Hyatt Hotels (H) is all set to acquire U.S.-based Playa Hotels & Resorts (PLYA) for $2.6 billion, aiming to strengthen its all-inclusive properties. The deal value includes roughly $900 million in debt, net of cash. Under the terms of the deal, Hyatt’s wholly owned subsidiary will purchase the remaining outstanding shares of Playa Hotels it doesn’t already own for $13.50 per share. Following the news, PLYA stock gained 2.55% in pre-market trading, while Hyatt saw a 1.4% decline.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Hyatt Boosts All-Inclusive Platform with Playa Acquisition

With this acquisition, Hyatt boosts its all-inclusive platform by adding Playa’s robust portfolio of resorts. Notably, Playa operates 24 high-end, all-inclusive resorts in top beachfront locations across Mexico, Jamaica, and the Dominican Republic. The deal will also enable Hyatt to establish long-term management agreements for its Hyatt Ziva and Hyatt Zilara properties in Mexico.

Additionally, the acquisition will broaden Hyatt’s distribution channels, enhancing its market reach and customer base in Mexico and the Caribbean.

Hyatt plans to fully finance the acquisition through new debt. The company also aims to sell Playa Hotels’ owned properties to third-party buyers, expecting to generate at least $2 billion from these asset sales by the end of 2027. Proceeds from these sales will be used to repay the newly incurred debt.

The company expects to close the deal later this year, subject to regulatory approvals.

Is Hyatt Stock a Good Buy?

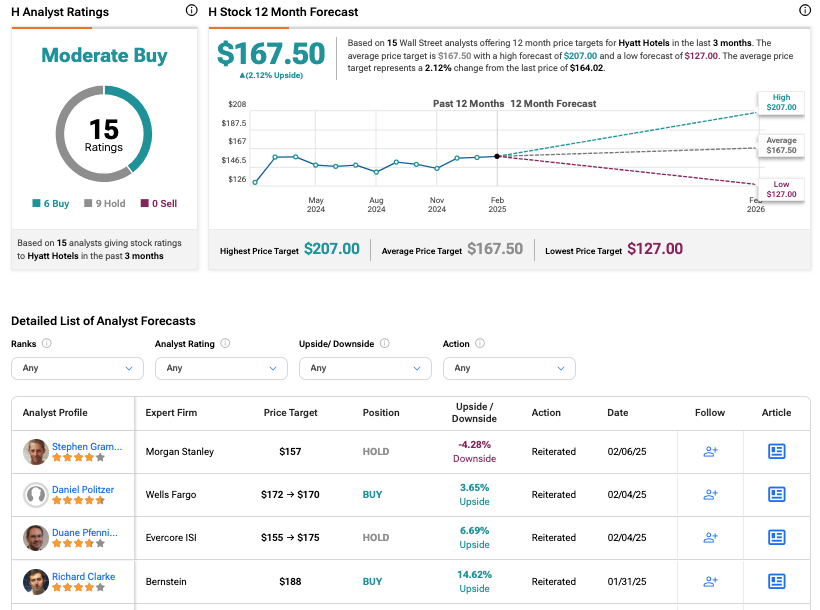

According to TipRanks consensus, H stock has a Moderate Buy rating, based on six Buys and nine Holds assigned in the last three months. The Hyatt share price target of $167.50 suggests a 2.12% upside from current levels.