Roku (ROKU) has announced a $185 million acquisition of Frndly TV, a subscription service known for its affordable live TV bundles. The deal, expected to close in Q2 2025, strengthens Roku’s push into subscription-based streaming.

Frndly TV, launched in 2019, offers over 50 live TV channels, such as A&E, Hallmark Channel, The History Channel, and Lifetime. With plans starting at $6.99 per month, it focuses on family-friendly content, avoiding costly sports programs.

It must be noted that a portion of the purchase price, $75 million, is contingent upon Frndly TV achieving specific performance goals over the next two years.

Importantly, the deal was announced alongside ROKU’s Q1 earnings report, released after the market closed yesterday.

Roku’s Motive Behind the Deal

According to CEO Anthony Wood, the deal directly supports one of Roku’s three key growth strategies – growing platform revenue through subscriptions. Also, the acquisition will help Roku improve content suggestions to boost engagement and expand its presence in live TV streaming.

On deal’s completion, Frndly TV will continue to operate on Amazon Fire TV, Android TV, Google TV, Apple TV, Samsung, and Vizio, without any changes for current users.

Importantly, Roku expects the deal to boost subscription growth, using its 90 million streaming households to expand Frndly TV’s reach.

Top Analyst Bullish about Frndly TV Deal

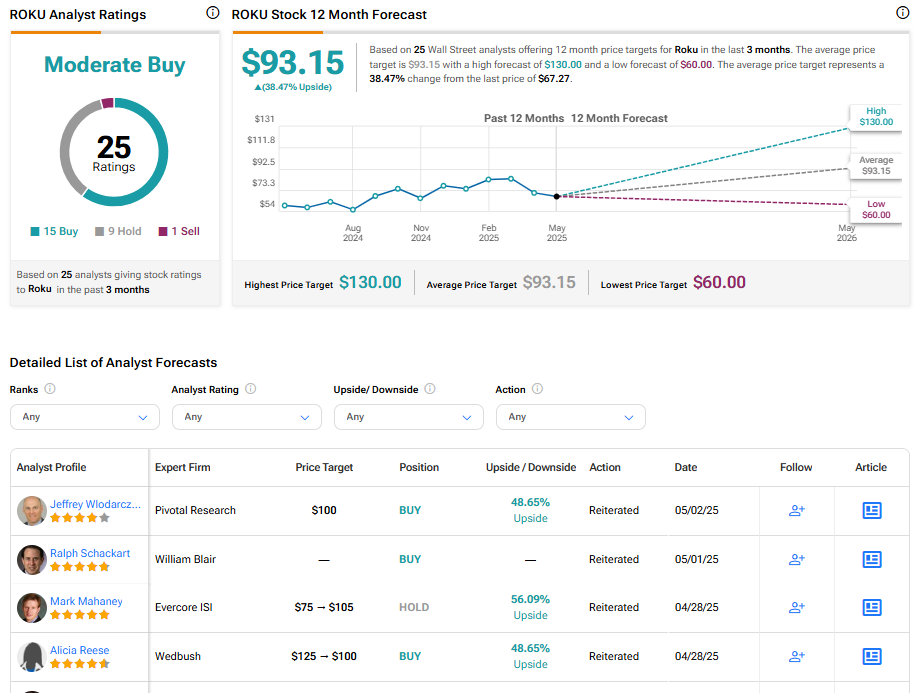

Following the Q1 results, Pivotal Research analyst Jeffrey Wlodarczak gave Roku stock a Buy rating, citing its strong market position and growth potential. The Top-rated analyst noted that the Frndly TV acquisition, while small, fits Roku’s strategy to expand its content ecosystem.

The analyst further believes that Roku’s deep presence in the U.S. and growing international footprint support its long-term success. Also, Wlodarczak sees Roku Channel’s strong engagement to its advantage.

Wlodarczak assigned a price target of $100 on ROKU stock, which implies a 48.65% upside potential from the current level.

What Is Roku’s Price Target?

Turning to Wall Street, ROKU stock has a Moderate Buy consensus rating based on 15 Buys, nine Holds, and one Sell assigned in the last three months. At $93.15, the average Roku stock price target implies a 38.47% upside potential.