It has been a big few days for asset manager stock Brookfield Asset Management (TSE:BAM). Not only did they have a major milestone recently, but they also made a big new deal to pick up First National Financial Corp. (TSE:FN). The move did Brookfield few favors with investors, though, as shares dipped fractionally in Monday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Brookfield got together with Birch Hill Equity Partners and built an acquisition vehicle to take over First National. The deal was valued at around $2.9 billion, and sees the acquisition vehicle take over the funds managed by Birch Hill. Though Brookfield and Birch Hill will not take over completely, reports noted, as First National founders Stephen Smith and Moray Tawse will still have an indirect 19% interest in the company.

The acquisition vehicle offered a purchase price of $48 per share, which at the time represented a 15.2% premium against the previous 30 days of trading, reports noted. It was also a figure that beat the stock’s 52-week high, though not the peak share price, which was around $52 per share back in 2021. Strategic review indicated the deal would offer “…compelling value and liquidity to shareholders,” reports noted.

A Win for Brookfield

The dip in Brookfield’s stock today may not be so much a reflection of displeasure at the First National deal, but rather, a bit of profit-taking. Just days ago, Brookfield posted an all-time share price high, reports noted, coming in at $62.66 per share US.

Most of those share price gains were accomplished via one simple expedient: an excellent performance over the last year, which featured a 56.75% return at one point, reports noted. It is becoming clear to investors that Brookfield’s asset management operations are delivering opportunity, and its overall strategy is bearing positive results.

Is Brookfield a Good Stock to Buy?

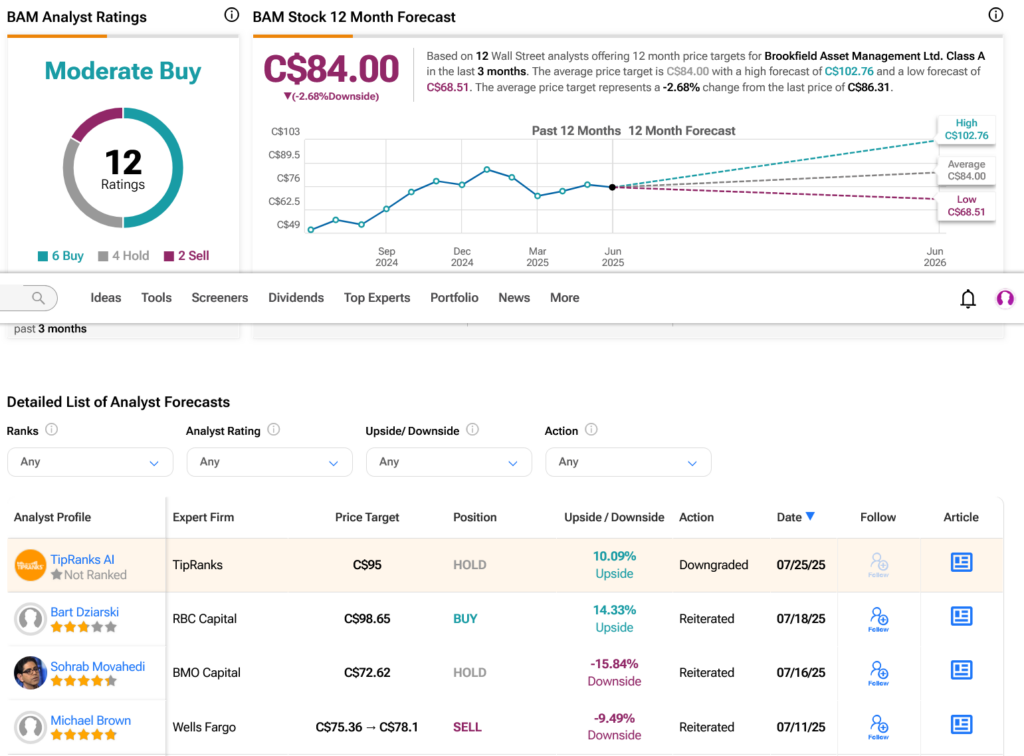

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:BAM stock based on six Buys, four Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 47.71% rally in its share price over the past year, the average BAM price target of C$84 per share implies 29.71% upside potential.