Danish beer and beverage major Carlsberg (OTC:CABGY) is acquiring the U.K.’s soft drink producer Britvic (GB:BVIC) in a deal worth nearly $4.2 billion. The combination promises to help Carlsberg expand into the non-alcoholic beverages category.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Acquisition

Today’s deal announcement comes after Britvic rebuffed two previous bids from Carlsberg. The Danish company had earlier offered to acquire Britvic at 1,200 pence per share and 1,250 pence per share, which Britvic deemed undervalued and turned down.

However, this time around, Britvic’s board has accepted Carlsberg’s sweetened offer of 1,315 pence per share. The new offer represents a nearly 36% premium over Britvic’s pre-deal-chatter share price, leading to a surge in Britvic’s London-listed shares today.

Why It Matters

The strategic move is expected to help Carlsberg expand beyond beer. Moreover, the deal follows the seizure of its Russian operations amid the Russia-Ukraine conflict. Last year, Russia took control of Carlsberg’s stake in Baltika, the country’s largest brewer. In response, Carlsberg pledged to explore all possible avenues to safeguard its assets and operations in Russia.

Another driver behind Carlsberg’s decision is shifting consumer preferences. The alcoholic beer category is stagnating as consumers increasingly favor soft drinks and zero-alcohol beer. According to Bloomberg, Carlsberg is achieving higher margins in markets where it offers both alcoholic beverages and soft drinks.

What Is the Price Target for Carlsberg Stock?

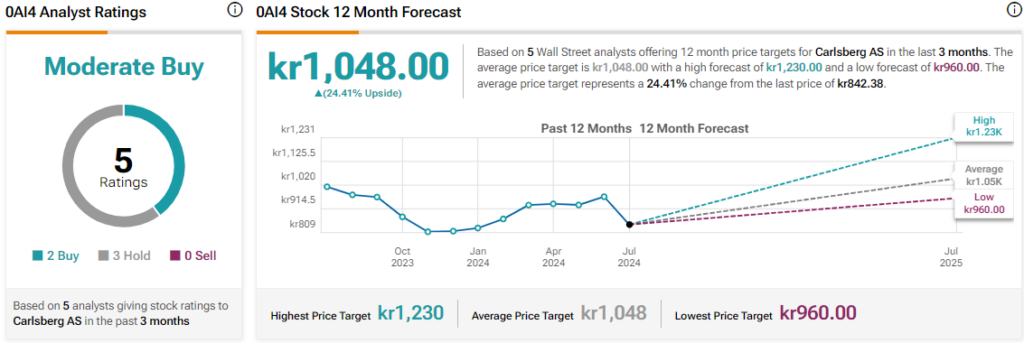

Meanwhile, analysts have assigned Carlsberg’s London-listed shares a Moderate Buy consensus rating, alongside an average Carlsberg price target of KR1,048. This points to a nearly 24% potential upside in the stock.

Read full Disclosure