SoftBank Group (SFTBY) has agreed to acquire the robotics division of Swiss engineering company ABB (ABBNY) for $5.4 billion. The deal highlights SoftBank and CEO Masayoshi Son’s commitment to growing their AI and automation capabilities.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based in Japan, SoftBank is known for its investments in technology, telecommunications, and AI. Meanwhile, ABB is a Swiss engineering and technology company specializing in robotics, automation, and electrification solutions.

What This Deal Means for ABB

ABB chose to sell its Robotics division to SoftBank instead of a previously planned spin-off. As a result, the deal ends ABB’s plans to list the robotics business as a separate company.

The sale is expected to benefit ABB shareholders, providing significant cash proceeds and a pre-tax gain. ABB plans to utilize the funds for acquisitions and return capital to shareholders through dividend payments and share repurchases.

The deal is expected to close by mid-to-late 2026, subject to global regulatory approval. Following the announcement, ABB shares were up around 1% in Zurich as of this writing.

SoftBank Bets on AI Boom

Son has aimed to position SoftBank at the heart of the AI boom through strategic investments and acquisitions across technology sectors. The company owns chip designer Arm (ARM) and holds a significant stake in OpenAI (PC:OPAIQ).

Son said SoftBank’s next goal is “Physical AI,” where the partnership with ABB Robotics will bring together advanced technology and talent to combine super-intelligent AI with robotics, aiming to create a breakthrough for humanity.

Interestingly, SoftBank has a history in robotics. In 2012, it acquired a majority stake in French company Aldebaran, and in 2014, it launched the humanoid robot Pepper. While Pepper didn’t succeed commercially, robotics has now become a key focus for the Japanese conglomerate once again.

Is SoftBank a Good Stock to Buy?

SoftBank shares traded on U.S. OTC markets do not have analyst coverage. Investors interested in these shares can refer to Japan-listed SoftBank shares (JP:9984) for guidance when making investment decisions.

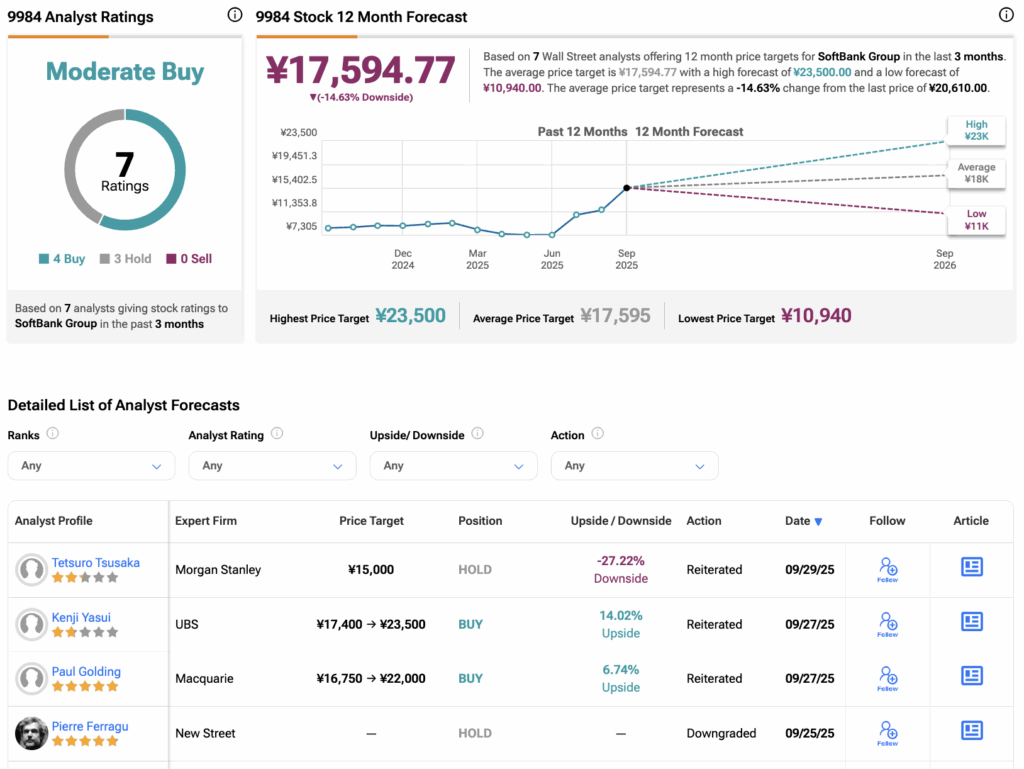

According to TipRanks, 9984 stock has a Moderate Buy consensus rating based on four Buys and three Holds assigned in the last three months. At ¥17,594.7, SoftBank’s share price target implies a downside of 14.63% on the current trading level.