Shares of TKO Group (TKO) sank at the time of writing as analysts at Benchmark weren’t impressed with the firm’s latest acquisition. In fact, they removed their price target while downgrading the stock to Hold. TKO, the parent company of the UFC and WWE, struck a $3.25 billion all-equity deal to acquire Professional Bull Riders (PBR), On Location, and IMG from Endeavor Group (EDR). The analysts are concerned that the deal could stunt growth and shrink adjusted EBITDA margins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Benchmark specifically pointed to On Location’s weak 6% adjusted EBITDA margin, which they called more of a favor than a sound business strategy, and IMG’s complicated fit with TKO’s existing operations. Additionally, PBR’s $40 million contribution to adjusted EBITDA was labeled as “insignificant” by the analysts.

Acquisition Details

The acquisition is expected to help TKO grow its footprint in the premium sports market by gaining exposure to revenue from events like the Super Bowl, FIFA World Cup, and the Olympics through On Location.

In addition, IMG will bring sports content production and event management to the firm, although the deal excludes certain parts of IMG’s business, like licensing and tennis representation. Furthermore, TKO will gain an additional one million fans through PBR, which hosts more than 200 live events each year.

This transaction will see Endeavor take a 59% stake in TKO as Endeavor is set to receive around 26.14 million common units of TKO Operating Company, LLC, along with an equal number of Class B common stock.

Is TKO a Good Stock to Buy?

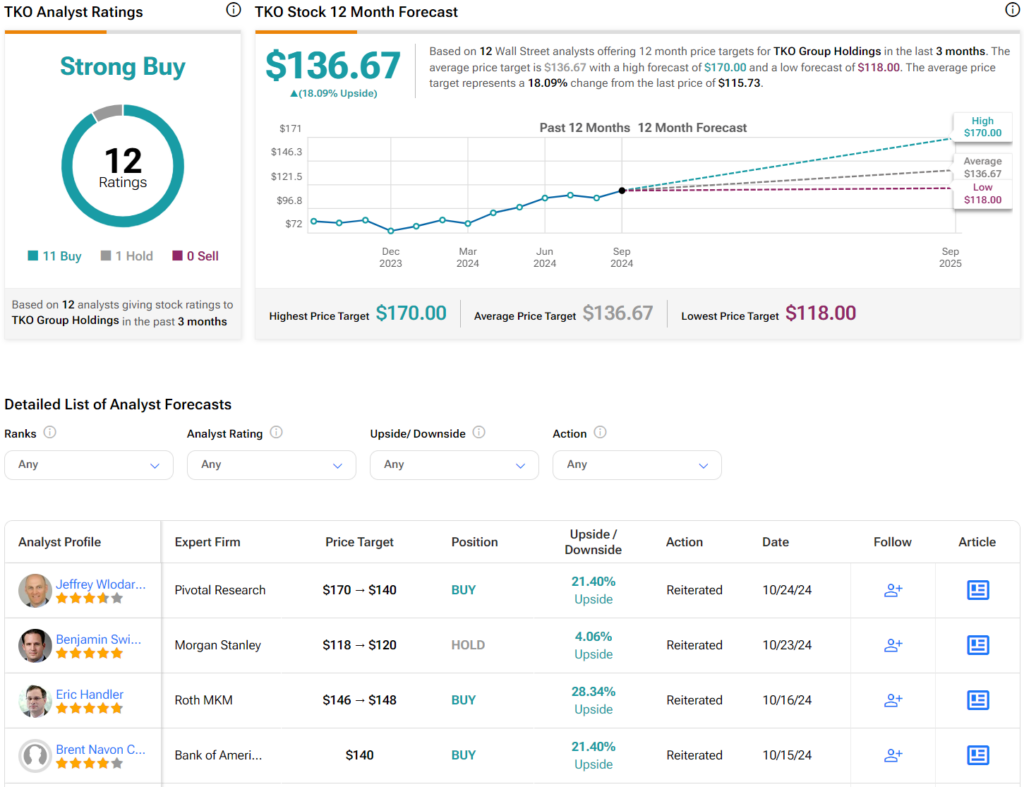

Overall, analysts have a Strong Buy consensus rating on TKO stock based on 11 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 54% year-to-date rally, the average TKO price target of $136.67 per share implies 18.1% upside potential.