Shares of Firefly Aerospace (FLY) jumped almost 18% in pre-market trading on Monday after the company announced an $855 million acquisition of SciTec, a provider of advanced technology for national security. The deal strengthens Firefly’s position in the defense and intelligence sector, expanding its reach beyond launch services.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Firefly is a space and defense company that designs rockets, spacecraft, and technology solutions for commercial and government missions. Meanwhile, SciTec specializes in advanced data analytics, sensors, and software solutions that support U.S. defense and intelligence missions.

Firefly Gets a Major Boost with SciTec

Firefly said the deal will let it add SciTec’s advanced defense analytics to its space systems, boosting its overall capabilities. Moreover, SciTec’s strengths in missile tracking, defense, intelligence, and surveillance will further enhance Firefly’s launch, lunar, and in-orbit operations.

The deal, valued at $855 million, will be paid through $300 million in cash and $555 million in Firefly shares, issued to SciTec’s owners at $50 per share. Meanwhile, the deal is expected to close by year-end, subject to regulatory approvals.

Why Firefly’s Deal Has Investors Excited

The deal puts Firefly in the fast-growing military-space market, bringing in advanced analytics and surveillance technology while showing a clear growth plan. With global tensions rising, demand for advanced defense and space technologies is increasing, and this acquisition helps Firefly take advantage of that trend. Consequently, this deal could boost the stock and draw investor attention.

The deal comes just months after Firefly’s IPO on August 7, 2025, when it began trading on the Nasdaq. At the time, the company was valued at $9.84 billion, with shares surging 55.6% on their debut, making it the largest U.S. space tech IPO of the year.

However, since then, FLY stock has fallen about 45.5%.

Is FLY a Good Stock to Buy?

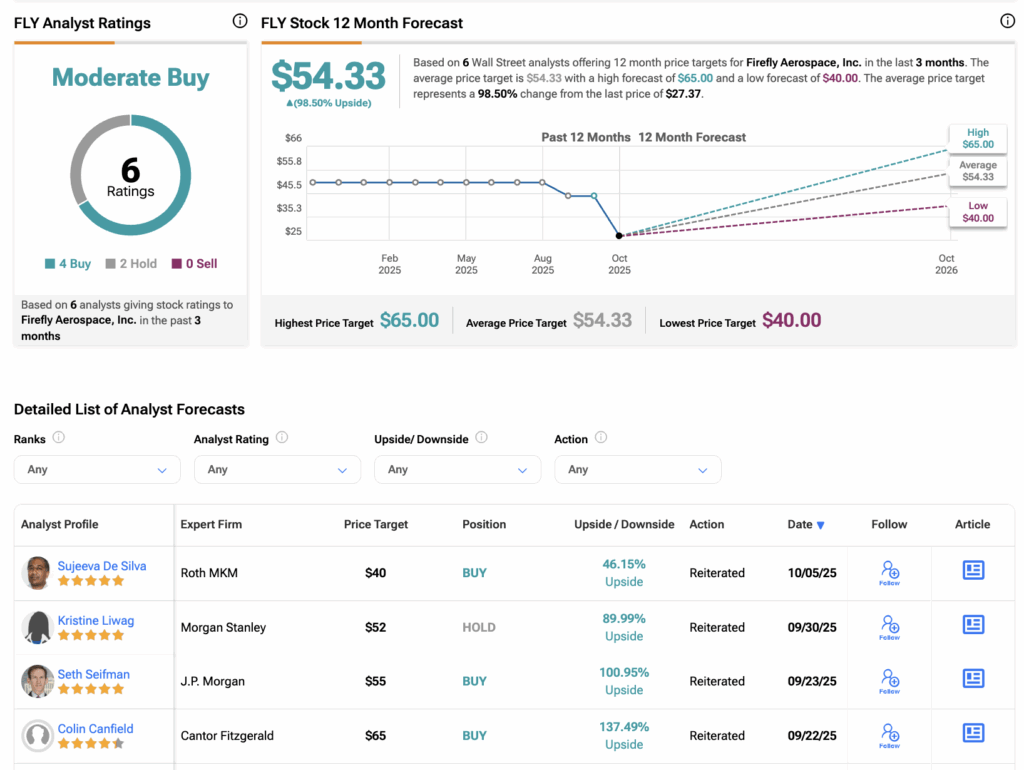

Turning to Wall Street, analysts have a Moderate Buy consensus rating on FLY stock based on four Buys and two Holds assigned in the past three months. The average stock price target for Firefly is $54.33, which implies a 98.50% upside potential from the current level.