Shares in the world’s third biggest footwear brand Skechers USA (SKX) jumped 25% today after it agreed to a $9.4 billion takeover by investment firm 3G Capital.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Going Private

The price being paid by 3G Capital represents a 30% premium over Skechers’ recent average stock price. The deal is expected to close in the third quarter of this year.

Once the deal is completed, Skechers’ shares will be delisted from the New York Stock Exchange, and the company will operate as a private business.

However, Skechers stressed that under the continued leadership of CEO Robert Greenberg, its focus on innovation, international development and direct-to-consumer expansion strategies would continue. Only Nike (NKE) and Adidas are ahead of it in the global footwear race.

“With a proven track-record, Skechers is entering its next chapter in partnership with the global investment firm 3G Capital,” Greenberg said.

The deal comes at a tricky time for both Skechers and the U.S. retail and consumer sectors so dependent on consumer confidence and discretionary spending. That has been bashed in recent months by concerns over the health of the economy as a result of President Trump’s tariff strategy and cuts in federal spending.

Tariff Hurdles

The tariff strategy also places extra pressure and strain on the retail sector’s supply chain particularly given the huge 145% levy on China.

Last week Skechers signed a letter produced by the Footwear Distributors and Retailers of America trade group asking Trump for an exemption from his tariff plan.

Skechers recently withdrew its full-year 2025 guidance “due to macroeconomic uncertainty stemming from global trade policies.” It’s not clear how exposed its supply chain is to tariffs.

Skechers has not said how much of its supply chain is based in China but has revealed that two-thirds of its business is outside of the U.S. and therefore won’t see as much of an impact.

According to a report on CNBC, one person close to the deal said the trade environment didn’t force Skechers into a deal and that 3G Capital had been interested in acquiring the company for years.

The person added that 3G Capital believes the long-term outlook of Skechers’ business remains attractive and is well positioned for growth.

What Stocks are Most at Risk From Tariffs?

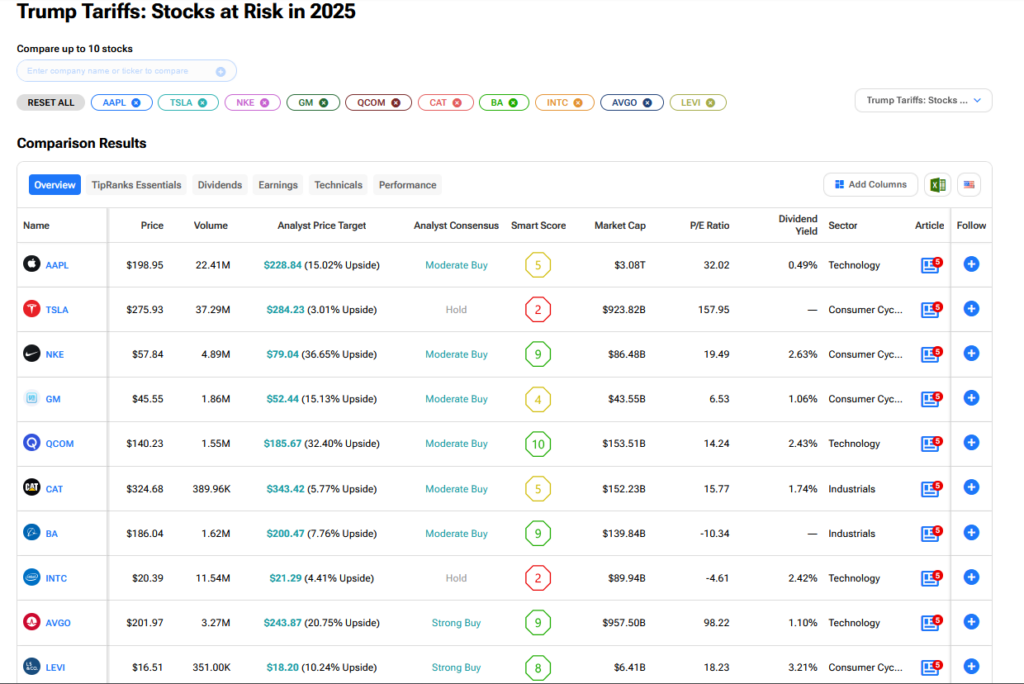

We have rounded up the stocks most at risk from Trump tariffs using our TipRanks comparison tool. On the list is Skechers rival Nike.