U.S.-based Union Pacific (UNP) is reportedly in early discussions with rival company Norfolk Southern (NSC) for a potential $200 billion merger. If the deal goes through, it would form a major rail powerhouse, reshaping the U.S. freight landscape and potentially triggering further consolidation in the industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Following the reports, NSC stock surged nearly 5% in after-hours trading, while UNP edged up 0.51%. Sources said the talks are still at an early stage and may not lead to a deal. Both Union Pacific and Norfolk Southern declined to comment.

The Deal Rationale

Union Pacific is one of the biggest freight railroads in the U.S., mainly covering the western two-thirds of the country. Norfolk Southern, on the other hand, operates across the eastern states.

With this merger, Union Pacific would gain full access to Norfolk Southern’s extensive eastern routes, creating a powerful coast-to-coast rail system and significantly expanding its national reach. Union Pacific CEO Jim Vena has recently highlighted the advantages of creating a transcontinental railroad. He believes such a network would enhance service by reducing delays at interchange points, where one railroad hands off railcars to another operator.

Union Pacific–Norfolk Southern Deal Set for Regulatory Hurdles

A key challenge for the deal will be convincing President Donald Trump’s administration that it’s a good move. However, analysts believe Union Pacific may be pursuing the merger in part because the current regulatory environment under Trump is seen as more business-friendly.

In addition, the merger would likely face strong review from U.S. regulators, especially from the Surface Transportation Board, which oversees freight railroads and is currently led by Republican appointee Patrick Fuchs. The deal would also draw attention from the Justice Department, investors, Amtrak, and labor unions.

Is Union Pacific Stock a Good Buy?

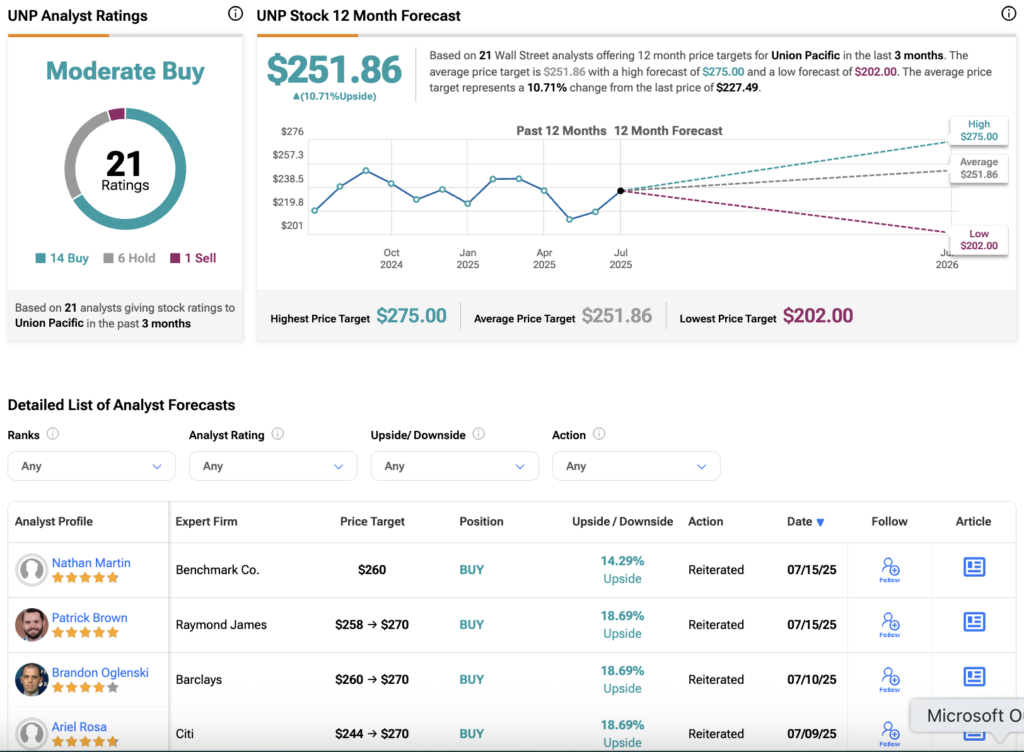

On TipRanks, UNP stock has a consensus Moderate Buy rating among 21 Wall Street analysts. That rating is based on 14 Buys, six Holds, and one Sell assigned in the last three months. The average Union Pacific stock price target of $251.86 implies an 11% upside from current levels.