The leading cryptocurrency exchange around, Coinbase (COIN) recently made a move that is catching a lot of attention, particularly among investors. Coinbase announced plans to shell out $2.9 billion to pick up Deribit, a Dubai-based operation that serves as an exchange for cryptocurrency derivatives. With one more function under its umbrella, investors bought in, and hard, sending shares up over 6% in Thursday afternoon’s trading.

The deal was a combination cash / stock deal, with Coinbase putting up $700 million in cash along with 11 million shares of class A common stock to finish out the rest. The deal is expected to conclude before 2025 is out, and allows Coinbase to better take on large-scale operations in the crypto derivatives market, like Binance.

While Coinbase is the biggest name in cryptocurrency sales in the United States, reports note, it has a much smaller chunk of the world market. Binance tends to be the leader on that front, reports note. But with Deribit’s derivatives functions kicking in, that should go a long way toward—as Luuk Strijers, Deribit’s CEO noted—helping Coinbase “…shape the future of the global crypto derivatives market.”

Paging James Halliday

Science fiction buffs know that, in the novel Ready Player One, the OASIS credit was actually considered the strongest currency on Earth at the time. How did an in-game currency become the leading money on the planet? Well, another recent Coinbase move might help make that happen in reality, as it became an official partner with both VALORANT and League of Legends (LoL) eSports global events. In fact, Coinbase is now the exclusive cryptocurrency exchange for these events as of the VCT Masters Toronto event, starting June 7.

Coinbase has been part of the sports scene for some time. It has connections to the Golden State Warriors, the Los Angeles Clippers, and Aston Martin Aramco Formula One racing. So the idea that, one day, a cryptocurrency traded through Coinbase might be a major real-world financial tool is not so far out of line.

Is Coinbase a Buy, Sell or Hold?

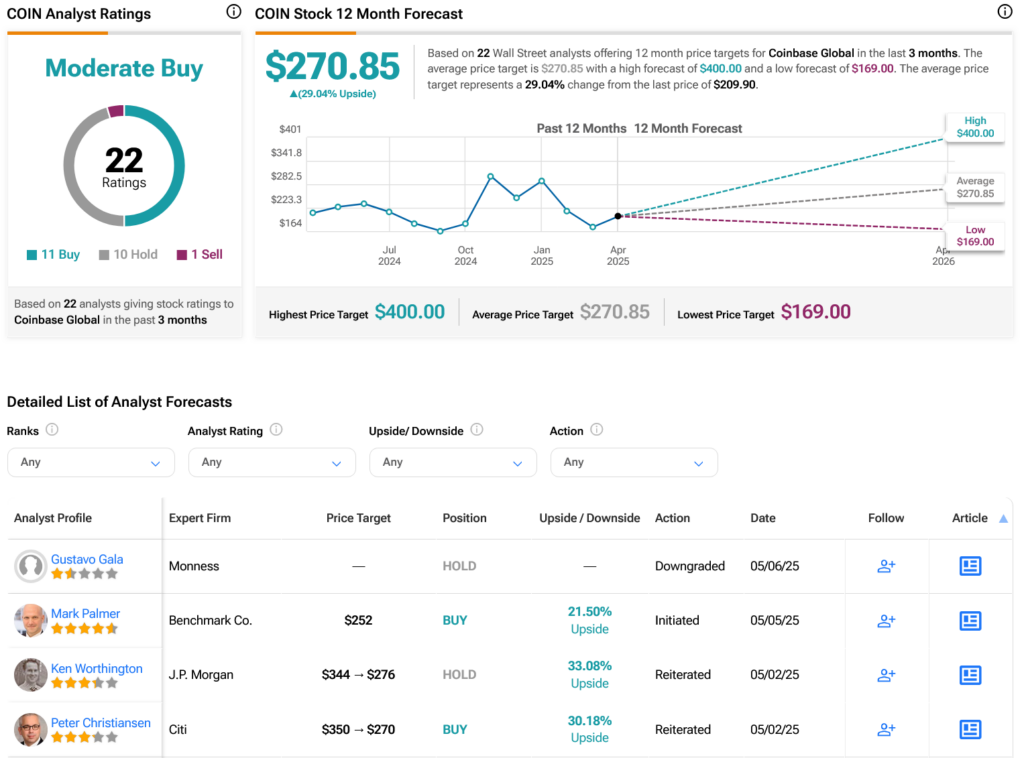

Turning to Wall Street, analysts have a Moderate Buy consensus rating on COIN stock based on 11 Buys, 10 Holds and one Sell assigned in the past three months, as indicated by the graphic below. After an 1.34% loss in its share price over the past year, the average COIN price target of $270.85 per share implies 29.04% upside potential.