Schlumberger (NYSE:SLB) announced a delay in its $7.75 billion all-stock acquisition of ChampionX (NASDAQ:CHX) due to a request for additional information from the U.S. Department of Justice (DoJ). This request extends the expected closing date to Q1 2025, from the initial projection of 2024-end.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SLB is an oilfield services company. Meanwhile, ChampionX provides chemical solutions and technologies that enhance oil and gas production.

Deal Background

SLB announced plans to acquire ChampionX in April 2024. According to the deal terms, CHX shareholders will receive 0.735 shares of SLB common stock in exchange for each CHX share.

Importantly, this acquisition is expected to strengthen SLB’s position in the oil production space. The union of SLB’s expertise with CHX’s technologies should boost SLB’s potential.

Heightened Scrutiny by Antitrust Regulators

The DoJ’s request reflects the Biden administration’s increased scrutiny of mergers within the oil and gas sector.

Interestingly, the Chesapeake Energy (CHK) and Southwestern Energy (SWN) merger, originally scheduled for Q2 2024, has been delayed to the latter half of the year due to a lack of information. This mirrors similar setbacks seen in other mergers.

Is SLB a Good Stock to Buy?

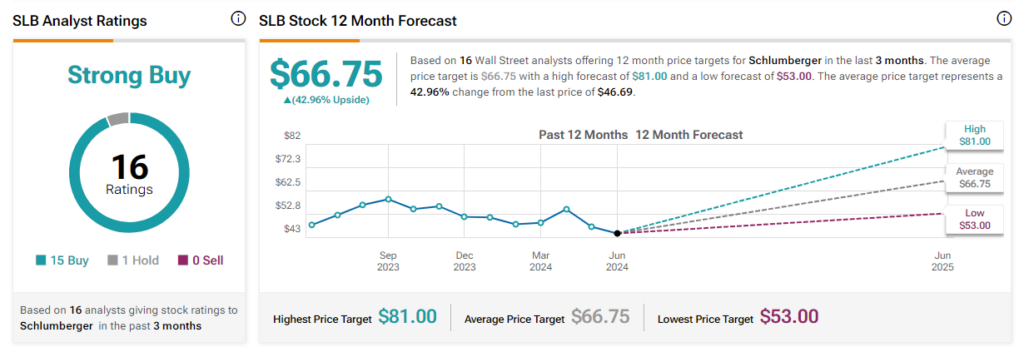

Schlumberger’s inorganic growth strategies and strong financial performance keep analysts bullish about its prospects. The stock has a Strong Buy consensus rating based on 15 Buy and one Hold recommendations. The analysts’ average price target on SLB stock of $66.75 implies about 43% upside potential from the current level.