The long-pending merger drama between DirecTV and Dish ends tonight, as the former has decided to walk away from the deal. EchoStar (SATS)-owned Dish TV’s bondholders rejected the terms of the bond-exchange deal, leading to the termination since it was a crucial part of the terms. In September, DirecTV agreed to acquire Dish from EchoStar for $1 and assume debt of roughly $9.75 billion. The merger could have created one of the largest pay-TV networks in the U.S., boasting over 19 million subscribers.

Here’s Why DirecTV Aborted the Dish Deal

The bond-exchange terms included holders to take a haircut (let go-off) of $1.57 billion on the debt holdings, which did not go well with them. Last week, reports suggested that about 85% of bondholders had rejected the offer, putting the deal in jeopardy. Commenting on the merger termination, DirecTV CEO Bill Morrow said that the proposed bond exchange terms were essential to protect its own balance sheet and operational efficiency.

DirecTV is partly owned by private equity group TPG, which had taken a 30% stake in 2021. TPG is yet to buy the remaining stake from telecommunications giant AT&T (T). The purchase of the remaining stake is expected to be completed in the first half of 2025.

Meanwhile, the acquisition could have freed EchoStar of the flagging satellite TV businesses of Dish DBS, which includes Dish and Sling TV. EchoStar wants to focus on reviving its wireless network operating business and is determined to do so, irrespective of the merger outcome. EchoStar Group has a current debt burden of over $20 billion. The deal could have shed some of the burden and made it easier for EchoStar to manage its debt.

Is SATS a Good Buy Now?

Analysts remain highly skeptical about EchoStar stock’s trajectory and prefer to remain on the sidelines. Owing to the failing satellite TV business and the debt load, EchoStar missed earnings estimates in all past five consecutive quarters.

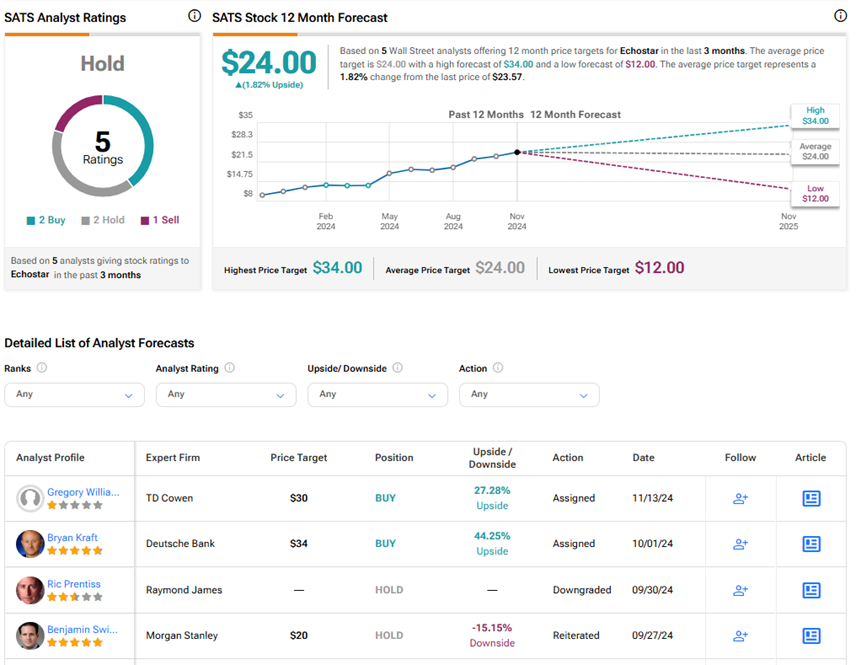

On TipRanks, SATS stock has a Hold consensus rating based on two Buys, two Holds, and one Sell rating. The average EchoStar Group price target of $24 implies 1.8% upside potential from current levels. Year-to-date, SATS shares have gained 42.3%.

Analysts could revisit their stock ratings following the news of the deal termination announced after the markets closed last night. SATS stock could also react to the news when the markets open today.