Tech giant Dell Technologies (DELL) is once again exploring the sale of its cybersecurity subsidiary, SecureWorks (SCWX), according to an exclusive Reuters report. This comes after its previous attempts to sell the company were unsuccessful. This renewed effort, according to sources familiar with the situation, signals Dell’s ongoing strategy to reassess its portfolio.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Dell has enlisted investment bankers from Morgan Stanley and Piper Sandler to gauge interest from potential buyers, including private equity firms. However, there is still a possibility that a deal may not work out. Dell may ultimately decide to retain ownership of SecureWorks, which currently has a market cap of around $771.7 million. Following the exclusive report, SecureWorks’ shares surged by more than 20% on Thursday.

Dell Has a Major Stake in SecureWorks

In recent years, Dell has divested several non-core assets, and it currently owns 79.2% of SecureWorks through its class B shares, along with controlling 97.4% of the company’s voting power via dual-class shares, as revealed in recent filings. Dell had previously explored the sale of SecureWorks in 2019 as part of a broader initiative to reduce its debt load.

Why Is Dell Attempting to Sell SCWX?

SecureWorks was founded in 1998 and is headquartered in Atlanta, Georgia. The company provides cybersecurity services designed to protect organizations from cyberattacks. Dell acquired SecureWorks in 2011 for $612 million, later taking the company public in 2016. However, SecureWorks has faced challenges in recent years. The company has struggled to differentiate itself in a highly competitive cybersecurity market dominated by larger players. SecureWorks is slated to report its second-quarter earnings on September 5.

What Is the Prediction for Dell Stock?

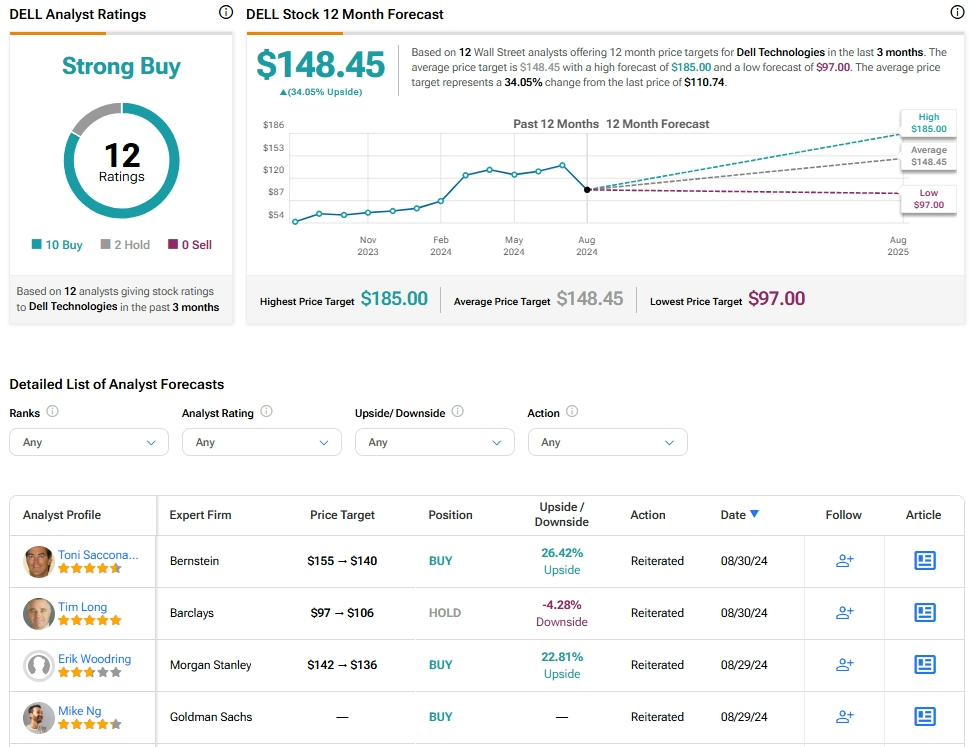

Analysts remain bullish about Dell stock, with a Strong Buy consensus rating based on 10 Buys and two Holds. Over the past year, Dell has surged by more than 100%, and the average DELL price target of $148.45 implies an upside potential of 34.1% from current levels. This is after the firm announced better-than-expected Q2 earnings on Thursday.