share in cash upon achieving certain revenue milestones, like net sales exceeding $346 million up to $361 million.

Benefits of the Proposed Transaction

Paragon 28’s acquisition is expected to boost Zimmer’s revenue growth. The former expects revenue growth of 18.2% to 18.4% for Fiscal 2025. Moreover, the transaction is expected to be immediately accretive to Zimmer’s adjusted EPS (earnings per share) within 24 months of the deal’s closure. Zimmer’s adjusted EPS will be diluted by 3% in FY25 and by 1% in FY26.

Zimmer Biomet believes that this acquisition will help in expanding its portfolio beyond core orthopaedics, giving it exposure to one of the “highest growth specialized segments” in musculoskeletal care.

Is Zimmer Biomet a Good Buy?

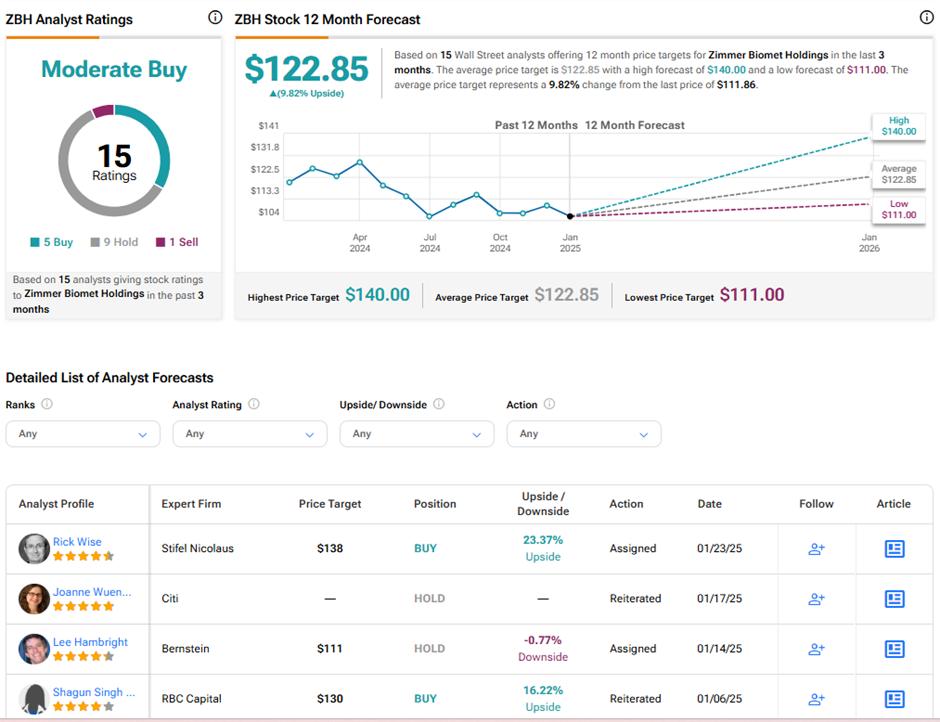

Analysts remain divided on Zimmer stock. On TipRanks, ZBH stock has a Moderate Buy consensus rating based on five Buys, nine Holds, and one Sell rating. The average Zimmer Biomet Holdings price target of $122.85 implies 9.8% upside potential from current levels. In the past year, ZBH shares have lost 8.2%.

Is Paragon 28 a Good Stock to Buy?

Analysts are hihghly optimistic about Paragon’s stock trajectory. With five unanimous Buy ratings, FNA stock commands a Strong Buy consensus rating on TipRanks. Also, the average Paragon 28 price target of $14.40 implies 20% upside potential from current levels. FNA shares have also lost 5.7% in the past year.