Paint manufacturer and retailer Sherwin-Williams (SHW) has agreed to acquire the Brazilian architectural paints business of BASF, which includes the well-known Suvinil brand, for $1.15 billion in cash. The Suvinil brand is a leading player in Brazil’s paint industry that generates over $500 million in annual sales and operates two production facilities.

The acquisition is expected to accelerate Sherwin-Williams’ growth in Brazil by expanding its distribution network while also creating operational synergies. The company plans to finance the deal through a combination of cash and new debt but will look to maintain a net debt-to-EBITDA ratio within its target range of 2.0 to 2.5 times. In addition, the purchase price equates to a low-teens EBITDA valuation multiple after adjusting for the anticipated post-transaction synergies and one-time costs.

The acquisition is expected to close in the second half of 2025 if it receives regulatory approval in Brazil. Once completed, Suvinil will be integrated into Sherwin-Williams’ Consumer Brands Group, and the firm will focus on improving customer experience and exploring new growth opportunities that will hopefully lead to an expansion of Suvinil’s EBITDA margin.

Is SHW Stock a Good Buy?

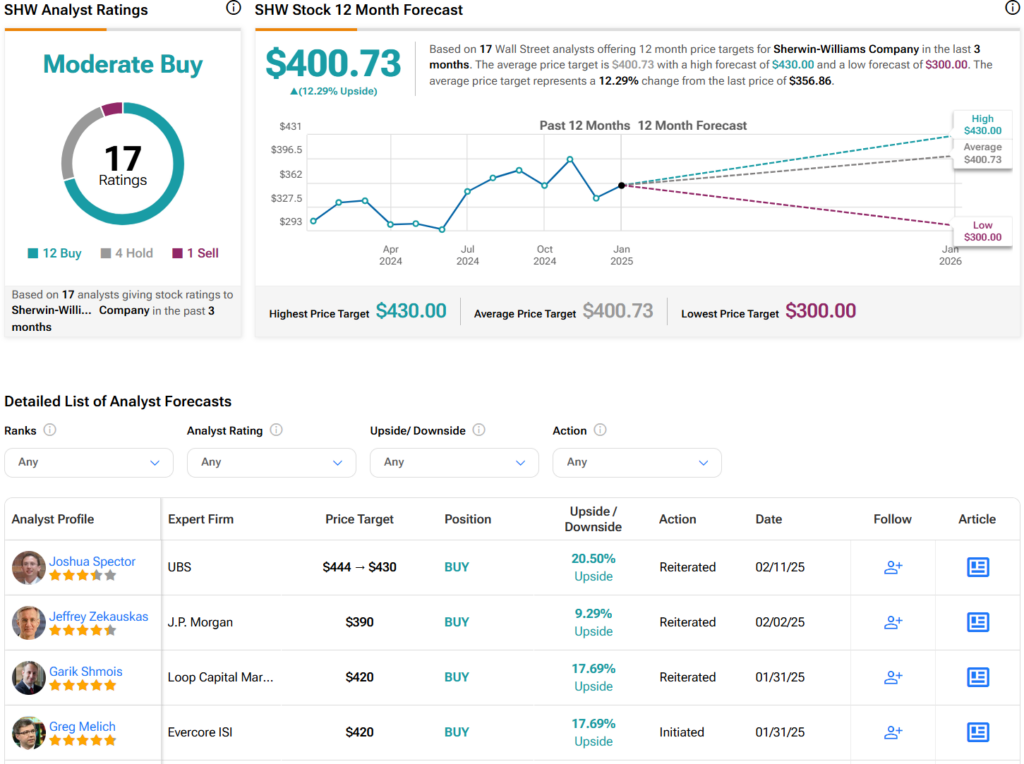

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SHW stock based on 12 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 16% rally in its share price over the past year, the average SHW price target of $400.73 per share implies 12.3% upside potential.