Sports retail chain Dick’s Sporting Goods (DKS) has entered deal to acquire athletic footwear retailer Foot Locker (FL) for $2.4 billion. The acquisition is expected to give Dick’s a stronger foothold in footwear and boost global presence. News of the buyout sent Foot Locker stock soaring 83% in pre-market trading, while DKS stock was down 8%.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the deal terms, Dick’s has agreed to buy Foot Locker for $24 per share. This offer reflects a premium of nearly 90% over Foot Locker’s closing price of $12.87 on Wednesday.

The news follows a recent agreement by sneaker maker Skechers (SKX) to be acquired by private equity firm 3G Capital in a $9.4 billion deal earlier this month, which points to an ongoing consolidation within the athletic and footwear retail market.

Why Is Dick’s Buying Foot Locker?

Foot Locker has been making turnaround efforts to boost sales, such as store revamps and a better rewards program. Despite this, Foot Locker’s revenue has dropped for the past three years, falling below $8 billion for the year ended February 1, as U.S. consumers cut spending.

Foot Locker stock is down 40% year-to-date, partly due to the tariff concerns and Nike’s (NKE) strategic price changes aimed at increasing its own sales.

For Dick’s, acquiring Foot Locker would mean instant access to 2,400 stores worldwide, compared to its 800 big-box locations in the U.S. This expansion could help Dick’s diversify its revenue streams and compete better with brands like Nike and Adidas (DE:ADS).

Is DKS a Good Stock to Buy?

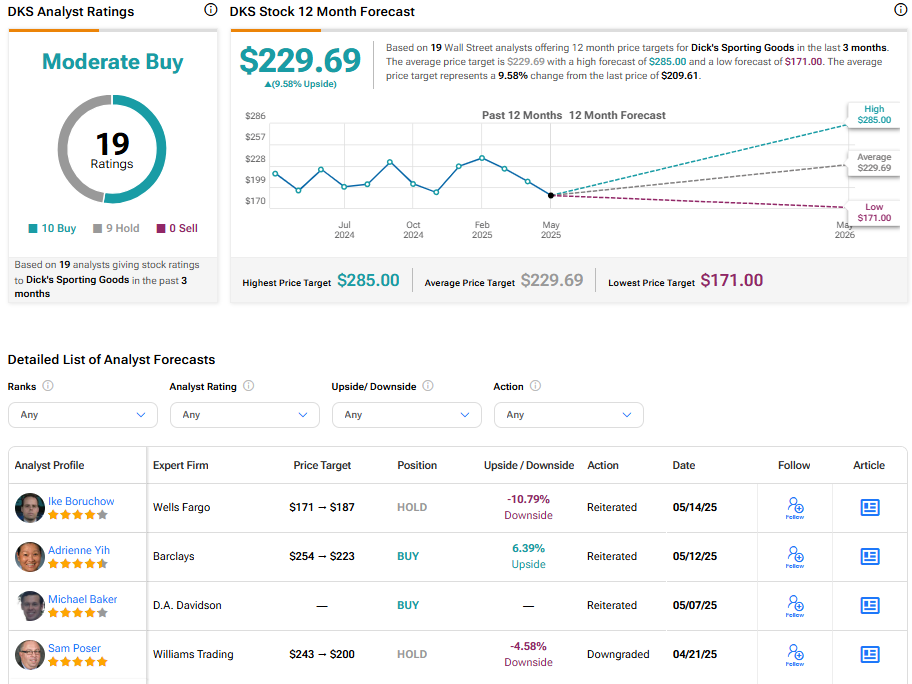

Turning to Wall Street, DKS stock has a Moderate Buy consensus rating based on 10 Buys and nine Holds assigned in the last three months. At $229.69, the average Dick’s price target implies a 9.58% upside potential.